Final publication date 04 Oct 2023

Rise of Work from Home & Post-pandemic Urban Form in Global Cities

Abstract

COVID-19 pandemic has unprecedented impact on the lives of urban residents in global cities. Due to the changing lifestyle facing the pandemic, global cities have experienced the structural shift in urban form. This paper aims to study the changing patterns of commuting (resulted from increasing work from home options), population (re)distribution, demand in office space at urban cores among the four global cities facing the COVID-19 pandemic. The four global cities included in this study are New York, London, Tokyo, and Los Angeles. Through meta-analysis among these four global cities, this paper compares the pandemic experience shapes the evolution of structural shifts in urban form. For all four cast study cities, the share of WfH (Work from Home) among workers has significantly increased during the pandemic and this pattern is expected to last in post-pandemic era. Population (re)distribution pattern differs slightly. In the global cities like New York, London, and Tokyo, intra-metro residential relocation was the main type of population redistribution. However, in Los Angeles, the inter-metro migration (mainly out-migration) to nearby metros with rapidly growing economy and more affordable housing options was the dominant type of population (re)distribution in pandemic. With the high WfH pattern in post-pandemic era, the observed population (re)distribution pattern is expected continue. Accordingly, demand for office space at urban core declines with higher vacancy rate and lower rental prices compared to that during the pre-pandemic period.

Keywords:

COVID-19, Global Cities, Urban Form, Commuting, Work from Home (WfH)Ⅰ. Introduction

The unprecedented massive spatial and temporal scale of COVID-19 pandemic is mainly due to the highly contagious nature of COVID-19 in the globalized world. Many of the early empirical studies of COVID-19 pandemic focused on the relation between urban density and the spread of pandemic, but their findings are somewhat inconclusive (Sharifi and Khavarian-Garmsir, 2020). For instance, Florida et al. (2021) argued that among the first-hit places, density was a main driver for the outbreaks, rather connectivity to the world mattered more. They quoted Nathan (2021) who claimed that it can be an ecological fallacy case by presenting the weakened relation between density and infection over time. However, others found strong correlation between urban density and the COVID-19 infection rate (among others, see Desai (2020), Banai (2020)). Using the empirical study for the 913 metropolitan counties in the U.S., Hamidi at al. (2020) found the metropolitan population as one of the most important determinants for the infection rate. When controlling the metro population, the density of the metro counties was no longer significant in predicting the infection rate. Rather, counties with higher population densities tend to have better health care systems that actually reduces the COVID-19 related mortality rate. In their empirical study, what really mattered was connectivity rather than density itself. This is also in line with the argument by Florida et al. (2021).

Sassen (2005) introduced the concept of global city based on the increasing intercity transactions on cross-border networks. Along with the formation of transnational urban systems, the global cities serve as the major financial and business centers in the global market and they include New York, London, Tokyo, among others (Sassen, 2005). From this perspective, the centrality of the global cities in the transnational network makes the global cities more vulnerable to pandemics such as COVID-19. As mentioned by Desai (2020), during the early-stage of COVID-19 pandemic, both London and New York, the mega global cities served as an epicenter of COVID-19 in the UK and US, respectively. Though some other global cities did not experience the early spike of COVID-19 cases in Spring to Summer of 2020, they had accumulated a massive number of cases over time, for instance, by late March 2023, Tokyo had over 4.7 million cases, while Los Angeles reported 3.7 million cases. Global mega cities had unique experience in COVID-19 pandemic and comparable policy responses with the aim to contain the pandemic spikes, to minimize the negative shock on economic activities, and to return to pre-pandemic normalcy. Against the global spread of COVID-19, World Health Organization (WHO) published a series of seven policy briefs for the national and sub-national policymakers with the technical guidelines between September 2022 and January 2023. (WHO, 2023a; 2022a; 2022b; 2022c; 2022d; 2022e; 2022f). However, these guidelines were implemented in many different ways reflecting the unique situations of various locations.

This paper aims to analyze the changing urban forms facing COVID-19 pandemic in global cities. Specific questions include: (1) do global cities experience a spatial restructuring process with population redistribution, office relocation, and change in commuting due to the rise of WfH (Work from Home)? and (2) do global cities return to pre-pandemic normalcy? Four global cities, New York, London, Tokyo, and Los Angeles are selected for the empirical case study for this paper. The first three are the original three in Sassen’s work. In her work and others’ related works, global cities at the top of global urban system. A disproportionally large number of the headquarters of largest multinational corporations, international organizations, and financial corporations are located in those cities, so the global cities themselves are the headquarters of the global economy. Due to its connectedness with the rest of the world, they are some of the largest victims of the COVID-19 pandemic and were also at the forefront in urban responses to the pandemic. These characteristics shared by the three cities make them worth studying but set limitation in generalizing the findings. That is why we add Los Angels. Los Angels is equally well-connected with the rest of the global urban system through its multiethnic composition of population. The economy of Los Angels is not specialized in headquarters of global organizations like the three global cities. Rather, it is the global capital of entertainment industry and has various manufacturing sectors such as textile, furniture, jewelry, among others. Inclusion of Los Angeles will add generalizability of this study. After analysis of these four cities, we conduct a meta-analysis to compare the pandemic shocks, policy responses that impact the spatial restructuring, post-pandemic reorientation, and how the pandemic experience are reflected in the long-term planning practice in the four cities.

For the comparison purposes, ‘Pre-Pandemic’ period is defined as the time period prior to March 2020, ‘Pandemic’ period refers to the 22 months between March 2020 to December 2021, and ‘Post-Pandemic’ period is defined as the time period since early 2022. Since each global city in this study has its unique experience with pandemic and the associated policy implementation, the suggested timeline does not perfectly fit; however, the three time periods employed provides the insightful analyses on the various trends facing COVID-19 pandemic and the plausible forecast for the new-normal after the pandemic.

The most significant change was in workplaces and commuting with increasing options/flexibility associated with ‘Work from Home’ (WfH) in the COVID-19 pandemic. WfH includes full remote (working 5 days a week remotely) and hybrid (working 1-4 days a week remotely). Both types of WfH increased significantly in many world cities. The case studies in this paper examine the changes in WfH and the associated change in commuting. These lifestyle changes also resulted in spatial restructuring in the proposed case studies of the global cities. Additionally, population redistribution in space can cause spatial restructuring as well. This paper compares the pre- and post-pandemic population redistribution patterns through intra-metro residential relocation and inter-metro migration. Change in demand for office space at urban cores and potential office relocation are other significant factors that impact spatial restructuring in global cities. These will be summarized to discuss the potential conversion from office space to residential use, and the office real estate market status in each metropolitan area will also be reviewed.

Finally, the meta-analysis will analyze the similarities and differences among the global cities’ experiences. In particular, each city region will be discussed, taking into account cultural and environmental aspects, as well as institutional differences in terms of administration and policy.

The next section describes major findings from the four global cities’ pandemic and post-pandemic reorientation in urban forms, followed by the meta-analysis and major findings from comparisons among the four global cities in section 3. The section 4 concludes with policy implications on the post-pandemic reorientation, also shares future directions of this study.

Ⅱ. Global Cities in Pandemic and Post-pandemic Reorientation

COVID-19 pandemic abruptly and unexpectedly changed our daily life since early 2020. The geographic scope of the pandemic extends massively and the impact has lasted much longer than expected. Especially, the global cities were more vulnerable to the pandemic due to the higher population density and higher level of interpersonal interactions. This section analyzed how the COVID-19 pandemic has impacted the selected global cities, New York, London, Tokyo, and Los Angeles since the onset of the COVID-19 outbreaks in early 2020.

1. New York Metro, USA

New York metro is often referred to as the tri-state area and covers 31 counties including 5 counties of New York City and 26 suburban counties in New York, New Jersey, and Connecticut states. This is a regionally adapted definition that was used for New York City’s regional analysis purposes (NYC DCP, 2022), which is equivalent to the definition of the U.S. Census Bureau’s New York–Newark, NY–NJ–CT–PA Combined Statistical Area. <Figure 1> shows the geography of the New York metro as well as its five sub-regions. As the most densely populated metro region in the US (U.S. Census Bureau, 2023), the New York metro has a strong foundation based on large and diverse labor and consumer markets. New York City is the economic and cultural core in the New York metro, occupying two thirds of the New York metro’s jobs with significance in trade, transportation and utilities, financial activities, information, professional and business services, educational services, health care and social assistance, and leisure and hospitality industry sectors (New York City Department of Labor, 2021).

Since the first COVID-19 case was confirmed in New York City on March 1, 2020 and New York State declared a state of emergency on March 7, 2020, a series of government responses to the pandemic have been made on travel restrictions, school closures, and mask requirements until the first phase of economic reopening on June 8, 2020. Workers phase by phase were permitted to return to the workplaces during the reopening time but most workers remained to work from home. Following the second wave of COVID-19 and approval of COVID-19 vaccines, the full opening of New York City was announced on June 15, 2021. This section discusses the recovery experiences that center on WfH and associated commuting, population redistribution, and office demand over the course of Pre-Pandemic through Post-Pandemic periods as of early 2023.

From the onset of COVID-19 pandemic, commuting in New York City and New York metro underwent substantial changes when compared with the Pre-Pandemic period. The recovery patterns of commuting impacted since the COVID-19 pandemic unfolded differently by each transportation mode such as private vehicles, commuter rails, buses, and subways.

<Figure 2> contrasts monthly commuting trends by transportation modes from January 2020 to February 2023. Road travel using private vehicles was the least impacted mode. Road traffic returned to the pre-pandemic level promptly after relaxing the first wave of travel restrictions. Traffic volumes on bridges and tunnels entering and exiting Manhattan, the region’s hub in the New York metro, continued to report over 90% of the pre-pandemic level within a year. In early 2023, the traffic volume essentially returned to the pre-pandemic level, reaching on average 99% of the pre-pandemic traffic volumes.

Public transportation ridership has experienced dramatic declines during the COVID-19 pandemic. Social distancing measures, fear of indoor space and the surge in remote work made many people avoid public transportation. Since then, the public transportation ridership has slowly climbed up, however, the recovery rates were not as fast as they were hoped. As of early 2023, the public transportation including buses, subways, and commuter rails overall returned to 60% to 70% of the pre-pandemic level. Looking further into the detailed recovery patterns in public transportation, ridership began to increase first in off-peak and weekends activities, and then buses and subways, followed by commuter rail ridership. Most recent growth in public transportation ridership shows that the peak-hour demand during weekdays has come back while Mondays and Fridays are still weak in ridership compared to mid-week.

Commmuting has been impacted and shaped by WfH, which has been the most significant change in people’s lifestyle in relation to the COVID-19 pandemic. WfH including both full remote work and hybrid work increased sharply. According to the American Community Survey, about 5.7% of workers worked from home in 2019. In 2021, about 17.9% of workers worked from home, which is three times higher than the 2019 level (Burrows et al., 2023). During the same period, the New York City’s workers who worked primarily from home increased even higher than the U.S. national average from 4.7% in 2019 to 24.0% in 2021 (NYC DCP Population Division, 2022). The WfH trend continues to stay and some employers expect to see permanent change in their work from policy.

In the New York metro, based on the methodology developed by Dingel and Neiman (2020), it is estimated that the maximum 40% of workers can work from home, and those who can work from are primarily office workers. More specifically in New York City, the Partnership for New York City conducted a series of surveys since 2020 on major employers in Manhattan to estimate the work from home trend of about 1 million office workers. According to the survey conducted in October 2021, on an average weekday, 28% of Manhattan office workers returned to the office, and 54% of Manhattan office workers are still fully working from home while only 8% returned to the office for full five days. In the latest survey conducted in January 2023, 52% of Manhattan office workers returned to the office, and 10% of Manhattan office workers are still fully working remotely while 9% returned to the office for five days. Overall, the return to office rate of 52% as of January 2023 is significantly low compared to the pre-pandemic level, and the majority of employers have adopted hybrid work patterns allowing employees to work from home one to four days a week. Although it would be hard to predict whether the current hybrid remote work patterns would be permanent, it is expected to stay for a while.

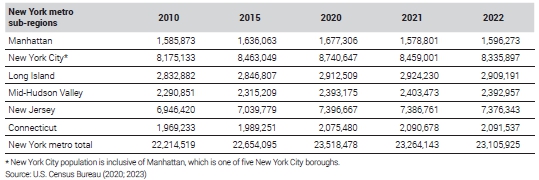

The U.S. Census Bureau released the latest population estimates of the New York metro and New York City as 23.1 million and 8.3 million in 2022 (U.S. Census Bureau, 2023), respectively as shown in <Table 1>. These population numbers reflect that the population estimates for the New York metro and New York City have declined for two years in a row since the COVID-19 pandemic. The declining trend casts concerns regarding the drivers for regional growths. However, according to the New York City Department of City Planning (NYC DCP Population Division, 2023), the recent population estimates and trends indicate that the population decline during the COVID-19 pandemic could be a short-term change. New York City planners expect that the New York metro along with New York City is in the process of returning to the pre-pandemic demographic patterns.

<Table 1> presents population changes during the past decade between 2010 to 2020 in 5-year increments, and recent changes from 2020 to 2022 annually. Before the COVID-19 pandemic, the overall growth patterns in the New York metro showed moderate increase with stronger growth in the region’s core areas. The population increases in New York City, the region’s core area, contributed 43% of the growth in the New York metro since 2010. Brooklyn and Queens counties in New York City have experienced robust population growths, and the fastest growing county in the New York metro was Hudson County in New Jersey state located west of Manhattan across the Hudson River.

As the COVID-19 hit, approximately 282,000 people left New York City from early 2020 to the peak of the pandemic in mid-2021, and Manhattan accounted for about one third of New York City population loss during the period while New York City’s suburban areas such as Long Island, Mid-Hudson Valley, and a few counties in Connecticut state gained population. Beginning from the COVID-19 related lockdown stage, remote work trends escalated and enabled workers to move out from the central business area and choose farther residence locations. On the other hand, population declines at the regional New York metro level were also observed during the same period, which was a result of an uptick in domestic outmigration, the lowest international immigration due to limited border crossings and closed consulates, increased deaths due to COVID-19, and decreased births (NYC DCP Population Division, 2023).

From the second half of 2021 to 2022, the declining population trends began to show signs of reversing them, and Manhattan appeared to gain population as a positive sign of returning to the pre-pandemic trend. Hybrid work patterns that allowed workers to commute one to four days a week still prevailed; however, New York City demographers assess that the population decline patterns were rather temporary phenomena experienced during the COVID-19 pandemic.

Before the COVID-19 pandemic, New York City recorded the highest level of employment with 4 million private sector jobs in 2019. Private sector employment in the New York metro as a region was approximately 9.3 million. However, as the COVID-19 hit, New York metro lost about 1 million private sector jobs over a year, and New York City lost 0.5 million private sector jobs, half of the New York metro's loss, plummeting to the worst since the financial crisis in the 1970s.

<Figure 3> presents private sector employment trends from January 2019 to March 2023, expressing in percent relative to January 2019 for New York City and adjacent submetro areas of Long Island and Mid-Hudson valley in New York state. As shown in the overall trajectory, the recovery from the job losses due to the shutdown of the economy during the COVID-19 pandemic has been modest. New York City’s recovery during the early post-pandemic period in 2020 and 2021 sluggish compared to its neighboring suburban areas of Long Island and Mid-Hudson Valley. From early 2022, New York City has showed steady growth with the stronger job gains in Brooklyn and Queens counties. As of March 2023, New York City’s private jobs returned to the pre-pandemic level with over 4 million private sector jobs.

Monthly private sector employment trends (percent relative to January 2019)Source: New York State Department of Labor (2023)

Despite the rebound from the COVID-19 pandemic-related employment declines, New York City’s economic prospect is not fully confident due to the record high level of office vacancies in Manhattan as reported in March 2023 (Colliers International, 2023b). The office market is an important driver in New York City’s economy not only as one of the major property tax revenue sources but also its secondary impact to bring commuters into the city and spend at local shops.

<Figure 4> shows the leasing activity volumes in square feet and available office inventory rate trends from 2018 to early 2023. During the pre-pandemic period in 2019, Manhattan’s office leasing has reached a high volume with close to a record-high average asking rent of $78.78 per square foot per year and almost 43 million square feet of leasing activities for a full year in 2019 (Colliers International, 2020). As the COVID-19 pandemic hit, office leasing activities dramatically declined to 6.8 million square feet during the first quarter of 2020. In 2021 and 2022, the office leasing activities have slowly recovered. As of the first quarter of 2023, Manhattan office leasing activities increased to 7.4 million square feet, however, this is approximately 75% of the pre-pandemic level, which hasn’t fully recovered the pre-pandemic office demand yet. The continuing trend of full remote and hybrid work patterns and resulting office vacancies became a post-pandemic challenge to New York City.

2. London, UK

The boundary of London has been changing, but in contemporary times, London can mean two different geographical areas. The first is City of London that is a small local government district with area of 2.90 km2, and the second, Greater London that encompasses City of London and 32 boroughs. The latter, defined in 1963 in its current form is the London that is conventionally referred to. Its area is 1,569 km2 and its population, estimated near 9 million. City of London and eleven boroughs at the center are called inner London. The remaining boroughs are called outer London. In this paper, we regard outer London as suburb as shown in <Figure 5>.

During COVID-19 pandemic, London, having little autonomy in health policy, followed the England government’s policies. being one of the most badly affected one among advanced economies, England had three lockdowns starting at 17 October 2020, 5 November 2020, and 5 January, 2021. 22 February 2021 saw the lifting of all COVID-19 related restrictions.

There was a large-scale increase in remote working during the pandemic and such increase was only partly reversed when the pandemic-related restrictions were all lifted. According to Home Office Life (2023), remote working was gradually increasing since 1981 and the pre-pandemic level was 5.7% in February 2020. It rose to 43.1% in April of the same year stayed around 40-50% during the pandemic. London had higher rate at 57.2%.

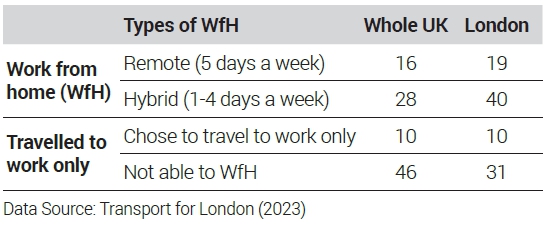

According to Transport for London (2023), in December 2022, 59% of London’s working population is working from home, either partly (hybrid) or fully (remote) (see <Table 2>), The majority of WfH workers is “hybrid working”. It is found that hybrid workers go to offices mainly between Tuesday to Thursday. The surprisingly high figure of 59% work-from-home (WfH) rate in London is even more striking when contrasted to the past. While we lack pre-COVID-19 WfH data for London, we do have comprehensive data for the entire UK. As indicated in <Table 2>, the post-pandemic WfH rate for the UK stands at 44%. In contrast, the rate was a mere 4.7% in February 2020, according to The Home Office Life (2023). This suggests an approximately 40% increase across the UK as a whole. Evidently, the widespread adoption of WfH practices during the COVID-19 pandemic played a significant role in this uptick.

Demographic variations also exist in the implementation of WfH. For example, individuals aged 25-54—who are more likely to be in stable office jobs—show a higher prevalence of home-based or hybrid work arrangements compared to other age groups. Educational attainment influences the likelihood of working from home, too: 67% of those with a university degree work from home, as opposed to only 14% of those without any qualifications. Income level also correlates with WfH rates; 80% of individuals earning above £50,000 work from home, whereas the figure drops to 14% for those earning less than £10,000. Among various occupations, professionals have the highest WfH rate at 71%, followed by managers, directors, and senior officials at 64%. The lowest rate is found among process, plant, and machine operatives at 10% (The Home Office Life, 2023).

The rise of WfH has undeniably had a significant impact on commuting trips, leading to a noticeable decrease in the number of bus and tube journeys. The number of bus and tube journeys did recover as pandemic control measures were lifted, but not to their pre-pandemic levels (see <Figure 6>). While transport statistics do not specifically differentiate between commuting trips and other types of trips, it is reasonable to assume that WfH is the primary factors contributing to this decline in public transport ridership.

The increasing prevalence of WfH is expected to have a significant impact on the spatial structure of London and the demand for housing in various locations. As workers prioritize proximity to their workplaces less due to the decrease in average number of commuting journeys, other factors related to the quality of houses become more influential in their decision-making process. Consequently, this shift is likely to lead to the migration of some workers to suburban areas. While direct statistical evidence of this trend is currently unavailable, several indirect measures suggest such migration.

The rental prices for new tenancies in London have experienced a significant decrease since the beginning of pandemic. GLA Demography (2021) reports, based on the HomeLet Rental Index, by February 2021, the rental prices for new tenancies in London were five percent lower compared to the previous year. This stands in stark contrast to other regions where rental prices showed comparable increases. The Rightmove Rental Trends Tracker data for the first quarter of 2021 quoted in GLA Demography (2021) indicates that asking rents in Greater London decreased by 7.8% compared to the same period in the previous year. This data further reveals a distinction between Inner and Outer London, with Inner London witnessing a major decline of 14.0%, while Outer London experienced a more modest fall of 1.1%. In contrast, national rental prices increased by 4.2% during the same period. The decrease in rental prices in Inner London may be attributed to a reduced demand for accommodation due to a decrease in the number of people seeking to rent in the city. This could be a result of fewer individuals moving to London or more people leaving the city. The substantial increases in rental prices observed in surrounding regions during the same period lend support to this possibility.

Surprisingly, the square footage of rental contracts of offices in central London is nearly returned to the pre-pandemic level according to Gerald Eve (2023), as shown in <Figure 7>.

However, it is difficult to believe that such a trend will continue. Given the WfH is a lot more prevalent compared to pre pandemic era as discussed earlier, demand for offices in central London is likely to be less than that in the pre-pandemic era, too. Then, why the number of transactions has recovered? While it is impossible to give the definite answers, this finding is in line with ARUP (2022) listing several causes of a temporary recovery: “1) Constrained supply, with a limited number of development opportunities available; 2) Significant pre-letting of new developments (a prelet is a lease agreement made before the property is up-and-built, for example whilst it is still under construction); 3) A flight to quality, leading to particular demand for new or refurbished prime office space. This has been driven by a desire for low carbon offices and wider environmental credentials, higher growth in emerging sectors that place a value on prestigious offices (and lower growth in those that do not), and growth in desire for central locations; 4) An enticement of shorter-term leases, often in exchange for protecting price; 5) A delay in decision making from 2020 and early 2021 and so some pent-up demand.” (p. 36)

3. Tokyo, Japan

The Tokyo metropolitan area is composed of the four main municipalities: Tokyo metropolis and three prefectures, Saitama, Chiba, and Kanagawa. The core of the Tokyo metropolitan area mainly represents the 23 wards of Tokyo where business, commerce, culture, and administration functions are mainly concentrated.1)

Since the first case of COVID-19 of Japan in January 2020, Japanese government had declared a state of emergency in Tokyo four times between April 2020 and September 2021. The main restrictive policies include refraining from unnecessary trips during the daytime and restricting the use of facilities and events. As a result, the government encouraged work from home. In particular, the declaration of a state of emergency is a top-down approach implemented in the global cities in this study.

This section focuses on the spatial restructuring process in the Tokyo metropolitan area, including commuting patterns, population redistribution, and demand for office spaces.

In April, 2020, Japan declared a state of emergency in seven metropolitan areas, including Tokyo, and further expanded it to the entire country later in the same month. Since then, commuting to the urban center in the Tokyo metropolitan area have decreased significantly, while migration (more specifically, residential relocation without the change of jobs) to suburban regions have increased.

Tokyo also experienced a massive increase in WfH during the pandemic. According to the Ministry of Internal Affairs and Communications (2023), the share of WfH across Japan has been on rise since the onset of the pandemic. Moreover, Tokyo's WfH share has increased even faster than other regions (Kanto region including Tokyo is 36.3%). According to the government survey (Tokyo Metropolitan Government, 2023), 51.1% of Tokyo's total workers were classified as WfH workers in February 2023 (see <Figure 8>). The peak of WfH share in the Tokyo metropolitan area was at 65% in September 2020, when a second state of emergency was declared.

In Tokyo, as in other global cities, there are many hybrid workers, working remotely 1-4 days a week. Although the number of full remote workers gradually decreases, they still account for 20.1% of WfH workers (10.3% of total workers) in February 2023 (Tokyo metropolitan government, 2023), while the share of hybrid workers is 79.9% of WfH workers (40.8% of total workers). Tokyo has by far the highest number of employees in service industry, and many of the service industry workers are office workers.

The implementation of the top-down restrictive policy resulted in the rapid growth in the share of WfH workers in Tokyo. The Tokyo Metropolitan Government promoted remote work by sending guidelines to companies and also provided support through subsidies. It also encouraged commuting by walking to reduce public transportation congestion.

<Figure 9> shows the change in foot traffic during commuting hours (6-9 a.m.) between pre-pandemic and pandemic periods. The red areas indicate that foot traffic has increased from the level in the pre-pandemic. On the contrary, foot traffic has decreased in the blue areas from the level in the pre-pandemic. Urban centers show significant decreases, while foot traffics in suburban areas have increased. In other words, while the urban core (or CBD, Central Business District) were busy during commuting hours before the pandemic, increased WfH decreases the number of commuters in pandemic.

Change in Tokyo’s foot traffic during commuting hours (6-9 a.m.) between pre-pandemic and pandemic periodsSource: NHK (2023)

Regarding the change in average daily foot traffic in Tokyo, there was a significant decrease in foot traffic to central Tokyo from December 2019 to November 2021. On the other hand, the average daily foot traffic in the suburbs of Tokyo has increased from December of 2019 to August 2022, indicating that people are moving out of the central area and into the suburbs.

The increasing share of WfH changed the spatial structure of Tokyo and the demand for housing in various areas. The spread of WfH has eliminated the need to commute, and proximity to workplace is no longer a priority (Tokyo Association of Real Estate Appraisers Research Committee, 2022). As a result, relocation statistics show that workers are moving to the suburbs around the Tokyo metropolitan area (especially in Kanagawa Prefecture), where rents are cheaper and the size of houses is relatively large. However, only residential relocation was significant. There has been no significant change in population movement that also involves a change in occupation (Koike, 2023). On the other hand, many of them do not change their jobs, but only move their place of residence with increasing WfH options. International net migration had decreased due to the sharp decline in the influx of foreigners. However, domestic migration among metropolitan areas is not noticeable, unlike the intra-metro residential relocations in the Tokyo metropolitan area.

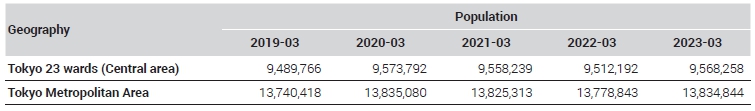

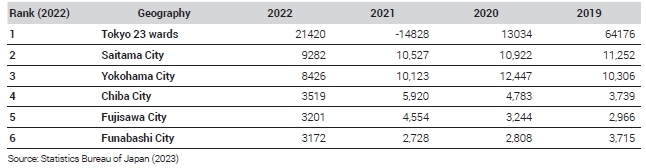

Based on the Ministry of Internal Affairs and Communications 2019-2022 Basic Resident Register population movement report, Tokyo had net out-migration in 2021. The majority out-migrants from the Tokyo metropolitan area have moved to the neighboring municipalities (Saitama, Chiba, and Yokohama) (see <Tables 3 and 4>).

This is the first time since 2014 that there has been net out-migration in the 23 wards of Tokyo. Kanagawa, Chiba, Saitama, Ibaraki, and Nagano prefectures have seen net in-migration from Tokyo and the migration patterns vary by age groups. Younger people in their 20s tend to move to Tokyo, while the outflow from Tokyo is mainly in their 20s and 30s. Additionally, those in their 30s and 40s tend to move to suburbs.

However, population inflows to central Tokyo municipalities are expected to recover, suggesting that the observed out-migration to suburban areas is limited to the pandemic period. The ranking of municipalities with the highest population growth in 2020-2021 was almost entirely suburban, likely due to lifestyle changes such as WfH. According to Recruit Holdings (2022)2), because the people in their 30s and 40s are leaving Tokyo in record numbers, popular areas in central Tokyo are falling in the rankings.

The COVID-19 pandemic has brought about significant changes in the way people work, particularly in urban areas in Tokyo. The increased WfH has significantly impacted commuting behavior of commuters to Tokyo's 23 wards, most of whom live in suburban cities. Companies in Tokyo are now adapting to this new work style and rethinking the use of office spaces in the future. As depicted in <Figure 10>, the vacancy rate of office in the central part of Tokyo had significantly increased from the pre-pandemic trough in March 2020 until July 2021 and maintained over 6% vacancy rate since then. With the significantly drop in demand for office space (reflected by rapid rise of vacancy rate), the average rental price per 3.3 m2 fell below 20,000 JPY (Japanese Yen) in February 2023. This is approximately 13% drop from the peak of 23,000 JPY recorded in July 2020.

4. Los Angeles, USA

Los Angeles metro (Los Angeles-Long Beach, Anaheim, CA MSA, LA Metro hereafter) is the home for 13 million residents, composed of two most populous counties in Southern California, Los Angeles and Orange counties (see <Figure 11>).

Los Angeles-Long Beach, Anaheim, CA MSA (Los Angeles County and Orange County)Source: California Open Data Portal [Map]

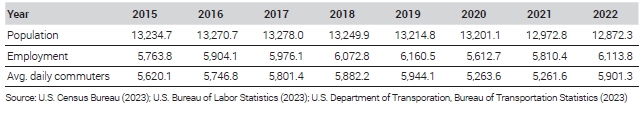

LA Metro is the second largest metro only next to New York metro in the U.S. and serves as a hub for global intercity transactions on global (cross-border) networks for various financial, business, entertainment, and tourism activities. However, the first wave of the COVID-19 in March, 2020 was not as harsh as it was in New York metro. Since the onset of the COVID-19 in the U.S., Governor of California proactively reacted to the potential threats from the contagious disease by placing very restrictive policy measures such as statewide stay-at-home order and public-school shutdown. California was relatively successful to slow the widespread of COVID-19 in the early stage of the pandemic but this brought about unexpected and sudden changes in the daily life in LA Metro. <Table 5> summarizes the annual estimates of population, employment, and average daily commuters in LA Metro. From the peak of population size in 2017, LA Metro has experienced the net loss of population every year until 2022. The largest annual loss of population was in the middle of the COVID-19 pandemic from 2020 to 2021. Even in the post-pandemic period in 2022, population loss continued. However, job market had continuously expanded until 2019, whereas LA Metro had 8.9% annual decrease of employment in pandemic. Employment recovery started in 2021 and by 2022, employment in LA Metro almost recovered to the peak level in 2019. Annual trend of average daily commuters in LA Metro is similar to employment trend, but the drop from the 2019 peak to the trough in 2021 is larger than the employment loss due to the increasing WfH. The increase of commuters in the post-pandemic period is slower than that for employment recovery.

According to the analysis by SCAG (Southern California Association of Governments) Modeling Taskforce Team (Hu, 2023), the share of WfH workers jumped to 27.3% during the COVID-19 pandemic compared to 8.8% in pre-pandemic period in the SCAG region that include six Southern California counties around Los Angeles-Long Beach-Anaheim, CA Metropolitan Statistical Area (LA Metro hereafter). In SCAG region, both types of WfH workers (Remote and Hybrid workers) increases from pre-pandemic period to pandemic period. The share of Remote workers more than tripled from 6.1% to 19.3%, while the share of Hybrid workers also rose almost 3 times from 2.7% to 8.0% as shown in <Figure 12> below.

Commuting pattern change by WfH modes in SCAG region (pre-, during, & post-pandemic)Data Source: Hu (2023)

Since the first statewide stay-at-home order and public-school closure 2020 in California started on March 19, it took almost 15 months to lift all restrictions on businesses and social gatherings until June 15, 2021. Even after all the statewide restrictions were lifted, the daily time spent outside home was at least 6% lower (it ranges from 6% to 16.8% lower) than pre-pandemic average (Chetty et al., 2020).

SCAG’s analysis utilized the two survey datasets for the post-pandemic projection. Based on the SWAA (U.S. Survey of Working Arrangements and Attitudes) data for the overall pattern in the U.S., the combined share of WfH (both Remote and Hybrid workers) is expected to slightly increase to 28.0% in post-pandemic period. However, the analysis based on UCD (University of California, Davis) survey data, the matching share in post-pandemic period is expected to decline by 7.4% (from 27.3% in pandemic to 19.9% in post-pandemic).

The projected post-pandemic WfH patterns in Greater Los Angeles Area (6-county SCAG region) reveals an interesting pattern. The overall share of WfH in Greater Los Angeles Area is estimated to decrease mainly due to the significant drop in the share of Remote workers (those who do not commute at all). Using UCD data, SCAG’s analysis found that it would drop from 19.3% during pandemic down to 7.4% in post-pandemic period. However, the exactly opposite pattern is anticipated for the Hybrid workers, it would increase from 8.0% to 12.5% in the SCAG Region. In sum, the significant drop in Remote workers is estimated to be compensated by the jump in Hybrid workers in post-pandemic period. Consequently, when compared to pre-pandemic period, the post-pandemic share of all WfH workers in Greater Los Angeles Area is projected to rise by 11.1% (8.8% in pre-pandemic to 19.9% in post-pandemic) mainly due to the 4.6 times higher share in Hybrid workers. This also reflects the shifting trend of WfH through the COVID-19 pandemic. Both employers and employees are embracing flexible work by adopting more option to work from home. This may expand the geographic boundaries for residential relocation without the change in jobs. Also, this may impact the future demand for the office/commercial space at the core employment centers in large metros like Los Angeles.

During the COVID-19 pandemic, the net outflow of population from high-cost costal metro areas accelerated (CBRE Research, April 2021). Using the U.S. Postal Service data, CBRE analyzed the impact of COVID-19 on resident migration patterns among the major metros in the U.S. The analysis found Los Angeles Metro at 4th rank only next to San Francisco, New York City, and Seattle for the impact of COVID-19 on net out-migration. Prior to COVID-19 pandemic, the net out-migration from Los Angeles Metro was 6.2 per 1,000 residents in 2019, while the matching net out-migration during pandemic (in 2020) was 8.3 and the increase of 2.1 in a year is estimated as the impact of COVID-19. Additionally, for the net out-migration among the U.S. major metros, Los Angeles Metro was ranked at 8th in 2019, but it was ranked at the 3rd during the pandemic in 2023.

Annual population estimates from U.S. Census indicates that LA Metro have shown the loss of population since 2018 (see <Figure 13>). This pattern is mainly caused by the massive domestic net-outmigration population loss for 2010s. On average, LA Metro had lost 74,298 people annually through domestic net-outmigration and this has accelerated rapidly during the COVID-19 pandemic to the annual net loss of 175,617 people for the 3-year period (2020-2022). The net domestic out-migration peaked in 2021 with an annual loss of 227,599 population to other part of the U.S., but this slowed in 2022 down to the net loss of 170,450.

Population change in Los Angeles-Long Beach-Anaheim, CA MSA (2010-2022)Source: U.S. Census Bureau (2023)

This rapidly growing net-outmigration from LA Metro was not fully driven by COVID-19 pandemic. Rather, rising cost of living and continuously increasing housing cost in Southern California are other major pushing factors. Especially, the housing market in LA Metro during pandemic were overheated and the housing affordability got significantly reduced (CAR, 2022). Many of the local residents from LA Metro moved to other surrounding metros with more affordable housing options and lower living cost like Las Vegas, NV, and Phoenix, AZ (Anderson, 2022). Linked by more enhanced inter-metro networks, these three metros in the Western U.S. have strengthened functional interactions based on specialized industrial and cultural interactions in a broader region. Increasing flows of people (e.g., migration, tourists, commuters, etc.) and trade flows (goods, services, and knowledge) in the region effectively linked the three metros to form a megapolitan cluster, Southwest Triangle (Nelson and Lang, 2011; Lang et al., 2020). The increasing trend of WfH, more specifically hybrid workers and the rising living cost (mainly driven by rapidly rising housing cost) in LA Metro, the out-migrants from LA Metro may still move to Phoenix or Las Vegas within the Southwest Triangle without changing their jobs. This pattern is expected to further intensify the inter-metro links benefiting affordable metro destinations from the spillover out of LA Metro.

Since the trough of employment in May 2020 following the statewide stay-at-home order in March, LA Metro has added approximately 1.25 million jobs until Feb 2023. However, the total nonfarm employment is still largely lagging behind the pre-pandemic peak in Feb 2020. According to BLS (Bureau of Labor Statistics) monthly estimates, the total number of jobs in LA Metro is 6,328,880 in February 2023, similar to that observed in September 2016. Even with the rebound and faster recovery in the second half of 2020 and 2021, the job growth in LA Metro had been sluggish during 2022. Coupled with the embracing flexible work with the increasing demand for WfH (especially, hybrid workers), the demand for office space in major employment centers of LA Metro has significantly decreased. According to the Marketbeat Reports by Cushman and Wakefield (Campion, 2023), the vacancy rate for the office space in Greater Los Angeles has been continuously on rise since the onset of COVID-19 pandemic (1st Quarter of 2020) (see <Figure 14>). However, even with the increasing vacancy rate during pandemic (Q1:2020 to Q4:2021), the asking rent for office space (measure in $/sf, monthly) continued to rise for the same period. This can be partially explained by the pre-pandemic shortage of office supply and optimistic expectation for strong rebound in office demand with the post-pandemic economic recovery. But, the rosy expectation in the office real estate market largely overlooked the impact of the WfH pattern in post-pandemic period.

Starting from the first quarter of 2022, the asking rent for office space has been declining and the vacancy rate continued to grow in Greater Los Angeles. In addition, Marketbeat Reports by Cushman and Wakefield (Campion, 2023) projects that the office vacancy problems in Greater Los Angeles continues with the greater downward pressure on rental price in coming months and years. This also reflects the reduced demand in office space due to increasing flexibility with WfH options among the workers in SCAG Region and the lagging recovery in employment market.

The unexpected massive shock of COVID-19 negatively impacted the regional employment in LA Metro where the housing affordability had been a growing concern. Flexibility of employers embracing the increasing demand for WfH in post-pandemic keeps the overall commuting volume lower than the volume in pre-pandemic period. Through the interactions of the commuting volume reduction due to the rise of WfH, population redistribution, and office real estate market, the observed changes in LA Metro during the pandemic are expected to last in post-pandemic period.

Ⅲ. Meta-analysis and Discussion

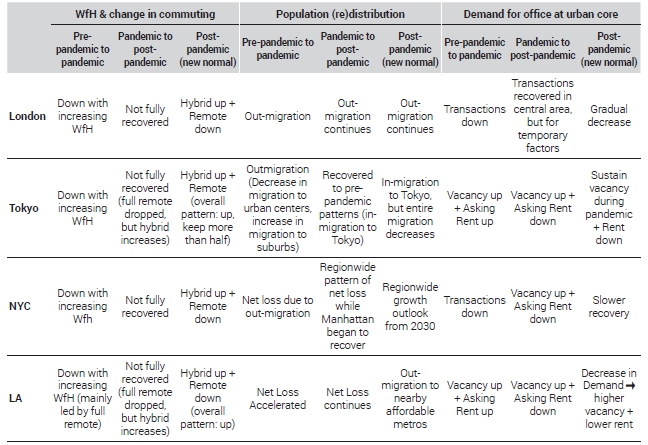

COVID-19 is likely to leave lasting change to cities. In this paper, we focused on factors that influence overall urban form. Four global cities analyzed in this study share some common paths of change facing the COVID-19 pandemic. However, in the post-pandemic period, the observed changes (both direction and speed) in the four global cities are different in details. <Table 6> summarizes the result of meta-analysis for Pre-Pandemic, Pandemic, and Post-Pandemic changes in the four global cities in this study.

First, all had experienced the sharp decline in daily commuting volume due to the rapidly increasing WfH in pandemic. Two types of WfH in pandemic, Remote Work (fully working at home for 5 days a week) and Hybrid Work (working at home for 1-4 days a week). Especially, in the early pandemic period, Remote Work had been the dominant type of WfH, while transition from Remote Work to Hybrid Work has been noticeable since the reopening with the widely available COVID-19 vaccine since spring 2021. Even in the post-pandemic period, none of the four global cities has fully recovered back to the pre-pandemic commuting levels and this can be largely attributed to the higher than per-pandemic level of WfH with growing importance of Hybrid Work. Second, net loss of population from the global metros are common as well at least during the pandemic. This is closely linked to the sharp decline in daily commuting trips and expanded flexibility for WfH. Housing cost in these global cities was another factor that pushed some residents to other locations. Though the observed population losses through net out-migration in pandemic still continues in post-pandemic period, the change and the prediction for the post-pandemic population (re)distribution vary by global cities included in this study. Thirdly, the office rental market at urban-core in the four global cities had declines in demand observed by growing vacancy rates. Even with the higher vacancy rates, the decline in demand for office space at urban core of the global cities was not fully translated into the reduction in rental price. This can be explained by the expectation in the market for quick and full recovery from the pandemic shock in the early stage of the COVID-19 pandemic. However, as the pandemic lasted longer than expected and the large share of the WfH in pandemic translates into quasi-permanent in post-pandemic period, the asking rental price in commercial real estate market started to decline following the declining demand. The recovery and predicted long-term change vary by the global cities as the level of WfH varies by location.

The observed common paths do not guarantee the common paths of change in post-pandemic period. New normal (the settled down permanent change in post-pandemic) is expected to diverge reflecting the specificities of each global city. In terms of the change in commuting, the share of WfH workers greatly vary. For example, except for LA Metro, WfH including both Remote and Hybrid Work in three other global cities is estimated to be over 50% in post-pandemic period. Even in LA Metro, the share of WfH workers will be at least three time higher than the pre-pandemic level, but it is estimated less than 30% of total workers. Among the four global cities, LA Metro has the highest concentration in entertainment, retail, and tourism services with higher inter-personal interactions. This can partially explain why the majority of the workers in LA Metro (over 70%) is still expected to be back to office while London, New York, and Tokyo are expected to have less than 50% of workers fully back to office. The permanent or at least, quasi-permanent change in commuting options as new normal in post-pandemic period raises concern about slow recovery in public transit ridership, especially among the long-haul commuters to New York City. For the predicted population relocation in post-pandemic period, the net out-migration pattern in New York City to surrounding regions got slower and by 2030 population growth is expected. However, the population losses in London and Tokyo to surrounding and more affordable cities without job change (this can be classified as residential relocation with flexible WfH options) are estimated to continue in post-pandemic period. In LA Metro, the net loss of population also continues in post-pandemic period, but the geographic scope of out-migrants is larger for their destination choices such as more affordable metros with abundant of jobs in nearby state such as Phoenix, AZ and Las Vegas, NV within Southwest Megapolitan Cluster in the U.S. The continuing relocation of residents in LA Metro to these destinations may induce the business relocations from LA Metro with higher business cost to nearby metros that offers much more attractive business environments. The long-term prediction for the office rental market at urban core shows different patterns by location. In New York City, the demand is still lower than the pre-pandemic level but it shows the signs of recovery, especially with the growing demand for newer office spaces, which drives up transactions. The declining demand in Tokyo stopped since the beginning of 2021, but with the growing WfH even in post-pandemic, the demand is expected to be weaker than the pre-pandemic level. Office rental price in LA Metro is predicted to further decline due to the demand for office space at urban core continuously declines combined with relocation of employers out of the urban core with unfavorably high rental cost. While the downtown office transaction records in London indicate a revival in post-pandemic period, experts caution that this recovery is dependent on several temporary factors. The combination of decreased space demand resulting from the rise of remote and hybrid work, along with London's diminishing status following Brexit, makes it highly probable that office demand will gradually decline over the following decades. The only plausible alternative scenario is that the downtown office market thrives at the expense of office markets in other parts of London.

The diagram in <Figure 15> reflects the “pattern” that we found across the four metropolitan areas.

Increase in work from home is likely to cause physical expansion of a metropolitan city. Obviously, this would not be a clean linear process. Reduction of rent in city center will attract some workers and businesses back to the city center. Businesses that longed for prestigious central locations but located in sub centers might be able to afford the central location after the change. Workers whose work cannot be done WfH might take advantage of the reduced rent after this change and move to more central locations. If these happen, the final losers of this change may be the secondary centers of the city not the center. Quick recovery of demand for office spaces in London might be the sign that such complex restructuring is happening. However, these complexities are not likely to reverse the final outcome. Metropolitan cities are likely to physical expand with commuters from more distant places.

Ⅳ. Conclusion

The change in pandemic period and post-pandemic new normal varies across four cities that we analyzed. However, we see clear similarity that might be generalized to other major metropolitan areas in the world. First, global mega cities are expected to expand the geographic scale for their residents and long-haul commuters due to the increased WfH options for workers. The number of commuting per day or even total number of commuters might decrease; however, the average commuting distance per commuting trip though less frequent may rise significantly. Regional transportation planners should step in to estimate the changing commuting behavior with the increased WfH options in a broadly-defined region and provide sustainable quasi-public alternative transportation options with the aim to reduce the long-haul drive-alone traffics from distant residential locations. Second, the rising cost for housing services in pre-pandemic period further accelerated during pandemic in the global cities. The reduced housing affordability creates various types of social issues including homelessness. The vacant office spaces can be transformed to accommodate the housing demand of residents. With the increased housing supply at urban core through the transformation, the housing affordability issues can be partially eased. Lastly, global maga cities will see growing demand for shared/temporary office spaces in relatively distant residential areas from urban core. The rising demand for the shared/temporary office spaces might be geographically fragmented and scattered around broadly-defined regions. Potentially, the semi-private office spaces in community centers and public libraries can be utilized at an affordable cost for the local residents who prefer working from/near home to commuting all the way to office at urban cores. In this way, the communities can attract more residents from urban core or other major employment centers, resulting in vibrant community development opportunities.

Because the observe changes in global cities serve resource saving for businesses and employees, we tend to believe these three changes that we found will further for coming decades. Depending upon industrial structure of cities and urban culture, some cities lag behind forerunning cities like New York and London. However, resource saving changes usually spread across globe, so we might see increasing hybrid working, decreasing CBD office rent, and increasing suburban house demand in most of other cities in coming decades. Similar studies on other major cities and revisit of the same topic in five to ten years will be needed to see if this paper’s findings are generalizable across space and time.

References

- ARUP, 2022. The Future of the Office in Central London, Central London Forward.

-

Banai, R., 2020. “Pandemic and the Planning of Resilient Cities and Regions,” Cities, 106: 102929.

[https://doi.org/10.1016/j.cities.2020.102929]

- Burrows, M., Burd, C., and McKenzie, B., 2023. Home-Based Workers and the COVID-19 Pandemic, American Community Survey Reports.

-

Chetty, R., Friedman, J.N., and Stepner, M., 2023. The Economic Impacts of COVID-19: Evidence from a New Public Database Built using Private Sector Data (No. w27431), National Bureau of Economic Research.

[https://doi.org/10.1093/qje/qjad048]

- Colliers International, 2020. Research Report, Manhattan Office 2019.

- Colliers International, 2023a. Market Snapshot, Manhattan Office.

- Colliers International, 2023b. Research Report, Manhattan Office Q1 2023.

- Desai, D., 2020. “Urban Densities and the COVID-19 Pandemic: Upending the Sustainability Myth of Global Megacities,” ORF Occasional Paper, 244(4): 1-4.

-

Dingel, J. and Neiman, B., 2020. How Many Jobs Can be Done at Home?, White paper: University of Chicago.

[https://doi.org/10.3386/w26948]

-

Florida, R., Rodríguez-Pose, A., and Storper, M., 2021. “Cities in a Post-COVID World,” Urban Studies, 60(8):1509-1531.

[https://doi.org/10.1177/00420980211018072]

- GLA Demography, 2021. Population Change in London during the COVID-19 Pandemic, Greater London Authority.

-

Hamidi, S., Sabouri, S., and Ewing, R., 2020. “Does Density Aggravate the COVID-19 Pandemic?,” Journal of the American Planning Association, 86(4): 495-509.

[https://doi.org/10.1080/01944363.2020.1777891]

- Koike, S., 2023. A Demographic Analysis of Domestic Population Movements: Focusing on Recent Year Changes Associated with the Spread of the New Coronavirus, MHLW Research Report [In Japanese].

-

Lang, R.E., Lim, J., and Danielsen, K.A., 2020. “The Origin, Evolution, and Application of the Megapolitan Area Concept,” International Journal of Urban Sciences, 24(1): 1-12.

[https://doi.org/10.1080/12265934.2019.1696220]

- Na, I. and Kenas, E., 2022. Downtown Los Angeles Marketbeat Reports, Cushman & Wakefield MarketBeat reports, Cushman & Wakefield.

-

Nathan, M., 2021. “The City and the Virus,” Urban Studies, 60(8): 1346-1364.

[https://doi.org/10.1177/00420980211058383]

- Nelson, A.C. and Lang, R.E., 2011. Megapolitan America: A New Vision for Understanding America’s Metropolitan Geography, American Planning Association Press.

- New York City Department of Labor, 2021. New York City Significant Industries: A Report to the Workforce Development System.

- NYC DCP (New York City Department of City Planning), Population Division, 2022. Highlights for New York City from the 2021 American Community Survey.

- NYC DCP (New York City Department of City Planning), Population Division, 2023. New York City’s Current Population Estimates and Trends.

- Open NY, 2023. MTA Monthly Ridership / Traffic Data: Beginning January 2008, New York State Open NY.

- PANYNJ (The Port Authority of New York and New Jersey), 2023. Monthly Traffic Volume and E-ZPass Usage, New York State Open NY.

- Sassen, S., 2005. “The Global City: Introducing a Concept,” The Brown Journal of World Affairs, 11(2): 27-43.

-

Sharifi, A. and Khavarian-Garmsir, A.R., 2020. “The COVID-19 Pandemic: Impacts on Cities and Major Lessons for Urban Planning, Design, and Management,” Science of the Total Environment, 749: 142391.

[https://doi.org/10.1016/j.scitotenv.2020.142391]

- U.S. Bureau of Labor Statistics, 2023. Annual Employment Estimate.

- U.S. Census Bureau, 2020. Annual Estimates of the Resident Population for Counties: April 1, 2010 to July 1, 2019. County Population Totals: 2010-2019.

- U.S. Census Bureau, 2023. Annual Resident Population Estimates for Combined Statistical Areas and Their Geographic Components for the United States: April 1, 2020 to July 1, 2022 (CSA-EST2022) Metropolitan and Micropolitan Statistical Areas Totals: 2020-2022.

- U.S. Department of Transportation, Bureau of Transportation Statistics, 2023. Commuting to Work.

- WHO (World Health Organization), 2022a. WHO Policy Brief: COVID-19 Testing, 14 September 2022, World Health Organization.

- WHO (World Health Organization), 2022b. WHO Policy Brief: Clinical Management of COVID-19, 14 September 2022, World Health Organization.

- WHO (World Health Organization), 2022c. WHO Policy Brief: Building Trust through Risk Communication and Community Engagement, World Health Organization.

- WHO (World Health Organization), 2022d. WHO Policy Brief: COVID-19 Infodemic Management, 14 September 2022 (No. WHO/2019-nCoV/Policy_Brief/Infodemic/2022.1), World Health Organization.

- WHO (World Health Organization), 2022e. WHO Policy Brief: Reaching COVID-19 Vaccination Targets, World Health Organization.

- WHO (World Health Organization). 2022f. WHO Policy Brief: Maintaining Infection Prevention and Control Measures for COVID-19 in Health Care Facilities, 14 September 2022, World Health Organization.

- Anderson, D., 2022, October 31. “Homebuyers Are Looking to Move to Sacramento, Miami and Other Relatively Affordable Places as High Rates, Inflation Cut into Budgets,” REDFIN News, https://www.redfin.com/news/housing-migration-trends-q3-2022/

- Anonymous, 2023. U.S. “County 1790-2019 [Geodata],” Accessed August 13, 2023. SocialExplorer.com, , www.socialexplorer.com/explore-maps

- California Open Data Portal [Map], “CA Geographic Boundaries,” Accessed September 4, 2023. https://data.ca.gov/dataset/ca-geographic-boundaries

- Campion, J., 2023. “Greater Los Angeles Marketbeat Reports,” Accessed 14 April, 2023. Cushman & Wakefield, https://www.cushmanwakefield.com/en/united-states/insights/us-marketbeats/greater-los-angeles-marketbeats

- CAR, 2022. “Housing Affordability for All Californians Worsened Amid Skyrocketing Home Price Growth during Pandemic,” Accessed March 24, 2023. C.A.R. Reports, California Association of Realtors, https://www.car.org/en/aboutus/mediacenter/newsreleases/2022releases/2021haibyethnicity

- CBRE Research, 2021. “COVID-19 Impact on Resident Migration Patterns,” Accessed August 1, 2023. CBRE Inc. https://www.cbre.com/insights/reports/covid-19-impact-on-migration-patterns

- Gerald Eve, 2023. “London Office Market Q1-2023,” Accessed August 1, 2023. https://www.geraldeve.com/insights/london-markets-q1-2023/

- Hu, H., 2023. “Work at Home Data Analysis of Pre, During, and Post‐Pandemic,” Accessed August 11, 2023. SCAG Modeling Taskforce Presentation, Southern California Association of Governments. https://scag.ca.gov/post/modeling-task-force-march-29-2023-work-home-data-analysis-pre-during-and-post-pandemic

- Mikishoji Co., Ltd., 2023. “Office Market,” Accessed August 11, 2023. https://www.miki-shoji.co.jp/rent/report/branch/21

- Ministry of Internal Affairs and Communications, 2023. “Telework Implementation Status,” Accessed August 13, 2023. https://www.soumu.go.jp/johotsusintokei/whitepaper/ja/r03/html/nd123410.html, [In Japanese] https://www.miki-shoji.co.jp/rent/report/branch/21

- New York State Department of Labor, 2023. “NYS Economy Added 19,100 Private Sector Jobs in March 2023,” Accessed August 13, 2023. https://dol.ny.gov/news/nys-economy-added-19100-private-sector-jobs-march-2023

- NHK, 2023. “Coronavirus Special Website,” Accessed August 15, 2023. https://www3.nhk.or.jp/news/special/coronavirus/outflow-data/

- NYC DCP (New York City Department of City Planning), 2022. “Metro Region Explorer,” Accessed August 23, 2023. https://metroexplorer.planning.nyc.gov/welcome/intro#6.9/40.857/-73.528

- Recruit Holdings, 2022. “2022 Desirable Neighborhoods in the Tokyo Metropolitan Area,” Accessed June 4, 2023. https://www.rethinktokyo.com/sites/default/files/suumo_livable_area_ranking_2022_metropolitan_tokyo_edition.pdf

- Statistics Bureau of Japan, 2023. “Basic Resident Register Population Movement Report 2022”, Accessed September 5, 2023. https://www.stat.go.jp/data/idou/2022np/jissu/youyaku/index.htm

- The Home Office Life, 2023. “Working from Home UK Statistics 2023,” Accessed August 19, 2023. https://thehomeofficelife.com/blog/work-from-home-statistics

- Tokyo Association of Real Estate Appraisers Research Committee, 2022. “Results of Questionnaire Survey on the Impact of the COVID-19,” Accessed January 12, 2023. https://www.tokyo-kanteishi.or.jp/jp/wp-content/themes/guest/assets/images/pdf/corona-05.pdf

- Tokyo Metropolitan Government, 2023. “The Results of the Telework Implementation Rate Survey”, Accessed May 18, 2023. https://www.metro.tokyo.lg.jp/tosei/hodohappyo/press/2023/03/17/12.html

- Transport for London, 2023. “Public Transport Journeys by Type of Transport,” Accessed June 3, 2023. https://data.london.gov.uk/dataset/public-transport-journeys-type-transport

- WHO (World Health Organization), 2023a. “WHO Policy Brief: Gatherings in the Context of COVID-19, 19 January 2023,” Accessed August 13, 2023. https://www.who.int/publications/i/item/WHO-2019-nCoV-Policy-brief-Gatherings-2023.1

- WHO (World Health Organization), 2023b. “Coronavirus Disease (COVID-19) Pandemic,” Accessed August 19, 2023. https://www.who.int/emergencies/diseases/novel-coronavirus-2019?adgroupsurvey=adgroupsurvey&gclid=CjwKCAjwzuqgBhAcEiwAdj5dRh83dHUzLvFNta4LXEW2oWrIXMgrF5U3XFu5v4yIQW3jAUUJrWPWaxoC94EQAvD_BwE