Final publication date 22 Aug 2021

Diagnosis of Existing Design Guidelines for Commercial Land with Changing Consumption Trends

Abstract

This study examined the manner in which the new consumption trends that are materializing because of the growth of online shopping malls and leisure services have affected the gross floor area of commercial properties so far. Furthermore, a diagnosis was presented on whether the existing design guidelines for commercial land will remain adequate for future purposes. To this end, the impact of new consumption trends on the gross floor area of commercial properties between 2003-2019 was confirmed using the data from the 「Online Shopping Trend Survey」 and 「Service Industry Survey」. After setting scenarios for the omni-channel sales, the sales of the online shopping malls, offline retail shops and leisure service businesses between 2021-2029 were estimated through extrapolation based on the actual sales data between 2003-2019. These estimates aided in predicting whether the existing design guidelines for commercial land will remain adequate in the future. It was found that the growth of online shopping malls and leisure service businesses affected the changes in the gross floor area of retail shops and leisure service businesses between 2003-2019. Further, the existing design guidelines for commercial land were confirmed to remain adequate during the 2020s. However, as the demand for commercial properties decline from the mid-2020s, the design guidelines are expected to be revised in the late 2020s. The authors have concluded that designing commercial land for new towns should be anticipated within the next ten years. Therefore, flexible designs for commercial land and solutions to the problem of vacancies in the existing commercial areas were proposed for the future.

Keywords:

Online Shopping Mall, Leisure Service Business, Commercial Land, Design Guideline, Extrapolation키워드:

온라인쇼핑몰, 여가 서비스업, 상업용지, 설계기준, 외삽법Ⅰ. Introduction

In the second half of 2018, the high vacancy rates of commercial properties in the second-phase new towns such as Sejong, Wirye, and Dongtan emerged as a social issue. One possible reason for this phenomenon is that tenants had just begun to move in, and new towns usually take several years to stabilize. However, some experts have pointed out that the problem is the excess supply of commercial real estate despite the low demand in the second-phase new towns. The excess supply relative to demand resulted from a lowering of the planned population while maintaining the commercial land area, which translates to a significant increase in commercial area per capita. Moreover, the increase in supply of mixed-use buildings contributed to the increase in retail shops. The commercial area per capita of new town apartment districts completed after 2015 was 2.2 to 3.5 times larger than that of the 1990s (Korea Land and Housing Corporation, 2015).

Another factor identified as a cause of high commercial vacancies in new towns is the change in consumption trends, best represented by the increase in online shopping mall transactions.1) As can be seen from the recent emergence of the term “retail apocalypse,” commercial properties for offline retail are losing competitiveness amidst the rise of online shopping malls (Shin, 2020). The United States began reporting a closing of major chain stores around 2010, followed by a rapid increase in 2017. More than 5,860 store closings were announced in 2018 alone (Baker, 2019). The situation in China, home to the world’s largest e-commerce market, is similar. Major retail businesses have declined since 2012, and the retail sector’ growth rate has mostly slowed. The number of department stores and superstores that closed in the first half of 2015 was a record-high at 121 (Lee,, 2015). In the United Kingdom, which has the largest online shopping mall market in Europe, there was a surge in the number of shops closing down in major shopping streets. Specifically, around 1,700 shops closed in 2017 alone (Kim,, 2018). Korea’s distribution industry faces a similar situation. Major distributors have announced plans to cut down the number of stores due to declining sales (Jeon, 2020). In developed countries with large e-commerce markets, the crisis experienced by offline commercial properties has been escalating since 2010.

The aforementioned trends are expected to continue at an accelerated pace. The World Economic Forum (2017) predicted that the share of online shopping mall transactions will increase from 10% of total retail sales in 2017 to over 40% in 2026. In Korea, online shopping mall transactions accounted for 24% of total retail sales as of 2018, which is one of the highest among countries with large e-commerce markets (Mirae Asset Daewoo Research, 2020). The outbreak of COVID-19 in early 2020 further stimulated online shopping mall transactions, which in turn aggravated the crisis of offline commercial properties.

This study analyzes the influence of changing consumption trends, including the increase in online shopping mall transactions, on the gross floor area of commercial properties, and based on the findings, assesses the practicality and relevance of the commercial land design guidelines amended by the Ministry of Land, Infrastructure and Transport in 2019. Considering the recent announcement of the third-phase new town projects, it is all the more essential to examine the existing commercial land supply criteria in relation to new consumption trends, so as to prevent the excess supply of commercial land in urban planning.

For the above, this study utilized the 2003–2019 results of the 「Online Shopping Trend Survey」 and 「Service Industry Survey」, provided by Statistics Korea. Extrapolation was employed to estimate future sales of online shopping malls and leisure service businesses, and the estimates were used to calculate changes in gross floor area of commercial property per capita. The existing design guidelines for commercial land were then assessed in terms of their practicality 10 years from now.

Ⅱ. Literature Review

1. Increase in Online Shopping Mall Transactions and Changes in Demand for Commercial Properties

The worldwide commercialization of the Internet in the mid-1990s triggered a gradual increase in online shopping mall transactions. Graham and Marvin (1996) forecasted that the increase in e-commerce will cause changes in the physical forms of cities, transportation, and infrastructure, while Baen (2000) predicted that the growing influence of e-commerce on traditional retail sales will ultimately result in a lower demand for traditional retail spaces. Weltevreden (2007) examined the impact of e-shopping on shopping at city centers in the Netherlands, and showed that e-shopping can substitute or complement offline shopping across various retail categories. Here, substitution occurs when online shopping malls replace traditional retail shops, whereas complementarity is the adoption of omni-channel by combining offline retail shops and online shopping malls (Wrigley and Lambiri, 2015). However, lower substitution rates were observed in the case of attractive stores that provide leisure and entertainment services for which digital consumption is difficult (Weltevreden, 2014). Zhang et al. (2016) compared online shopping mall transactions against commercial property sales from 1999 to 2013, and found that the online shopping mall market enjoyed consistent growth, but the commercial real estate market had slowed since 2011. The rate of increase in new commercial real estate also slowed in the same period.

While the effects of increased online shopping mall transactions vary by retail category, the most vulnerable shops are those specializing in electronics, clothes, daily supplies, music, books, and other products that can be sold through online channels. This is because these products are highly standardized, affordable, and have a stable market demand (Dixon and Marston, 2002; Worzala et al., 2002; Zentner et al., 2013).

The effects of online shopping mall transactions also vary by retail shop type. Worzala et al. (2002) compared the effects of e-commerce on different types of shops in the United Kingdom and United States, and found that the most affected were those along high streets in the former and regional shopping malls in the latter. Liu (2013) and Meng and Ding (2013) verified that the increase in e-commerce in China had a negative impact on traditional lowcost, brandless retail shops and shopping centers. Zhang et al. (2016) confirmed that department stores were the most vulnerable to e-commerce due to their simple tenant mix and undiversified commercial activities. Supermarkets were generally not as affected by e-commerce, but are threatened by the emergence of various online supermarkets. Shopping malls with more diverse options for food and beverage, leisure and entertainment facilities were less influenced by the increase in online shopping mall transactions.

The effects of online shopping mall transactions differed by geographical location as well. In the United Kingdom, major cities and larger town centers were less influenced by e-commerce compared to central areas of medium and small-sized provincial cities (Gillespie et al., 2001; Dixon and Marston, 2002). Singleton et al. (2016) measured the vulnerability of offline retail shops in the United Kingdom to online consumption using e-resilience as a framework. Large centers offering attractive leisure activities in large metropolitan areas and retail shops in rural areas showed the highest e-resilience, while secondary and medium-sized centers were the most vulnerable to e-commerce. While some smaller destinations were vulnerable to the increase in online shopping mall transactions, there were others that exhibited relatively high resilience due to their focus on convenience shopping. These findings demonstrate the geographic polarizing effect of online shopping mall transactions.

2. Adoption of Omni-Channel by Retailers

With the advent of the 21st century, some technologically advanced countries have experienced a shift from traditional offline retail to online shopping malls. Many retailers have adopted the multi-channel strategy of using both online and offline channels. More recently, the adoption of omni-channel has blurred the boundary between online and offline retail. While multi-channel refers to the separate operation of online and offline channels, omni-channel provides customers with a seamless experience through the integration of not only online and offline, but also mobile and SNS (Verhoef et al., 2015).

The Italian philosopher Floridi (2015) proposed an “onlife” future, meaning that there will no longer be distinctions between online and offline. Jongen (2019) predicted that retail will fully embrace “onlife” within the next decade with the integration of online and offline sales channels. This O2O (Online to Offline) trend, which began in 2015, is evident in the expansion of offline shops by Amazon and Alibaba.

Pauwels and Neslin (2015) examined the revenue impact of adding offline stores in a multichannel environment, and found that the addition of offline channels lifted total revenue through a net increase in frequency of purchases across channels. Herhausen et al. (2015) reviewed the effects of integrating access to and knowledge about offline channels into online channels, and verified the synergies of online-offline channel integration. In a ten-month study conducted by Iouguina (2015) in 2014, 100 companies that chose Shopify as their multi-channel e-commerce platform were analyzed. Online and offline channels were found to constitute 58.5% and 41.5% of sales, respectively.

3. Structural Change from Retail to Leisure Service Business

Recently, the increase in online shopping mall transactions and growth of leisure services has led to a change in the role of offline retail shops. Commercial properties that were mostly occupied by retail shops are now being filled by leisure and entertainment services, highlighting the importance of non-retail businesses. As such, striking a balance between retail units and the leisure service business has become a key factor in commercial property planning (Wrigley and Lambiri, 2014; Dolega et al., 2019).

In the United Kingdom, health and beauty services saw a 10.4% growth from 2011 to 2013, and these services together with food and beverage services enjoyed the fastest growth on high streets in 2014 (Wrigley and Lambiri, 2015). In China’s department stores and shopping centers, the proportion of retail shops has been lowered, while that of leisure services, entertainment services, food, and beverage have increased. Previously, the ideal ratio of retail:entertainment: food in shopping centers was 52:30:18, but it is now changing to 1:1:1. Leisure and entertainment services, including movie theaters, have become anchor stores in department stores (Zhang et al., 2016).

The emphasis on leisure and experience in shopping indicates that spaces intended for leisure are utilized for networking and meetings. Among leisure and entertainment services, those showing high growth include food and beverage services, non-alcoholic beverage services, barbers and beauty salons, sports, arcades, movie theaters, and performing arts facilities. These services can be seen as a reflection of the “leisure culture” of the 21st century (Wrigley and Lambiri, 2015).

4. Methods for Estimation of Commercial Land Demand

The various methods used to estimate demand for commercial land include the method based on purchasing power of trading area, comparative analogy method, basic unit method based on trading area consumers, method based on commercial property area per worker, Huff model, MCI model, Multi-Nominal Logit (MNL), regression analysis, and method based on trading area criteria. Among these methods, the more common ones are the method based on purchasing power of trading area, comparative analogy method, and basic unit method based on consumer population (Lee and Yoon, 2012).

The characteristics and problems of common estimation methods were first examined. The method based on purchasing power of trading area calculates shop area by dividing adequate sales per unit area of each retail category over the share of consumption. This is the most theoretically sophisticated and widely used among purchasing power models, but may cause deviation in estimation results as arbitrary judgement may be involved when determining the scope of trading area and estimating the trading area absorption rate by product type.

The comparative analogy method estimates the demand for commercial properties by comparing cities being developed and cities having similar conditions in terms of commercial property scale. While the process of demand estimation is simple and easy to apply, objective assessment is limited as the cities being compared cannot be exactly equal in size and conditions.

Lastly, the basic unit method based on consumer population estimates the potential consumers of commercial properties or number of related workers relative to the planned population, multiples the basic unit of commercial properties by the area, and estimates site area by reflecting the floor area ratio. This method offers the advantage of enhancing the reliability of demand estimation based on statistical data. However, it fails to consider the purpose of city development and site conditions, and may overestimate the number of potential consumers and workers by retail category.

Baek (2000) analyzed estimation methods for commercial land demand in 43 cities in South Korea. The common methods were area per capita, acceptance or random assignment of upper-level plans or unit development projects, and the average or calibrated value from combining the two. The most widespread was the area per capita approach.

From examining the various methods of estimating demand for commercial land, we can see that it is important to apply methods that take into account the different characteristics of commercial sites. The estimation of commercial land area should be performed after sufficient analysis of population, site conditions, and scope of trading areas. Since the increase in online shopping mall transactions and other changing consumption patterns are expected to influence commercial properties, they should also be reflected when estimating commercial land demand.

Ⅲ. Effect of Changes in Consumption Trends on Gross Floor Area of Commercial Properties

1. Need for Analysis

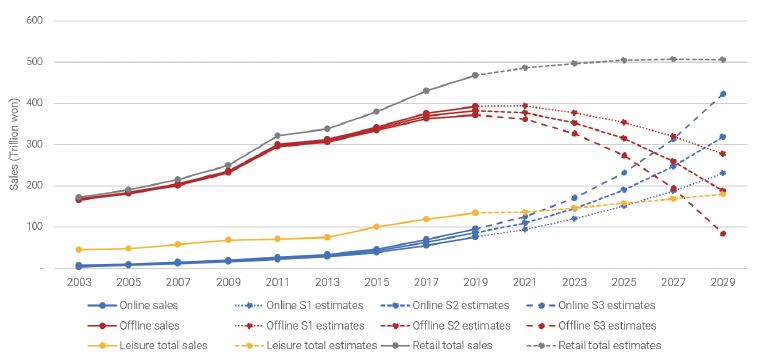

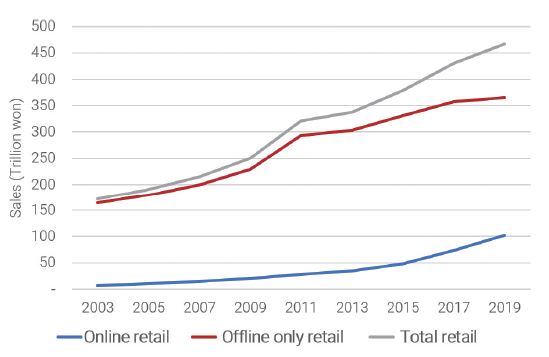

South Korea has seen a consistent increase in online shopping mall transactions over the past two decades or so, and this rate of increase accelerated around 2015. At the same time, the growth of offline retail sales has gradually slowed (Figure 1). Against this backdrop, it is necessary to examine the influence of the rapidly increasing online shopping mall transactions on the gross floor area of offline commercial properties. Past research on the effects of increased e-commerce on the gross floor area of offline retail shops was conducted for the Netherlands and China. For both countries, the expanding online shopping mall market acted as a substitute or complementarity to the offline market, resulting in a slowed growth of the latter (Weltevreden, 2007; Zhang et al., 2016). This study will look at how the increase in online shopping mall transactions has affected the gross floor area of commercial properties in South Korea from 2003 to 2019.

Changes in retail sales of online shopping mall and offline shop (2003~2019)Source: Statistics Korea 「Online Shopping Mall Trend Survey」, 「Service Industry Survey」

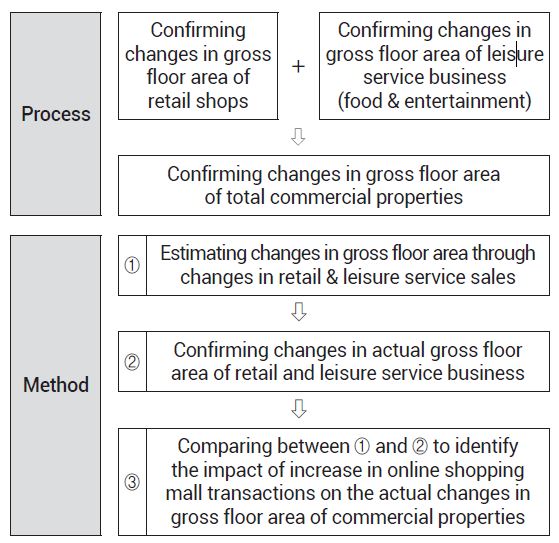

For the purpose of this study, the changes in gross floor area of offline retail shops were examined in relation to the increase in online shopping mall transactions. The changes in gross floor area of leisure service businesses were studied as well to reflect the shift in commercial property structure from retail to food, beverage, leisure and entertainment services. The two were then summed to assess the changes in gross floor area of overall commercial properties.

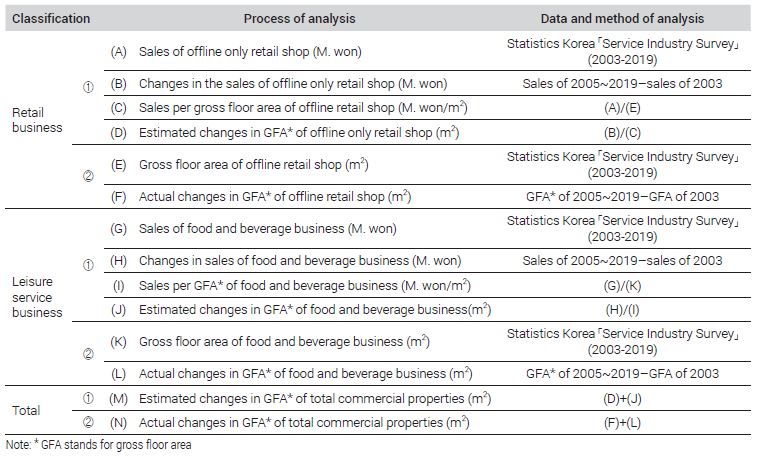

The changes in gross floor area of retail and leisure service businesses were examined using two methods: estimation based on changes in sales, and checking of actual changes in gross floor area. The results of the two methods were compared to identify the impact of increase in online shopping mall transactions on the actual changes in gross floor area of overall commercial properties (Figure 2).

2. Data and Method of Analysis

For the analysis, this study reviewed data on sales and gross floor area of offline retail shops, food and beverage services, and leisure and entertainment services nationwide for nine odd-numbered years in the period between 2003 and 2019. Statistics Korea’s 「Service Industry Survey」 was utilized for offline retail sales and gross floor area. Among data on entire retail shops (including new vehicle retail), those on unmanned shops were excluded. The 2005 data was retrieved from the 「Census of Service Industry」, and 2015 data from the 「Economic Census」.2)

The 「Service Industry Survey」 was used to determine sales and gross floor area of food and beverage services, but data on cafeterias operated within institutions were excluded. As for leisure and entertainment services (movie and video screening, performance facility operation, other sports facility operation, entertainment facility operation), sales records were retrieved from the 「Service Industry Survey 」. However, gross floor area data were only available for 2003 to 2007, and thus could not be fully reflected. For this reason, Leisure and entertainment services were excluded from the analysis as their sales accounted for only 11 to 14% of leisure service businesses from 2003 to 2019. The analysis was conducted using data for food and beverage services only.

This study regarded the increase in online shopping mall transactions as a decrease in offline retail sales. If a decrease in sales is assumed for offline shops, the gross floor area of shops can be reduced proportionately to sales per unit area since purchasing goods from online shopping malls substitutes purchasing from offline shops.

With these presumptions, this study calculated the changes in offline retail sales from 2005 to 2019, with 2003 being the reference year. The changes in offline retail sales in the 2005–2019 period were calculated relative to offline retail sales in 2003. Because it was difficult to accurately determine how much online sales of omni-channel retailers influenced the decrease in offline retail shop areas, this study assumed that 20% of online sales contributed to the decrease in gross floor area. Any difference from actual contribution was deemed negligible as online sales accounts for only a small proportion of total sales in the case of omni-channel retailers. The calculated values were divided by sales per unit area for each year to obtain changes in gross floor area of retail shops by year.

At the same time, the actual changes in gross floor area of retails shops from 2005 to 2019 relative to 2003 were determined. A comparison of the estimated changes against actual changes revealed whether changes in sales of offline retail shops arising from increased online shopping mall transactions led to a decrease in the gross floor area of such shops.

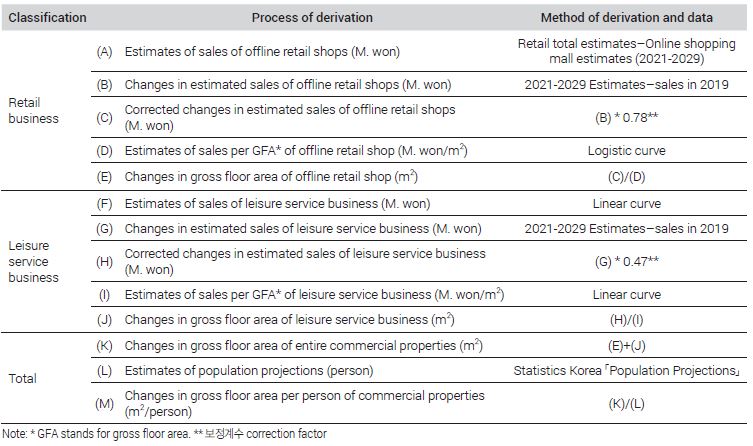

Similarly, the changes in gross floor area of food and beverage businesses were estimated based on changes in sales. First, the changes in sales of food and beverage businesses were calculated for 2005 to 2019 relative to 2003, and divided by gross floor area per year to get changes in gross floor area of food and beverage businesses by year. Next, actual changes in gross floor area of food and beverage businesses were obtained, and compared against estimated values. The estimated and actual changes in gross floor area of retail shops and food and beverage businesses were summed, providing an overall changes in gross floor area of commercial properties (Table 1).

3. Results of Analysis

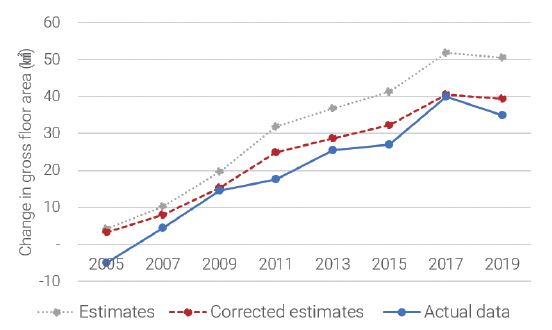

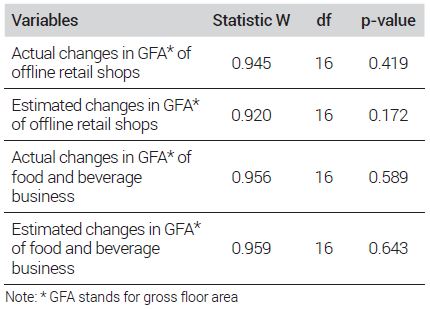

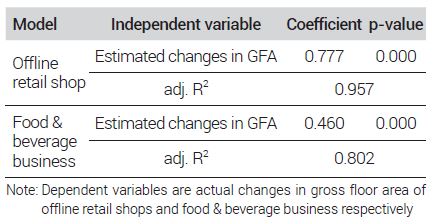

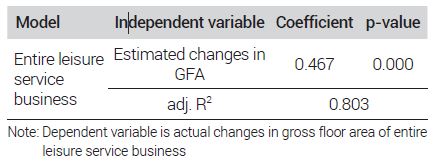

The analysis was carried out as described in the previous section, and the results are as follows. First, in the case of offline retail businesses, both estimated and actual changes in gross floor area saw a drop in rate of increase in the period between 2005 and 2019 (Figure 3). The estimated changes in gross floor area were greater than actual changes, which highlights the need to consider operating expenses in addition to sales. According to Statistic Korea’s 「Service Industry Survey」, the operating profit margin of offline retail shops was about 6% as of 2019. The estimated changes in gross floor area based on sales may show similar trends to actual changes, but the two will not necessarily coincide. To determine how much changes in retail sales influences changes in actual gross floor area, this study introduced a correction factor to make estimated changes in gross floor area similar to actual changes. The correction factor was derived by examining how well the estimated changes, obtained from simple regression analysis, describes actual changes in gross floor area.3) Through this process, the correction factor for offline retail businesses was set as 0.78.

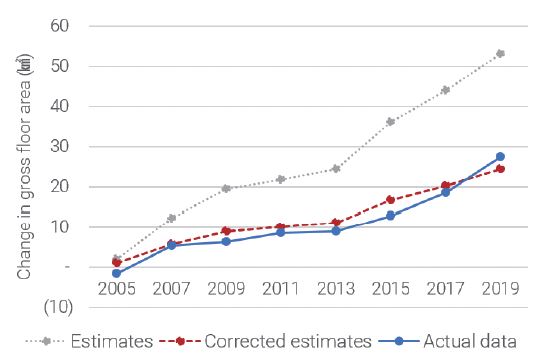

Next, the results for food and beverage businesses show that both estimated and actual changes in gross floor area increased gradually up to 2013, and increased more dramatically thereafter (Figure 4). The estimated changes based on sales were significantly larger than actual changes. Similar to retail businesses, this difference can be traced to the lack of consideration for operating expenses. According to Statistics Korea’s 「Service Industry Survey」, the operating profit margin of food and beverage businesses was about 9% as of 2019. The difference was more significant for food and beverage businesses than offline retail because of their different profit structures in the use of commercial spaces. From this, we can see that the gross floor area of food and beverage businesses is less elastic under changes in sales compared to that of offline retail businesses. To determine how much changes in sales of food and beverage businesses influences changes in actual gross floor area, this study introduced a correction factor to make estimated changes in gross floor area similar to actual changes. Using the process described earlier, the correction factor for food and beverage businesses was set as 0.46.

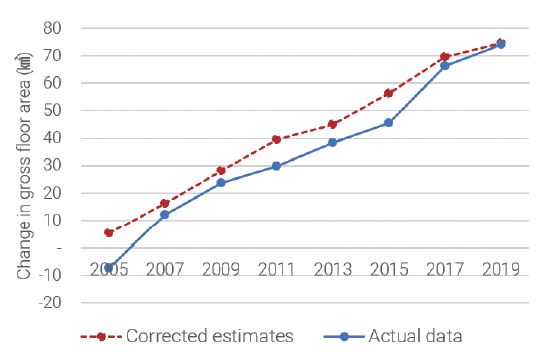

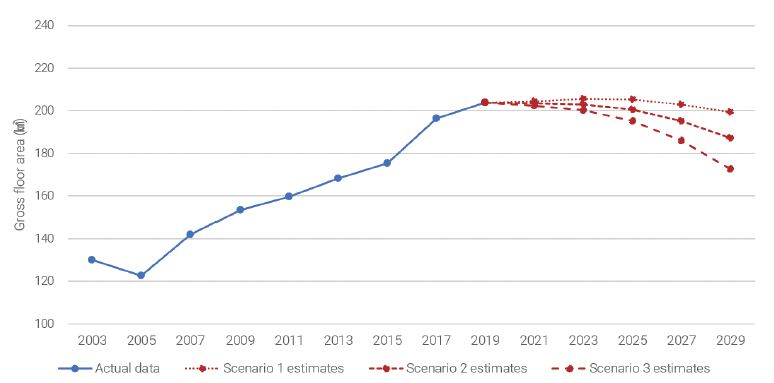

Lastly, the estimated and actual changes in gross floor area of offline retail businesses and food and beverage businesses were summed to determine changes in gross floor area for overall commercial properties (Figure 5). Here, calibrated values were used for estimated changes of both business types. The estimated changes were highly consistent with actual changes, and the gross floor area of commercial properties showed a slowing rate of increase since 2017.

The above results verified that the increase in online shopping mall transactions induce a decrease in sales, and also contribute to changes in gross floor area of offline retail shops. The increase in sales and gross floor area of leisure service businesses, represented by food and beverage, points to the growth of leisure culture services. Commercial properties are undergoing changes with the rise of online shopping malls and leisure service businesses. The next chapter looks at how these trends will unfold in the future.

Ⅳ. Assessment of Adequacy of Existing Guidelines for Design of Commercial Land

1. Need for Assessment of Adequacy of Existing Guidelines for Design of Commercial Land

Recently, the demand for commercial properties has changed with the rapid increase in online shopping mall transactions and growth of leisure service businesses. In particular, the boom of online shopping malls is expected to have an impact on the future demand for commercial properties. As such, it is necessary to assess the adequacy and practicality of the basic unit of gross floor area, a criterion in the supply of commercial properties.

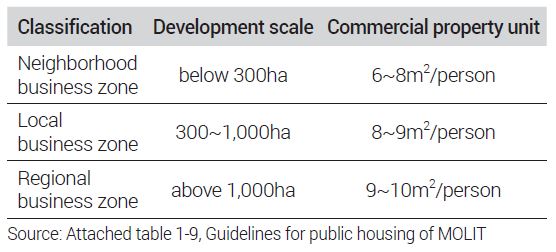

The existing guidelines for design of commercial land were announced by the Ministry of Land, Infrastructure and Transport (2020) in 2019 after amending part of the guidelines on handling of affairs concerning public housing (Table 2). The basic unit of gross floor area of commercial properties is presented as a criterion depending on the size of new towns under development. Here, commercial properties include not only properties in commercial areas, but also properties supplied to quasi-residential and other non-commercial areas. This is why it is necessary to calculate the gross floor area of commercial properties distributed across planned districts. Previously, the criteria proposed by the Korea Research Institute for Human Settlements (1995) more than 20 years ago was deemed too outdated to reflect the rapidly changing circumstances of modern society. The Ministry of Land, Infrastructure and Transport conducted a survey of commercial properties in 20184) to assess the latest trends, and developed today’s guidelines for design of commercial land. The basic unit of gross floor area increased by over four times compared to past criteria, indicating an increase in national income and purchasing power. While this criteria may have reflected commercial property trends in 2018, further assessment is required to determine its relevance and practicality amidst changing consumption trends.

This study seeks to assess the guidelines for design of commercial land, amended by the Ministry of Land, Infrastructure and Transport in 2019, in terms of its adequacy 10 years from now while taking into account the changing trends of online shopping malls and leisure service businesses. Having an accurate future outlook is essential as it takes more than 10 years from the start of new town planning to construction and stabilization.

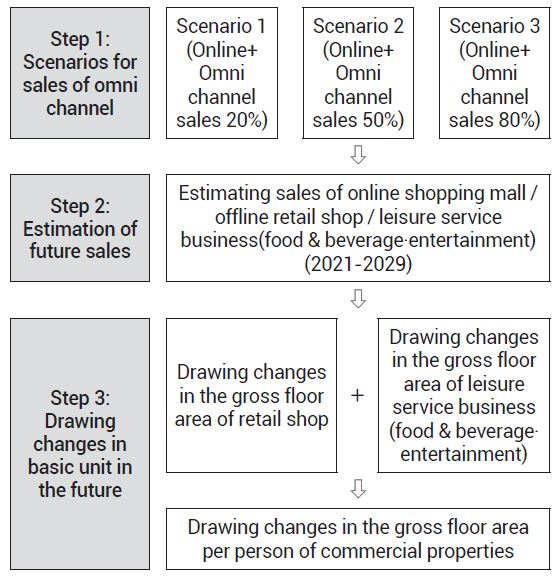

2. Process for Assessment of Adequacy of Existing Guidelines for Design of Commercial Land

With online shopping mall transactions expected to continue increasing rapidly, this study assessed the adequacy of the basic unit of gross floor area of commercial properties as provided in the existing guidelines for design of commercial land. The flow chart of the process is shown in Figure 6.

Flow chart of process for assessing the adequacy of the existing guidelines for design of commercial land

First, this study reflected the trend of adoption of omni-channel by offline retail shops following the increase in online shopping mall transactions. Due to the difficulty of determining how much the online sales of offline retail shops affects the decrease in gross floor area, different scenarios had to be set. The scenarios were designed to see how much of the decrease in gross floor area of retail shops can be attributed to sales generated through online channels of such shops.

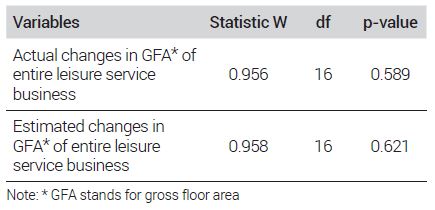

For each omni-channel scenario, the 2021–2029 sales of online shopping malls, offline retail shops and leisure service business were estimated. This step was performed to determine changes in gross floor area of offline retail shops and leisure service businesses. To accurately estimate the influence of leisure service businesses on gross floor area of commercial properties in the future, the analysis in this chapter relied on data for not only food and beverage businesses, but also leisure and entertainment services. While the analysis in Chapter 3 excluded leisure and entertainment services as data was only available for 2003 to 2007, this chapter estimated gross floor areas for 2008 to 2019 based on 2003–2007 data, and included them in the analysis.5) The analysis was conducted with and without estimates for leisure and entertainment services to ascertain differences between the two cases. The method and process of estimating future sales will be explained later in detail.

Lastly, by calculating the changes in gross floor area of retail shops and leisure service businesses as of 2019 based on estimated sales, the changes in gross floor area per person of commercial properties were derived. These changes in gross floor area per person represent the changes in basic unit of gross floor area of commercial properties, and thus can be used to assess the adequacy of the existing guidelines for design of commercial land 10 years from now.

The data used in the analysis of effects of changing consumption trends on gross floor area of commercial properties, as presented in Chapter 3, were utilized, along with nationwide online shopping mall transactions from 2003 to 2019. The data on online shopping mall transactions was retrieved from Statistics Korea’s 「Online Shopping Mall Trend Survey」, and only products falling under retail were included. Service businesses such as travel · transportation and culture · leisure services were excluded as they had no direct influence on offline commercial properties or were deemed to have insufficient data due to differences in item organization. To draw changes in gross floor area per person, the data of Statistics Korea’s 「Population Projections」 2021–2029 were used. The process of assessment of the existing design guidelines for commercial land is examined in detail below.

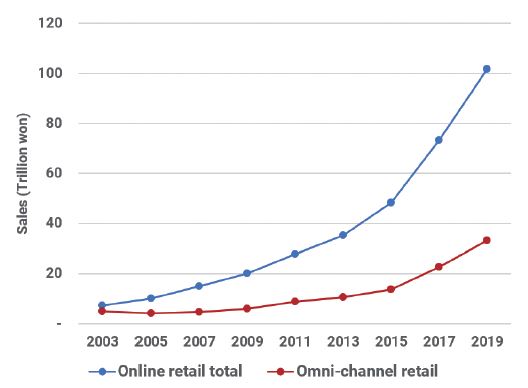

Recently, the rapid increase in online shopping mall transactions has led to some offline retail shops facing a drop in sales. Some shops have embraced online channels to adapt to new consumption trends. The combination of online and offline channels is known as omni-channel retail. In South Korea, omni-channel retail sales has surged with the increase in online shopping mall transactions (Figure 7).

Change in the online sales of omni-channel retail shop (2003~2019)Source: Statistics Korea 「Online Shopping Mall Trend Survey」

Chapter 3 showed that offline retail sales decreased as much as the increase in online shopping mall transactions, which ultimately resulted in a decrease in gross floor area of retail shops. It is necessary to determine how much the online sales of omni-channel retail shops influences the decrease in gross floor area. However, omni-channel retail shops can choose to scale down or maintain their offline shop areas. Some retailers may operate smaller shops to reduce their rent, but others may not.

As such, this study set up different scenarios according to the extent of influence of omni-channel retailers’ online sales on decrease in gross floor area. Among the three scenarios, the first scenario assumed that 20% of online sales of omni-channel retail shops would influence the decrease in gross floor area. The second scenario assumed that 50% of online sales would affect the decrease in gross floor area, while the third assumed 80%. The adequacy of the existing design guidelines for commercial land was assessed for each of the three scenarios.

To assess the adequacy of the existing guidelines for design of commercial land in the future, extrapolation was performed to estimate the 2021–2029 sales of online shopping malls, leisure service businesses, and food and beverage businesses under the three scenarios. The future sales of offline retail shops was derived by first predicting the 2021–2029 sales of all retail shops, both online and offline, and then subtracting the estimated sales for online shopping malls.

Extrapolation is a method that predicts future circumstances based on existing trends. It relies on estimation, not inference, but is widely used to make new discoveries. Accurate estimation is impossible if certain variables are overlooked. As such, a trend equation may be developed by adding variables to the estimated results obtained from extrapolation.

This study considered two variables in the process of deriving an optimal trend equation based on extrapolation. The first is the trend of population decrease. The 「Population Projections」, released in 2019 by Statistics Korea based on the 2017 「Population and Housing Census」, predicts that the total population including foreigners will begin decreasing from 2028. These projections are consistent with 「Resident Population Statistics」, which shows that the number of residents will decrease from 2020 after peaking in 2019. A decrease in population means a decrease in workforce and consumers, which causes a decrease in not only GDP and household income, but also private-sector consumption and expenditure. These changes will lower the sales of retail shops and leisure service businesses. According to Huh (2019), private consumption and expenditure can be maintained proportionately to population based on the permanent income hypothesis6) if workforce declines, but will drop rapidly with population decrease. In estimating retail sales for 2021 to 2029, this study assumed that the increase in sales will gradually slow with the population changes forecasted in 「Population Projections」.

The second variable is the advent of the age of “with Corona.” The COVID-19 pandemic that began in early 2020 is expected to continue, and will have an impact on consumption trends. First, it will accelerate the increase in online shopping mall transactions, and cause a decline in offline retail sales. The sales of leisure service businesses will also decrease, people cutting down on leisure and restaurant dining. This study reflected these trends when estimating the future sales of retail shops and leisure service businesses through extrapolation.

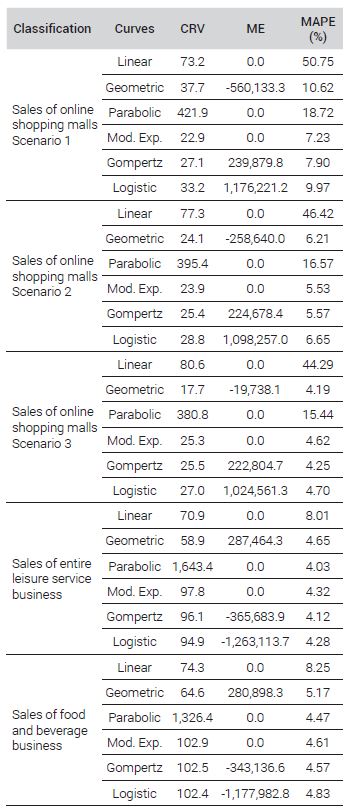

The reference year for extrapolation was 2003, and a two-year interval up to 2019 was applied, giving a total of nine years. The limit of increase was not set, and extrapolation was performed for five years between 2021 and 2029 with a two-year interval. The trend equations used were the linear equation, geometric curve equation, parabolic curve equation, modified exponential curve equation, Gompertz curve equation, and logistics curve equation. The optimal curve equation was selected based on the results of input evaluation method and output evaluation method. The input evaluation method compares the increase in actual sales against changes of the trend equation, and selects the equation that has the smallest coefficient of relative variation (CRV). The result evaluation method examines the differences between actual sales and trend equation results, and selects the equation that most accurately describes past trends. Through this process, the trend equation with the smallest absolute mean error (ME) and mean absolute percentage error (MAPE) is selected. While mean error is not an absolute criterion, it shows how much a trend equation is biased (Kim, 2016).

This study estimated the 2021–2029 sales of online shopping malls, leisure service businesses, and food and beverage businesses for each of the three scenarios. The trend equations were evaluated based on input evaluation method and output evaluation method,7) and the final equation was selected in consideration of the two variables mentioned above. The Gompertz curve equation was selected for future sales of online shopping malls for all three scenarios, while the linear equation was used for all leisure service businesses and food and beverage businesses. The future sales of total retail businesses was estimated with reference to data on projected populations, and the future sales of offline retail shops was calculated by subtracting the estimated online shopping mall transactions from total retail sales for each scenario (Figure 8).

The changes in basic unit of gross floor area of commercial properties were derived based on the estimated future sales of online shopping malls, offline retail shops, leisure service businesses, and food and beverage businesses. Because the basic unit of gross floor area in the existing guidelines for design of commercial land was introduced through a 2018 survey of commercial properties, the adequacy of the guidelines for the future will be able to be assessed by deriving changes in the basic unit based on 2019 figures. Using the same method and process described in Chapter 3, the changes in gross floor area per person of commercial properties in the future were derived (Table 3).

Process and Method of derivation of changes in the GFA* per person of commercial properties in the future

The changes in gross floor area of offline retail shops between 2021 and 2029 were first determined. The future sales of offline retail shops was calculated by subtracting the estimated online shopping mall transactions from total retail sales. The 2019 sales of offline retail shops was subtracted from calculated values to obtain changes in estimated sales of offline retail shops from 2021 to 2029. After applying the correction factor of 0.78, as described in Chapter 3, the values were divided by estimated sales per gross floor area of offline retail shops to get changes in future gross floor area of offline retail shops.

Next, to obtain changes in gross floor area of leisure service businesses and food and beverage businesses for 2021 to 2029, the changes in estimated sales were determined by subtracting 2019 sales from estimated sales. As described in Chapter 3, the correction factor of 0.46 was applied to food and beverage, and a newly established correction factor of 0.47 to leisure service businesses.8) The corrected values were divided by estimated sales per gross floor area to obtain changes in future gross floor area of leisure service businesses and food and beverage businesses, respectively.

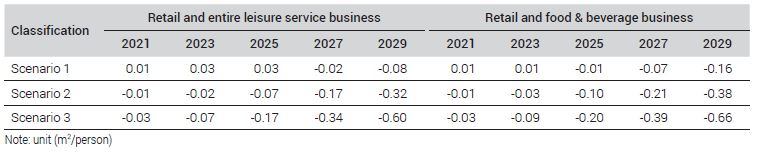

Lastly, the changes in gross floor area of retail businesses and leisure service businesses were summed to get changes in gross floor area of overall commercial properties. The values were divided by projected populations for 2021 to 2029, so as to obtain changes in gross floor area per person of commercial properties for each scenario (Table 4).

3. Results of Assessment of Adequacy of Existing Design Guidelines for Commercial Land

In the previous section, the adequacy of existing guidelines for design of commercial land in the future was assessed in consideration of new consumption trends, including the growth of online shopping malls and leisure service businesses. The gross floor area per person of commercial properties was found to decrease for all scenarios, albeit with variation, from 2021 to 2029. For Scenario 1, the gross floor area estimates increased slightly up to the mid- 2020s, and then gradually decreased. For Scenario 2, the estimates showed a slight decline in the early 2020s, followed by a rapid decrease from the mid-2020s. For Scenario 3, the estimates decreased rapidly from the early 2020s and dropped further in later years. Considering the growing adoption of omni-channel by retailers, however, Scenario 3 is not likely to occur.

Meanwhile, the estimates derived for both leisure service and food and beverage businesses were compared to estimates for food and beverage businesses only. When the analysis was limited to food and beverage businesses, the basic unit of gross floor area was smaller by 0.08m2/person. Since this difference is negligible, the study could be carried out using food and beverage businesses only. However, this study included estimates for leisure service businesses, as doing so would further minimize inaccuracies.

Similar trends can be observed in estimates of gross floor area of commercial properties for 2021 to 2029 (Figure 9). Here, commercial properties include retail shops and leisure service businesses only, but not other business types for which special consumption trends have yet to be observed. The gross floor area of commercial properties falling under retail and leisure service businesses increased consistently from 2003 to 2019, but slowed or stopped in the 2020s. For Scenario 1, the estimates entered stagnation in the 2020s and then gradually decreased from the mid-2020s. For Scenarios 2 and 3, the estimates rapidly decreased from the early 2020s.

The existing design guidelines for commercial land, which were amended in 2019, can be seen as adequate up to the late 2020s for Scenario 1, but less so for Scenarios 2 and 3 in the same period. Since new towns under development will take more than 10 years to stabilize, it is necessary to devise measures for 2030 and later. In particular, the decrease in population from 2030 onwards should also be taken into account. In the near future, there will be a demand for new design guidelines that reflect changing consumption trends.

Ⅴ. Conclusion and Implications

Changing consumption trends, represented by the growth of online shopping malls and leisure service businesses, have been pointed out as a cause behind the high vacancies of commercial properties in new towns. This study analyzed how the new consumption trends affect changes in gross floor area of commercial properties, and assessed the future adequacy of existing design guidelines for commercial land.

The results can be summarized as follows. First, from analyzing the effects of consumption trends between 2003 and 2019 on changes in gross floor area of commercial properties, the increase in online shopping mall transactions led to a decrease in the rate of increase of offline retail sales, thereby contributing to changes in gross floor area. The higher sales of food and beverage businesses, which reflects the growth of leisure services, led to an increase in gross floor area. The changes in gross floor area of retail shops and food and beverage businesses were summed to determine overall changes in gross floor area, and the results showed that the rate of increase in gross floor area had slowed since 2017.

Based on the analysis, the design guidelines for commercial land that had been amended in 2019 were assessed in terms of their adequacy amidst changing consumption trends. Three scenarios were set to reflect varying degrees of influence of omni-channel sales, and different results were obtained. The scenarios were similar in that the existing guidelines may not be adequate 10 years from now due to the decrease in demand for commercial properties. In order to keep up with changes in consumption trends, new design guidelines for commercial land should be developed for the 2030s.

The implications for related policies are as follows. First, when planning commercial land for new town development projects, the plans should consider the effects of new consumption trends on commercial properties 10 years down the road. Since the demand for commercial land is expected to decrease beginning as early as the mid-2020s or in the 2030s at the latest, commercial land supply should be lowered to match the estimated changes in basic unit of gross floor area. At this point in time, it is difficult to accurately predict how much the demand for commercial land will change. New plans for commercial land should thus be more flexible, allowing for the designation of white zones and step-by-step supply of commercial properties.

Second, measures should be devised to respond to vacancies in commercial properties located in existing urban areas. If vacancies in commercial properties are left neglected, such areas may experience a drop in real estate prices or become prone to crime based on the broken windows theory. Other usages should be designated to commercial land with high vacancies through district-unit plan. As the reduced demand for commercial land will be more prominent in areas with rapid population decrease, related policies should be developed with a focus on small- and medium-sized cities in non-Seoul metropolitan areas.

This study has several limitations. First, extrapolation was performed to estimate future sales of online shopping malls, retail businesses, leisure service businesses, and food and beverage businesses. However, it is difficult to determine how much online shopping malls and leisure service businesses will grow, and how much the population decrease and COVID-19 will affect the gross floor area of commercial properties. Although the estimates may not be fully accurate, the demand for commercial properties is bound to gradually decrease.

Second, this study examined changes in sales and gross floor area of retail shops and leisure service businesses to determine changes in gross floor area of commercial properties in relation to changing consumption trends. Due to the difficulty of obtaining data, estimated values were used for the gross floor area of leisure and entertainment services from 2008 to 2019, and changes in gross floor area of living · education · healthcare services could not be obtained. As for wholesale and accommodation, sales and gross floor area data were provided in Statistics Korea’s 「Service Industry Survey」. The two categories, however, were excluded as distinct changes in consumption trends were not observed yet. In the case of wholesale, the share of online shopping mall transactions (B2B) surged from around 2018, and this was accompanied by a decrease in gross floor area. The expansion of online shopping mall transactions in wholesale is thus expected to lead to a decrease in gross floor area even in the future. The analysis of this study was limited to certain business types for various reasons. According to Statistics Korea’s 「Service Industry Survey」, retail shops and leisure service businesses accounted for 66% of businesses with leased commercial properties in 2019, while living · education · healthcare services accounted for 18%, and retail and accommodation constituted 16%. Therefore the changes in gross floor area of retail shops and leisure service businesses, which have the largest share, can be used to generalize trends for all commercial properties. If the gross floor area of living · education · healthcare services increases in the future, it can compensate for the decrease in gross floor area resulting from the increased online shopping mall transactions in wholesale. On the other hand, if the gross floor area of living · education · healthcare services shrinks following the population decline, the gross floor area of overall commercial properties will decrease at a faster rate.

Third, it is mentioned in the literature review chapter that the effects of online shopping mall transactions can differ by geographical location. However, this study did not examine the relationship between changes in consumption trends, including the increase in online shopping mall transactions, and geographical location in South Korea. This is because the primary purpose of this study was to assess the adequacy of existing design guidelines for commercial land amidst changing consumption trends. Since the existing design guidelines for commercial land was developed for nationwide use, this study did not look at how changes in consumption trends differed by geographical location.

Despite the above limitations, this study holds significance in that it performed extrapolation to predict commercial land demand 10 years from now with consideration of changing consumption trends. Moreover, the results can serve as a valuable reference in the planning of commercial land for new town development and to address the issue of high commercial vacancies in urban areas. In follow-up research, more accurate estimates of demand for commercial properties may be derived by employing advanced estimation techniques. Internet usage and income per person can be used as indicators of the varying effects of changing consumption trends by geographical location, allowing the design guidelines to be customized accordingly. In addition, office properties supplied together with commercial properties in commercial land may also be considered for a more realistic assessment.

Acknowledgments

This paper was prepared by extracting and modifying the part of commercial land plans in the report on 「Re-establishment of Urban Construction Plans to Reflect New Demand Trends」 (2019), entrusted by the Korea Land and Housing Corporation (LH) to Korea Planning Association and Yooshin Engineering Corporation.

This paper was prepared by revising and improving a paper presented in the 2019 Fall Congress of the Korea Planning Association.

References

-

Baek, K.Y., 2000. “A Study on Valuation of Estimated Methods for Population and Areas of Each Zoning”, Journal of the Korean Cadastre Information Association, 2: 89-110.

백기영, 2000. “도시계획인구 및 용도지역면적 산정방식 평가에 관한 연구”, 「한국지적정보학회지」, 2: 89-110. -

Baen, J.S., 2000. “The Effects of Technology on Retail Sales, Commercial Property Values and Percentage Rents”, Journal of Real Estate Portfolio Management, 6(2): 185-201.

[https://doi.org/10.1080/10835547.2000.12089607]

- Baker, Sinead, 2019, April 17. “The Retail Apocalypse Has Claimed 6,000 US Stores in 2019 so Far, More Than the Number that Shut Down in All of 2018”, Business Insider.

-

Dixon, T. and Marston, A., 2002. “U.K. Retail Real Estate and the Effects of Online Shopping”, Journal of Urban Technology, 9(3): 19-47.

[https://doi.org/10.1080/1063073022000044279]

-

Dolega, L., Reynolds, J., Singleton, A., and Pavlis, M., 2019. “Beyond Retail: New Ways of Classifying UK Shopping and Consumption Spaces”, Environment and planning B: Urban Analytics and City Science, 48(1): 132-150.

[https://doi.org/10.1177/2399808319840666]

-

Floridi, L., 2015. The Onlife Manifesto: Being Human in a Hyperconnected Era, Springer.

[https://doi.org/10.1007/978-3-319-04093-6]

- Gillespie, A., Marvin, S., and Green, N., 2001. “Bricks versus Clicks: Planning and the Digital Economy”, in Digital Futures: Living in a Dot-Com World, edited by Wilson J., London: Earthscan.

- Graham, S. and Marvin, S., 1996. Telecommunications and the City: Electronic Spaces, Urban Places, Routledge.

-

Herhausen, D., Binder, J., Schoegel, M., and Herrmann, A., 2015. “Integrating Bricks with Clicks: Retailer-level and Channel-level Outcomes of Online-Offline Channel Integration”, Journal of Retailing, 91(2): 309-325.

[https://doi.org/10.1016/j.jretai.2014.12.009]

-

Huh, G.H., 2019. “The Economic Impact of Demographic Change Accompanied with the Special Estimate of Future Population”, NABO Economic Trend & Issue, 83: 58-71.

허가형, 2019. “장래인구특별추계에 따른 인구구조변화의 경제적 영향”, 「NABO 경제동향 & 이슈」, 83: 58-71. -

Iouguina, A., 2015. “Retail in a Multichannel World: Beyond ‘Online vs. Offline’ Usability Research”, Procedia Manufacturing, 3: 5611-5616.

[https://doi.org/10.1016/j.promfg.2015.07.751]

-

Jeon, Y.S., 2020, Feb 13. “Lotte is Destined to Restructure Its Stores⋯ 200 Stores Shut”, JoongAng Ilbo.

전영선, 2020.2.13. “ ‘유통 왕국’ 롯데, 운명 건 점포 구조조정⋯200개 문 닫는다”, 중앙일보. -

Jongen, Wijnand, 2019. The End of Online Shopping, Translated by Moon, K.R., Seoul: Knomad.

[

https://doi.org/10.1142/11106

]

Jongen, Wijnand, 2019. 「온라인 쇼핑의 종말」, 문경록 역, 서울: 지식노마드. -

Kim, H.B., 2016. Analysis of Urban and Regional Economy, Seoul: Kimoondang.

김홍배, 2016. 「도시 및 지역경제 분석론」, 서울: 기문당. -

Kim, S.T., 2018, July 13. “Supermarket, Restaurant, Department Store⋯ the British ‘Retail Apocalypse’ Fear”, JoongAng Ilbo.

김성탁, 2018.7.13. “수퍼·식당·백화점까지⋯ 영국 ‘소매업의 종말’ 공포”, 중앙일보. -

Korea Land and Housing Corporation, 2015. “Establishment of Planning Criteria for Commercial Areas Considering Customer’s Needs and Business Feasibility”, Internal Report of Urban Planning Office, Chapter 1-2, Gyeongnam.

한국토지주택공사, 2015. “고객 니즈(Needs) 및 사업성을 고려한 상업용지 계획기준 수립”, 도시계획처 내부 보고서 제1-2장, 경남. -

Korea Research Institute for Human Settlements, 1995. A Study on the Development Density and Land Use in New Town Development, Gyeonggi.

국토연구원, 1995. 「신시가지의 적정개발밀도 및 용도별 면적배분 기준」, 경기. -

Lee, S.J. and Yoon, J.J., 2012. “Comparative Analysis on the Demand Estimation Method of Commercial Site: Focused on the Case of New Towns in Korea”, LHI Journal of Land, Housing, and Urban Affairs, 3(4): 343-355.

[

https://doi.org/10.5804/LHIJ.2012.3.4.343

]

이상준·윤정중, 2012. “상업용지 수요추정기법 비교분석 연구: 수도권 신도시 사례를 중심으로”, 「LHI Journal of Land, Housing, and Urban Affairs」, 3(4): 343-355. -

Liu, D., 2013. “Jones Lang LaSalle: E-commerce Fully Impacts Retail and Logistics Real Estate”, China Real Estate, 10:92-95.

刘大苗, 2013. “仲量联行: 电子商务全面影响零售, 物流地产”, 「中国房地产业」, 10: 92-95. -

Meng, T. and Ding, H., 2013. “The Discussion on the Business Development Mode in the Era of Online Consumption”, Commercial Times, 20: 38-39.

[

https://doi.org/10.1111/j.1365-2036.2004.02144.x

]

孟特·丁洪艳, 2013. “络消费时代的商业开发模式刍议”, 「商业时代」, 20: 38-39. -

Mirae Asset Daewoo Research, 2020, April 16. Internet Company Report–NAVER, Seoul.

미래에셋대우 리서치센터, 2020.4.16. 「인터넷 Company Report– NAVER」, 서울. -

Pauwels, K. and Neslin, S.A., 2015. “Building with Bricks and Mortar: The Revenue Impact of Opening Physical Stores in a Multichannel Environment”, Journal of Retailing, 91(2): 182-197.

[https://doi.org/10.1016/j.jretai.2015.02.001]

-

Shin, Y.S., 2020, Feb 15. “Retail Apocalypse”, Dong-A Ilbo.

신연수, 2020.2.15. “소매업의 종말”, 동아일보. -

Singleton, A.D., Dolega, L., Riddlesden, D., and Longley, P.A., 2016. “Measuring the Spatial Vulnerability of Retail Centres to Online Consumption Through a Framework of E-resilience”, Geoforum, 69: 5-18.

[https://doi.org/10.1016/j.geoforum.2015.11.013]

-

Verhoef, P.C., Kannan, P.K., and Inman, J.J., 2015. “From Multi-channel Retailing to Omni-channel Retailing: Introduction to the Special Issue on Multi-Channel Retailing”, Journal of Retailing, 91(2): 174-181.

[https://doi.org/10.1016/j.jretai.2015.02.005]

-

Weltevreden, J., 2007. “Substitution or Complementarity? How the Internet Changes City Centre Shopping”, Journal of Retailing and Consumer Services, 14(3): 192-207.

[https://doi.org/10.1016/j.jretconser.2006.09.001]

- Weltevreden, J., 2014. “The Digital Challenge for the High Street: Insights from Europe.” in Evolving High Streets: Resilience and Reinvention–Perspectives from Social Science, edited by N. Wrigley and E. Brookes, 32-35. Southampton: University of Southampton.

- World Economic Forum, 2017. “Shaping the Future of Retail for Consumer Industries”, Insight Report.

-

Worzala, E.M., McCarthy, A.M., Dixon, T., and Marston, A., 2002. “E-commerce and Retail Property in the UK and USA”, Journal of Property Investment and Finance, 20(2): 142-158.

[https://doi.org/10.1108/14635780210420034]

- Wrigley, N. and Lambiri, D., 2014. High Street Performance and Evolution: A Brief Guide to the Evidence, Southampton: University of Southampton.

- Wrigley, N. and Lambiri, D., 2015. British High Streets: from Crisis to Recovery? A Comprehensive Review of the Evidence, Southampton: University of Southampton.

-

Zentner, A., Smith, M., and Kaya, C., 2013. “How Video Rental Patterns Change as Consumers Move Online”, Management Science, 59(11): 2622-2634.

[https://doi.org/10.1287/mnsc.2013.1731]

-

Zhang, D., Zhu, P., and Ye, Y., 2016. “The Effects of E-commerce on the Demand for Commercial Real Estate”, Cities, 51: 106-120.

[https://doi.org/10.1016/j.cities.2015.11.012]

-

Lee, M.M., 2015, Feb 26. “The Latest Trend of Chinese Retail”, Kotra Overseas Market News, http://news.kotra.or.kr/user/globalAllBbs/kotranews/album/604/globalBbsDataAllView.do?dataIdx=140563&column=&search=&searchAreaCd=&searchNationCd=&searchTradeCd=&searchStartDate=&searchEndDate=&searchCategoryIdxs=&searchIndustryCateIdx=&page=155&row=80

이맹맹, 2015.2.26. “중국 소매업 최신 동향”, Kotra 해외시장뉴스, http://news.kotra.or.kr/user/globalAllBbs/kotranews/album/604/globalBbsDataAllView.do?dataIdx=140563&column=&search=&searchAreaCd=&searchNationCd=&searchTradeCd=&searchStartDate=&searchEndDate=&searchCategoryIdxs=&searchIndustryCateIdx=&page=155&row=80 -

MOLIT, “Guidelines for Public Housing”, Accessed March 25, 2020. Center for Korea Laws, http://www.law.go.kr/admRulLsInfoP.do?chrClsCd=&admRulSeq=2100000183619#AJAX

국토교통부, “공공주택 업무처리지침”, 2020.3.25 읽음. 국가법령정보센터, http://www.law.go.kr/admRulLsInfoP.do?chrClsCd=&admRulSeq=2100000183619#AJAX