Final publication date 17 Dec 2020

Analysis on the Change Pattern and Dynamic Characteristics of Location Centrality in K-REITs’ Underlying Assets Using the Spatial Statistical Model

Abstract

This study explores the dynamic characteristics of the level of spatial clustering and the changes in location centrality according to the distribution of domestic real estate investment trusts (REITs) investment property. The analysis targeted 239 K-REITs in operation, nationwide, at the end of 2019. As the methodology to analyze the spatial characteristics, the Bachi measurement and Moran’s index, a type of GIS-based spatial statistical model, were used. The main findings of the research are briefly summarized as follows: First, the location of REIT properties showed significant spatial distribution differences between Seoul and provinces (non-Seoul areas) depending on major attributes, such as the business type, structure, use, management entity, anchor investment, and policy effects. Second, the centrality of the REITs moved southward from the Seoul oriented to provincial areas. In addition, the more residential assets and anchor investors existed in the development project, the faster was the movement of the standard deviation distance. Third, the distribution of REITs tended to be concentrated in certain areas at the global level, such as in downtown Seoul, whereas it displayed random external dispersion patterns in provinces, in line with the issue of new town construction and residential district development on the outskirts of capital regions. From a local perspective, it was observed that the strong hot-spot areas of the REITs formed not only in the southern Gyeonggi province (e.g., Gimpo, Anseong, and Hwaseong) and Incheon within the Seoul metropolitan area (SMA) but also in Chungcheong and North Gyeongsang provinces (e.g., Busan, Daegu, and Cheonan) of the non-SMA. The unique distribution pattern has been largely attributed to the effect of revitalizing the supply of rental housing owing to the prescription of the government-led New Stay policy in the REIT market. These facts indicated that institutional investors with REIT growth adopted investment diversification strategies to minimize the volatility of profit risk by varying the location and size of the portfolio composition. Therefore, the results of this study are meaningful because they quantitatively determined the changes in the location of the underlying assets of REIT from a spatial geographic perspective. Moreover, the study presented a new data visualization technique as a useful basic material for identifying the place of origin of excessive investment trading activity.

Keywords:

Urban Regeneration, REITs, Underlying Asset, Location Centrality, Spatial Statistical Model키워드:

도시재생, 리츠(부동산투자회사), 기초자산, 입지 중심성, 공간통계모형Ⅰ. Introduction

1. Background and Purpose

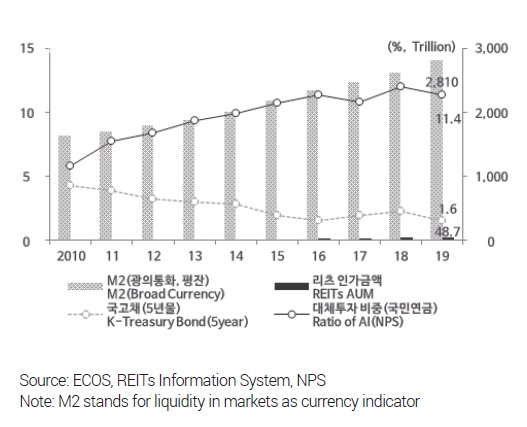

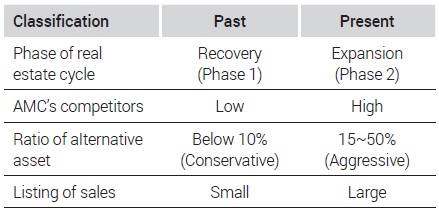

In Korea, Real Estate Investment Trusts (REITs) have long played a huge role in the construction economy; for example, they rescued insolvent enterprises going through financial difficulties during the IMF foreign exchange crisis in 1997 by purchasing real estate. In the long-term new normal period of low growth rate and low interest rate since the global financial crisis in 2008, REITs have been drawing much attention from Pension Fund and Mutual Aid Associations, which have abundant liquid funds, as an attractive alternative investment that can make a high profit stably (Bank of Korea, 2019; Ministry of Land, Infrastructure, and Transport, 2019).1) The National Pension Service, which is one of the three largest pension funds in the world, has prepared a midterm assets distribution plan for 2024 to increase the target alternative investment ratio for real estate and infrastructure (social overhead capital, SOC) up to 15%, instead of increasing the ratio of stocks and bonds (see Figure 1).

In addition to the favorable market environment and the pan-government REITs activation policies (Methods of Increasing Competitiveness of REITs Industry, February 2016; Residence Welfare Roadmap, November 2017), citizens have joined in the investment craze through public offerings. As a result, the REITs market has rapidly grown in the size in a short time compared to real estate funds. With the emergence of urban regeneration new deal projects throughout the country (500 locations, 5 trillion KRW) in response to the period of economic recession, low growth rate and population reduction, REITs have been in the limelight as an efficient financial alternative for urban regeneration in connection with not only governmental finance but also private capital investment.

For example, as of the end of the last year, 247 REITs were in operation, and their total assets under management (AUM) were estimated to be 48.7 trillion KRW (+17.1%) (Korea Association of REITs, 2019). Therefore, it is expected that, along with Real Estate Funds (REF) that invest mainly in actual commercial assets in the private sector, REITs will be considered representative and competitive indirect investment vehicles, and the market demand for REITs will increase further.2)

As REITs business licenses increase each year, and asset management companies compete with each other more severely, REITs are subdividing into different sectors to search out and secure high-quality real estate, even by outbound investment in foreign countries. The locations of the invested assets are also gradually diversifying, breaking free from the high concentration in Seoul (Hong, 2020). Moreover, in association with the efficient asset portfolio strategies of institutional investors to distribute returns and risk (Brueggeman and Fisher, 2016), locations of real estate are becoming more important as core factors in the final decision-making patterns in investment.

The ultimate question that is raised is this: “From where and to where is the center of underlying assets moving in the domestic REITs market, and what is the spatial distribution of locations?” Technically, this question is about the unique characteristics of REITs, including differences between object properties, centrality and mobility, and clustering. This is because the right understanding of the movement of the central points of REITs investment assets and their dynamic motion will be the start of a recognition of the investment strategy of institutional investors.

Few studies have been conducted in Korea in this regard except for Kim et al. (2017). Therefore, there is a need for early exploratory research to acquire basic information in the context of spatial geography.

In line with this, the Ministry of Land, Infrastructure, and Transport established a REITs information system in the form of a comprehensive platform and connected it with the geographic information system (GIS) through the First REITs Advancement Project in 2016, providing a location information map search service to show in the main screen of the platform an overview of REITs-invested real estate in individual metropolitan cities and provinces throughout Korea. Although it is difficult to find details about location trends and differences between regions in Korea because the sample size (75 samples) is small and updating is slow, the platform provides a foundation to investigate the current spatial distribution based on open REITs data that have been accumulating for a considerably long time.3)

With this background, focusing on GIS-based methodology (Korea Research Institute for Human Settlements, 2004; Rogerson, 2010), which has often been used for observation of spatial structures and growth patterns in the fields of urban planning/regeneration and national geography, we have attempted a new interdisciplinary and convergent4) application of the methodology to the REITs, which are corporations according to the Commercial Act (Article 2 of the Real Estate Investment Company Act)5) and of which stocks are traded for investment when listed on the stock market.

The purpose of the present study is to investigate changes of the center movement paths and the dynamic characteristics according to the nationwide distribution of the underlying assets of REITs, and to empirically analyze clustering trends of spatial centralization and decentralization and differences among regions. The results of the present study will help to resolve the spatial imbalance of REITs investment in Korea and find an appropriate urban space structure for the future.

2. Scope and Method of Research

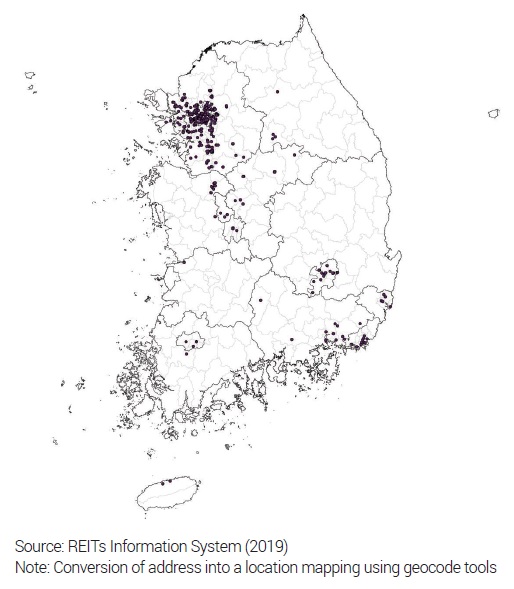

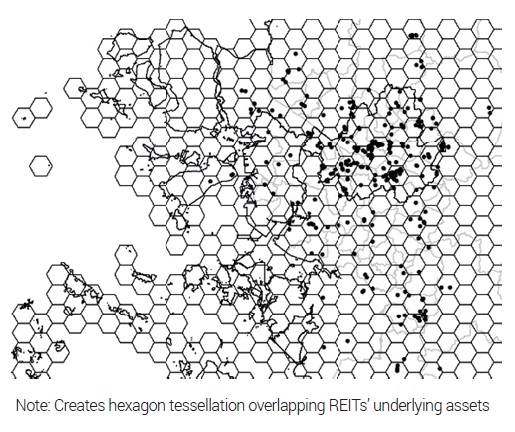

As shown in Figure 2, the spatial scope of the present study consisted of 239 final samples of real assets purely invested in by REITs, which were expressed as small dots on the map. Out of the 254 samples of assets currently invested in by REITs, 15 samples (5.9%), including 5 samples of international investment, 6 samples of trading and acquisition of beneficiary securities, and 4 samples of purchasing equity stake, were excluded, because they can hardly be considered genuine real estate investment in actual assets,6) and they have characteristics different from those of other REITs. The coverage of the research subjects in the present study was about 94.1% with reference to the number of REITs (96.8% with reference to the amount of funds), which was slightly higher than that of the study by Kim et al. (2017).7) Therefore, the samples of the present study improved the accuracy of the analysis and reflected the population parameters well.

The temporal range was 18 years for which continuous time series data are available, from 2002, when REITs were first introduced to Korea, to the end of December 2019, which was the last date of licensing.

The range of contents was divided into four sections, i) to investigate differences in the general locational status between overall REITs underlying assets and the characteristics factors, ii) to derive patterns and characteristics of movement of centers and standard deviation distance from viewpoint of urban growth pattern, iii) to determine spatial centralization or decentralization, and iv) to propose policies for investment diversification to establish an appropriate spatial structure.

The methodologies employed for the present study include a theoretical review based on previous reports and an empirical analysis. The former was combined with a qualitative study for the organization of the significant topology (variable) of REITs attributes and for the logical validity. For the latter methodology, we employed, as a metric model, the spatial statistical model, which is widely used to measure spatial changes. The collected data were analyzed using the SPSS 24.0, ArcGIS 10.7, and GeoDa 0.9.5-i software programs.

Ⅱ. Literature Review

1. Previous Studies on REITs Locations and Spatial Distribution

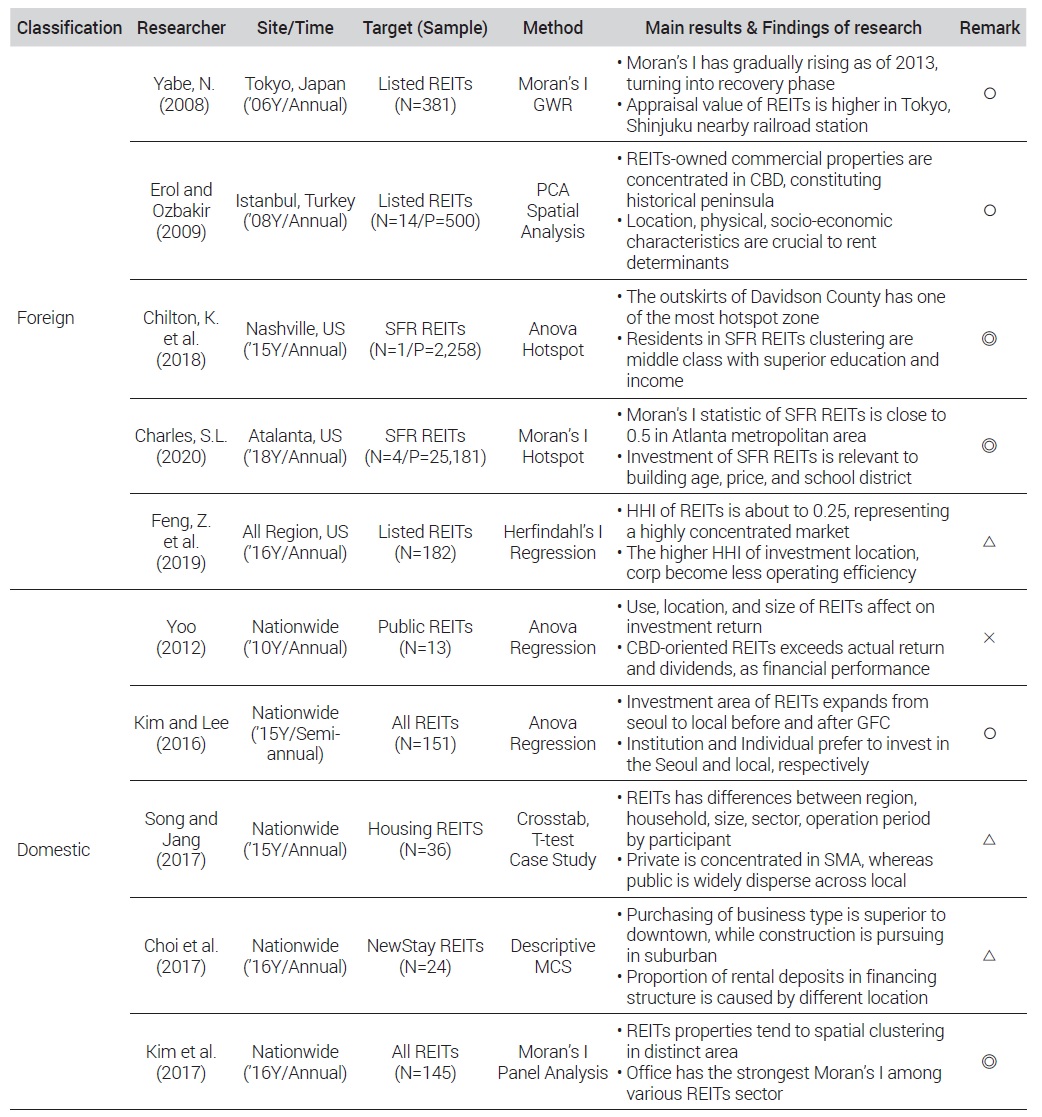

In last a few decades, due to interest of citizens in the market as well as the policy-based support of governments, REITs in both Korea and other countries have become more useful as typical indirect investment vehicles. Hence, numerous studies have been continuously conducted on the REITs market in the fields of economics, industry, and real estate.

In the early years after the introduction of REITs, studies centered on basic academic research to superficially describe and introduce the overall status and characteristics of REITs and to identify operational problems of the system and derive solutions to the problems based on REITs operated in advanced countries such as the US, Japan, Australia, Singapore, and Hong Kong (Jeong, 2008; Choi 2011; Jin 2015).

In the intermediate period when the REITs system settled down, empirical studies began to be conducted to predict stock prices in dynamic interactions with financial and economic variables or investigate the correlation with other capital markets of stocks, bonds, and real estate (Kim & Han, 2010; Lee & Lee, 2010; Choi and Yoo, 2011). On the other hand, studies were actively conducted from a practical perspective on the development stage of new REITs to examine the feasibility (feasibility study: F/S); this was done by calculating the cash flow through yearly income and expense in feasibility studies and perform investment simulations (Seo, Jeong & Cho, 2013; Hyeon et al., 2017).

In more recent years, with various types of REITs established and their quantitative financial accomplishments well-documented, studies have been conducted through a metric approach. In particular, numerous microscopic studies have been conducted to examine the socioeconomic ripple effects of REITs and to identify factors that determine the investment earning rate, the index of management performance (Shin, Yoo & Han, 2016; Lee et al., 2016; Kim, 2019; Kim and Koh, 2019; Park and Jin, 2019). The main methodologies were the time series model of simultaneous equations (ARIMA, VAR, VEC) and multiple regression analysis limited to overall REITs. The scope of exploration was gradually expanded to investment targets and submarkets of individual types of listing.

As REITs are recently being considered as competitive portfolio means for institutional investors, especially during an economic recession, the strategy to diversify the investment areas has been intensified, and in-depth academic studies are being carried out on the importance of location or spatial distribution (Yabe, 2008; Erol & Ozbakir, 2009; Yoo, 2012; Kim & Lee, 2016; Song & Jang, 2017; Choi et al., 2017).

Yabe (2008) investigated how REITs, triggered as a means of securitization of real estate, occupied 64% of real estate in conventional urban areas of Tokyo, Japan, and verified the effects on the variation of the land price, which is a dependent variable. The Geographically Weighted Regression (GWR) model showed that REITs had a positive effect on the deflation of the land price throughout Tokyo, but a high spatial stability was found in urban business zones, such as Shinjuku and Shibuya, with a sudden rise of land price (over 9%) and signs of speculation.

Erol and Ozbakir (2009) used GIS to find that the locations of commercial real estate owned by REITs in the Istanbul Metropolitan Region, as well as their physical, social, and economic characteristics, are the factors that determine the rent, and presented the Real Estate Valuation Index (REVI), based on the combination of the weights of the factors, with a geographical map.

Yoo (2012) reported that the factors to the earning rate of REITs include the use, location, and asset size of the real estate; they performed a variance analysis using location as a dummy variable, showing that public offering REITs located in urban cores acquired high earning rates and paid high dividends.

Kim & Lee (2016) analyzed the locations of 151 REITs-invested assets according to the propensity of the largest shareholders, who have the right of decision-making. The results showed that the quantity of assets of the largest shareholders is concentrated on Seoul in the order of corporations, foreign investors, pension funds/beneficiary associations/public enterprises, and financial institutions (banks, insurance companies and security companies), while individual investor investments are centered on regions other than Seoul. This suggests that corporations that manage the assets of their customers have stricter REITs investment guidelines than do individual investors.

Song and Jang (2017) investigated the sharp contrast in the investment regions among 36 subjects (N≥30) of rental house REITs in the early stage. Results of cross analysis showed that private REITs are concentrated in the Seoul Metropolitan Area, including Seoul and Gyeonggi, where locations and feasibility are superior, while public REITs are widely dispersed throughout the country.

Similarly, Choi et al., (2017) classified the 24 New Stay REITs that passed the investment examination by the Korea Housing and Urban Guarantee Corporation (HUG) into purchase type and construction type, and observed the number and characteristics of each type. Purchase type REITs were mostly officetels and urban lifestyle housing, dependent on and oriented to monthly rent, while construction type REITs for large apartment complexes on the outskirts realized high earnings through deposits for rent. Therefore, the financing structure was very different between the two types. However, the results failed to secure statistical confidence and robustness due to the small sample size.

In consideration of the combination of REITs information and GIS technology, previous studies that are most similar to the present study include the domestic study by Kim et al. (2017) and overseas studies by Chilton et al. (2018), Charles (2020) and Feng et al. (2019), all of which are highly evaluated because of the high accuracy of their systematic analysis of local markets.

Kim et al. (2017) analyzed 145 REITs in the units of si, gun, and gu, the local administrative units of Korea, by applying Moran’s I technique to investigate the spatial distribution of investment assets and business types. Spatial clusterings of the entire investment asset were distinctive in specific regions. With regard to the REITs products, office facilities (0.189) and commercial facilities (0.107) showed a high intensity, but warehouse facilities were not explained with significance. With regard to business types, only residential facilities (0.067) showed a significant tend of spatial clustering among development projects. This previous study was Korea’s first declaratory empirical research on visualization of the spatial distribution of REITs, and prepared the theoretical foundation for extensive follow-up studies.

Chilton et al. (2018) combined 325 census tracts of the US with 2,258 sets of spatial data of Single-Family Rental (SFR) Housing REITs portfolio of Nashville, TN, and found that the hot spots were Davidson County and new outskirts at the boundary. The demographical results also showed that REITs hot spots included more middle class or upper class residents with higher educational and income levels compared to areas where REITs were not concentrated.

Charles (2020) argued that single-family houses invested in by the four large listed REITs in Atlanta, GA, form a U-shaped spatial cluster surrounding the downtown (H-H). In detail, a generalized linear mixed model was used with REITs-owned single-family housing as a dependent variable, highlighting the close correlation with physical assets, neighboring environment, and school district characteristics.

Finally, Feng et al. (2019) substituted the Hurfindahl Hirschman index (HHI), an index that represents market concentration in industry, for the US National Association of REITs (NAREIT), and found that the value was less than 0.25, indicating that the market is oligopolistic. In addition, they reported that the management efficiency decreased as the HHI increased in areas where investment assets were located, and that diversification of locations is effective in increasing the transparency and creating more value.

2. Distinguishing Features of Present Study

As described above, compared to research on REITs conducted with different topics, very few empirical studies have been conducted on locations and spatial distribution. Among the many characteristics of REITs, location is often handled lightly, because it is not a major issue that directly affects stockholders as much as earning rate; also, the huge amount of necessary data is difficult to acquire. Therefore, most previous studies have been limited to fragmented descriptions of the geographical status of REITs, without differentiation of attributes, and a detailed approach to spatial analysis has not been sufficiently conducted.

The consensus of previous studies is that, despite different national or regional ranges, REITs are concentrated in metropolitan areas where capital is accumulated and show a strong trend of spatial clustering (see Table 1). This suggests that it is highly important to identify causal relationships of location of underlying assets with other characteristics, wherein the locations of REITs are considered in the Korean REITs market environment to decide investment, together with the earning rate.

Since almost no previous study has been conducted to investigate in detail the attributes of Korea’s entire REITs assets and their dynamic distribution patterns in different locations by applying a GIS-based spatial statistical model from a geographic point of view, it is urgently needed to perform a thorough empirical analysis and verification.

Ⅲ. Analytical Framework

1. Configuration of Variables

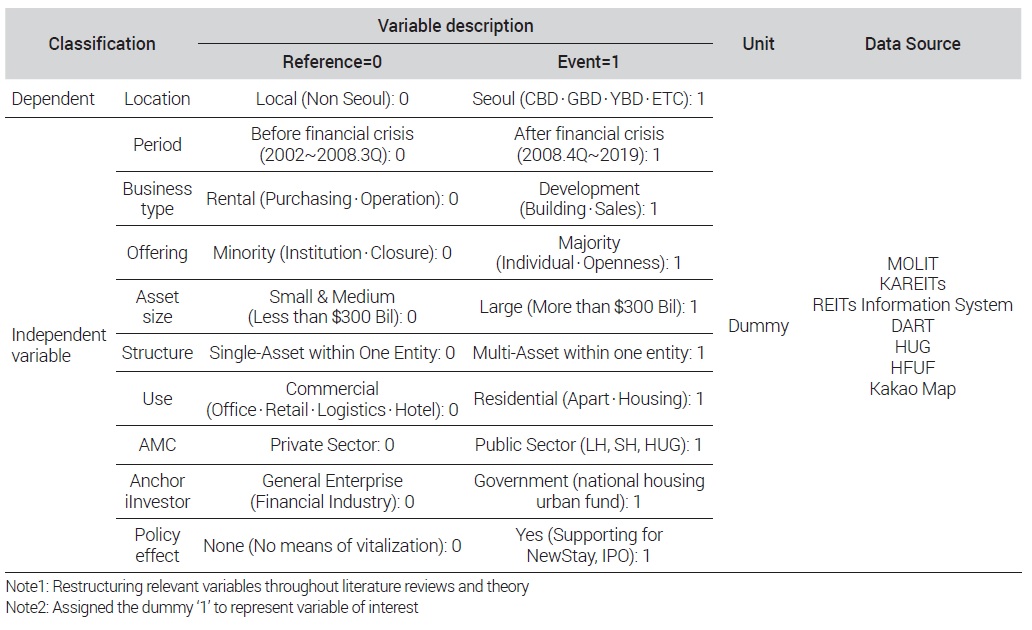

In this chapter, for an empirical analysis of the spatial distribution patterns of the individual underlying assets of REITs, which have not been investigated in previous studies, we performed a preliminary screening of the factors that have been considered in previous reports (Erol and Ozbakir, 2009; Yoo, 2012; Kim & Lee, 2016; Song & Jang, 2017; Choi et al., 2017) and then reconstructed and determined the relevant variables by reflecting the comments obtained through in-depth expert interview.

The location (regions other than Seoul=0 and Seoul=1), which is the dependent variable, is an inherent factor that has a very high immobility (fixedness) in connection with the earning rate and management performance from the stage in which the investors decide on REITs-based real estate investment. According to the Korea Association of REITs (2018), the earning rate depending on the investment region is in the order of Seoul < Provinces < Seoul Metropolitan Area except Seoul, showing that the locations of the underlying assets are closely related to the earning rate. Therefore, we performed geo-coding of the addresses of the REITs real estate to convert the locations to spatial data, and divided the regions into Seoul and regions other than Seoul. If the location data of the invested assets are divided into more categories, for example, into Seoul, the Seoul Metropolitan Area other than Seoul, the regions other than Seoul or the Seoul Metropolitan Area,8) overseas, and others, as in the case of the Korea Association of REITs, a statistical bias is unavoidable due to the small sample size. The division of the location data into Seoul and regions other than Seoul can reflect the recent social trend of REITs establishment, which is currently extended to regions other than Seoul. The ratio of locations in Seoul to that of regions other than Seoul was determined to be 4:6 to allow for good balance in the analysis.

The independent variables are the internal and unique attributes and the non-systematic factors surrounding the enterprise characteristics of REITs companies and the invested real estate. The 9 independent variables are period, business type, offering, asset size, structure, use, asset management company (AMC), anchor investor, and policy effect. To maintain a balance of the ratio, simple dummy values (dummy=0, 1) were given to all the variables.

With regard to the period, since REITs are known as indirect investment products of which the hurdle rate is designed by sensitively responding to the macroeconomics (corporate bond, KOSPI and land price) and the interest rate (Hyeon et al., 2017), the period was used as an exogenous variable (control ×) to investigate the change of the location selection before and after the 2008 Global Financial Crisis (GFC) (before GFC=0; after GFC=1),9) which had a negative effect on the global real estate market as well as the general industry (Kim & Lee, 2016; Park and Jin, 2019).

The business type includes the initiation or management of general rent operation (0) after purchasing or acquiring a property that has been completely constructed, and the one-time parcelling or selling (1) of a property that is under development by construction (process rate less than 100%, before occurrence of sales) in pursuit of capital gains.

The offering is determined based on the access to information with reference to the disclosure of the information to many and unspecified persons and thus consists of the closed private offering (minority of institution=0) and the public offering (majority of individual=1), which allows for participation by general citizens.

The asset size and structure are binary conditions that are proportional to each other, wherein the asset size is divided into small and middle size (less than 300 billion KRW=0) and large size (=300 billion KRW or larger=1) and the structure is divided into single-asset within one entity (single=0) and multi-asset within one entity (multiple=1) with reference to the amount of 300 billion KRW10) and the number of assets within one entity according to the asset allocation.

The use is an endogenous variable that best represents the characteristics of the REITs submarkets of the individual REITs property sectors. The use includes residential assets (residential=0; apartments, houses, officetel, etc.) and all other nonresidential assets (commercial=1, offices, retails, warehouses, hotels, composites) (Song, 2018).

The AMC (private sector=0; public sector=1) and the anchor investor (general enterprise=0; government=1) as the largest shareholder11) were considered as differentiating factors that determine corporate governance and return-risk investment style (Kim & Lee, 2016; Kim, 2019).

In consideration of the system, the policy effect was added as a variable to reflect the effects of New Stay (enterprise type rent houses) and support for public offerings (absent=0; present=1).

Table 2 expresses the variables as quantitative indexes under operational definition; they serve as important standards in the description of the dynamic changes of REITs attributes.

The analytical data were obtained from the Ministry of Land, Infrastructure, and Transport, the government department that supervises REITs, the Korea Association of REITs, the REITs Journal, and the settlement term investment reports directly submitted by AMCs to the REITs Information System (http://reits.molit.go.kr).12) In addition, the business and auditing reports registered with the Data Analysis, Retrieval and Transfer (DART) System of the Financial Supervisory Service, and the statistical data of funding by HUG were investigated and reprocessed to establish the database.13)

Incorrect or missing information was replaced by press releases from AMCs, on-site interviews with working-level staff, and surveys via telephone. The location information was checked by referring to satellite maps available on the internet (Kakao Maps). The data acquisition procedures described above are reasonable methods to effectively obtain status data from actual investors in the business, and thus are highly reliable.

2. Analytical Model Setup

The Bachi method, developed by R. Bachi (1963), has been widely applied to quantitative measurement of centrality or standard deviation distance of urban planning elements such as population, facilities, activities, employment, industry, and land price (Bachi, 2007). Due to the advantage of the method in visualizing dynamic time-series variation of geographically distributed characteristics and correlations among elements, the method is a popular technique in the field of national planning for exploring urban spatial structure, land use, and local economic growth pattern (Lee, 2001; Kim and Ha, 2002; Lim, Lee & Lee, 2006; Kim, Kim and Ahn, 2009; Lee & Sun, 2009; Hong & Lee, 2011; Kim, 2012; Oh & Lee, 2012; Lim & Song, 2013; Seo et al., 2014; Kim, 2015; Lee, 2015).

Since the underlying assets of REITs, the major subjects of real estate study, are also physical facility assets including point-unit constructions that constitute a city, the methodology can be easily extended and applied to the present study.

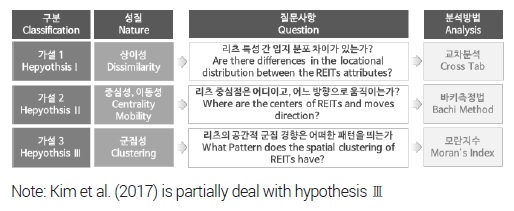

Before the empirical analysis, it was assumed, based on the theoretical accomplishments and the variables discussed above, that REITs, which are one type of investment property, can probably cause spatial disparity. Under this assumption, we focused on changes in the last two decades and established the following alternative hypotheses about the attributes of REITs (difference, centrality and mobility, and clustering) according to the scientific methodology, as shown in Figure 3.

First, REITs may have different locational and spatial distributions depending on the key attributes of the objects, which are the period, business type, offering, asset size, structure, use (type of investment target), AMC, anchor investor, and policy effect.

Second, the centrality of REITs may gradually move southward from initial locations in Seoul or the Seoul Metropolitan Area to non-Seoul regions when governmental policies are implemented in pursuit of publicity; among the investment targets, residential assets (REITs for rent houses) may show the longest movement distance and the highest movement speed.

Third, REITs may be highly and densely clustered at centers of specific regions, but the scope may be distinctively expanded through diversification of the investment areas due to intensified competition among AMCs and reduction of assets on sale.

SPSS 24.0, ArcMap 10.7.1, and GeoDa 0.9.5-i were selected as statistical tools to collectively test the hypotheses described above by performing cross tab, Bachi measurement, and spatial autocorrelation in parallel.

Bachi measurement is a statistical method to investigate distribution patterns from the mean center (MC), standard deviation distance (SDD), and standard deviation ellipses (SDE) of variables of spatial data (Kim, 1986; Korea Research Institute for Human Settlements, 2004; Lee & Sun, 2009; Hong & Lee, 2011; Lee, 2015). Figure 4 is a simple conceptual diagram of the key terms of the method.

The MC is expressed with x and y coordinates () of the mean positions of the centers of the analytical units (i) distributed in zones according to Equation (1):

| (1) |

SDD, representing how distanced the many observed values of the analysis targets are from the MCs (square root of the variance of the distance), is automatically calculated using Equation (2). If the distance from point to a center () is denoted as , when the value decreases, the point is more centered on the MC and expands more rapidly. When the value is increased, the point is regarded as being dispersed to the peripheral areas away from the center.

| (2) |

The SDE, obtained by calculating the angle of declination (θ), the standard deviations of the major axis (σ(x)) and the minor axis (σ(y)), and the oblongity (ο), compensates for the drawback of the SDD, which is not capable of precisely reflecting differences in concentration and dispersion depending on directions.

The angle of declination, referring to the angle of clockwise (⟳) rotation (θ°) from the x-axis and y-axis, is calculated using Equation (3):

| (3) |

The oblongity,14) which a measure that represents the direction in which the distribution is developed, is determined by the principal axes that pass through the MC. When the oblongity value is 0, the distribution is a circle with constant radius (γ). When the oblongity has a large value, the distribution has the shape of an oblong ellipsoid that is declined to one direction (see Equation (6)).

The standard deviations of the major axis σ(x) and the minor axis σ(y) are calculated using Equations (4) and (5), respectively; the oblongity is a relative ratio of the two standard deviations.

| (4) |

| (5) |

| (6) |

Moran’s I (1950) is a powerful technique to estimate the level of clustering based on the presence of autocorrelation of spatial data among phenomena in the social sciences; it involves measuring the similarity of values between a certain research target and adjacent regions, which is difficult to do using the Bachi measurement method (Lee et al., 2006; Lim, Lee & Lee, 2006; Oh & Lee, 2012; Lee, 2015).15) Moran’s I consists of global statistics related to the entire analytical range and local statistics localized to a specific region.

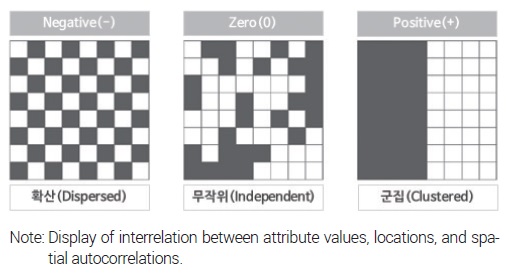

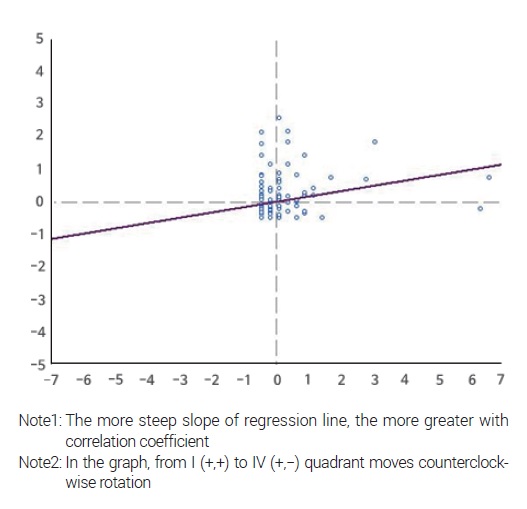

The global Moran’s I, expressed by Equation (7) below, generally has a value between -1 and 1 (-1≦I Statistics≦1) according to the spatial arrangement (see Figure 5). An index that is close to the endpoint means a highly negative (–) or positive (+) autocorrelation. In other words, a Moran’s I that is close to -1 represents dispersion in which high or low heterogeneous values are arranged alternately and regularly as in a grid. A Moran’s I that is close to 1 represents clustering in which similar attribute values are near each other. When Moran’s I is 0, the distribution is an independent random distribution of individual values in which no characteristics are observed and there is no spatial autocorrelation. The continuous spatial distribution of random values means leap-frogging16) of urban development without mutual pulling or pushing (Lee & Roh, 2013).

| (7) |

On the contrary, the local Moran’s I (Anselin, 1995) is a probability variable of the standard normal distribution (Z-score) for variables in specific regions and surrounding adjacent regions (see Equation (8)).17) The Local Indicators of Spatial Association(LISA) extract clusters and outliers based on similarity or dissimilarity. Regarding deviation from the mean, a highly positive (+) LISA value means a hot spot in which the similarity is high between the specific region and adjacent regions. A negative (–) LISA value means a cold spot between low negative values. Beside the areas represented by these values, there are outliers in which dissimilar positive and negative values are mixed together.18)

| (8) |

Ⅳ. Empirical Analysis

1. Locational and Spatial Distribution of REITs Attributes

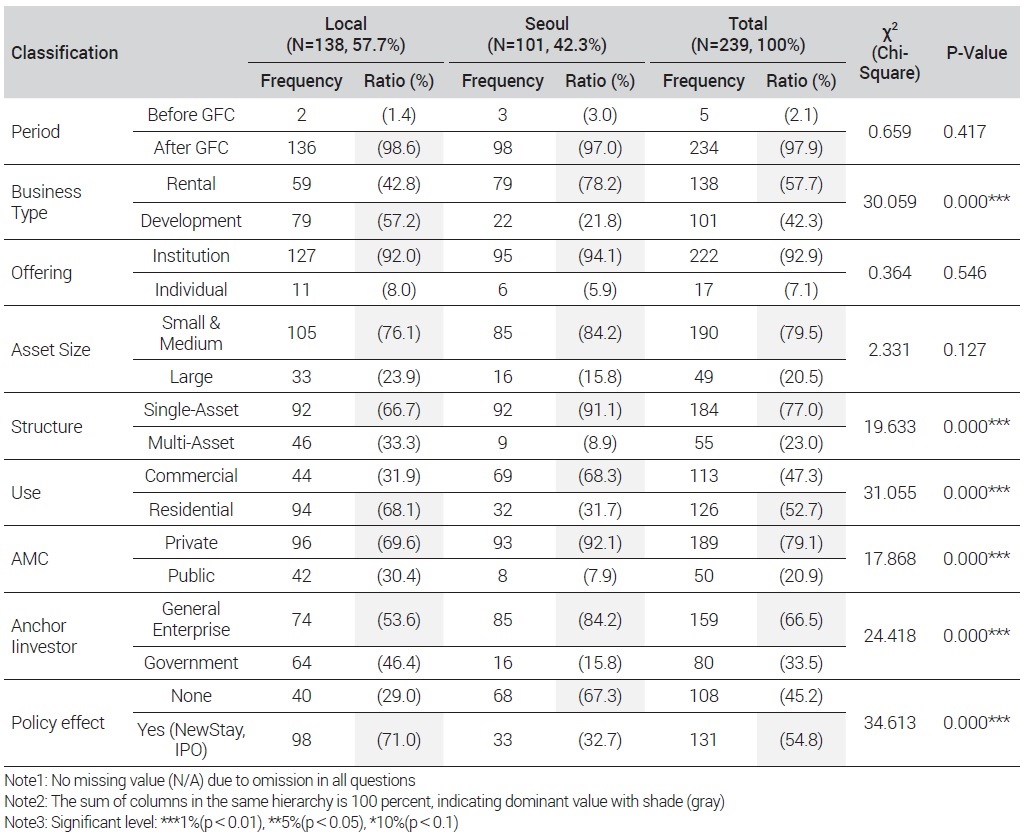

In this chapter, a frequency analysis and cross analysis (test of homogeneity) were performed to examine if there are any differences in locational distribution of REITs attributes including period, business type, offering, asset size, structure, use, AMC, anchor investor, and policy effect (see Table 3).

The analytical results showed that the ratios of REITs locations in non-Seoul regions and in Seoul were 57.7% (138 properties) and 42.3% (100 properties), respectively, with reference to the number of established REITs properties at the end of the last year, indicating that the ratio was slightly higher in non-Seoul regions. Within Seoul, the ratio was 40.6% in regions other than the 3 major zones, 31.7% in Gangnam, 19.8% in the inner city, and 7.9% in Yeouido. In the Seoul Metropolitan Area outside Seoul, the REITs properties are uniformly distributed in the south of Gyeonggi, which has a high population, and good economy and industry (Bundang, Gimpo, Yongin, Anseong, Hwaseong, Pyeongtaek, etc.), and in Incheon (Dohwa and Yeongjong). In non-Seoul regions, REITs are widely dispersed at strategic positions in some metropolitan cities of the Gyeongsang region (Busan and Daegu) as well as in small and mid-sized cities of the Chungcheong region (Cheonan, Gongju, and Cheongju) (see Figure 2). It was found that the locational concentration of the REITs properties in Seoul has been weakened more than our expectation. Commercial REITs properties in the past were concentrated in the 3 major zones in Seoul, but the scope of the REITs market has extended, as shown by the analytical results.

Among the 9 variables, the period, offering, and asset size did not show significant differences (p>0.1), because the ratios of ‘after GFC (97.9%)’, ‘institution (92.9%)’,19) and ‘small and medium (79.5%)’ were absolutely high regardless of the locations. This means that these 3 variables did not have significant influences on determination of REITs locations due to the uniform and consistent investment practices, including temporary management and half-way liquidation, centered on financial investors (FI) who pursue only the profits (internal rate of return (IRR) ≧6.0%).

On the contrary, the other 6 attribute variables, including business type, showed highly significant differences (p<0.01).

First, the main business type in Seoul was rental business (78.2%), in which income is stable due to rapid payback and cash flow, while the major business type in non-Seoul regions was parcelling and development (57.2%), in which no intermediate profits occur but the total dividend corresponding to the principal and interest is paid at the time of sale.

With regard to the structure, single-assets are still dominant (91.1%) in Seoul, while the ratio of multi-assets increased to 33.3% in non-Seoul regions because of increasing package deals in which superior/sub-prime zones possessed by the Korea Land and Housing Corporation (LH) and the Seoul Housing & Communities Corporation (SH) are pooled and sold to REITs to enable cross coverage at profit-loss balance.

With regard to use, residential facilities, consisting of only apartments and officetels are more numerous in the non-Seoul regions (68.1%) where land for development is abundant and the share of land price is low in the total business cost. Commercial facilities, including offices, retails, warehouses, hotels, and composite facilities are more numerous in Seoul (68.3%), which is the center of traffic. This indicates that REITs locations preferred by investment targets are very different depending on use of property. Locations of underlying real estate for residential purposes were basically different from those of commercial real estate, which are the investment targets of traditional institutional investors.

With regard to the substantial AMC of REITs, private AMCs are centered in Seoul, where potential investment demand is abundant. On the contrary, public AMCs have REITs in slum areas of non-Seoul regions at a ratio as high as 30.4% according to the purposes of the public policies, even though feasibility may not be guaranteed. This result is consistent with the report by Song and Jang (2017).

Anchor investors, playing the role of blue-chip companies, participate in national housing funds in the non-Seoul regions at a ratio of 46.4%, which is almost identical to that ratio for general private funds (53.6%). The ratio in non-Seoul regions was three times as high as the ratio in Seoul (15.8%), which is harmonized with the original function of low-interest financial investment for revitalization of degenerating urban areas. As mentioned by Kim and Lee (2016) and Kim (2019), the ratio of anchor investors who have the right of management as the largest shareholders of REITs may have a considerable influence on locations of investments.

Finally, with regard to policy effects, most REITs assets in non-Seoul regions (71.0%) enjoy benefits of the New Stay program or other systems for activating public offerings, while only 32.7% of REITs assets in Seoul benefited from these systems.

In summary, the analytical results show the differences of REITs assets between Seoul and non-Seoul regions. In Seoul, REITs assets consist of rent-type, large-sized single-assets, which are safe profit-type commercial facilities that can be easily managed by private financial institutions and that are excluded from governmental policies. On the contrary, REITs assets in non-Seoul regions are development-type multi-assets for large residential facilities that are invested in by the public sector, including governmental funds and HUG, to seek capital profits; these are supported directly or indirectly by policy effects based on the public interest (non-profit) (Song & Jang, 2017; Song 2018; 2020).20)

2. Patterns of REITs MC Movement and SDD Variation

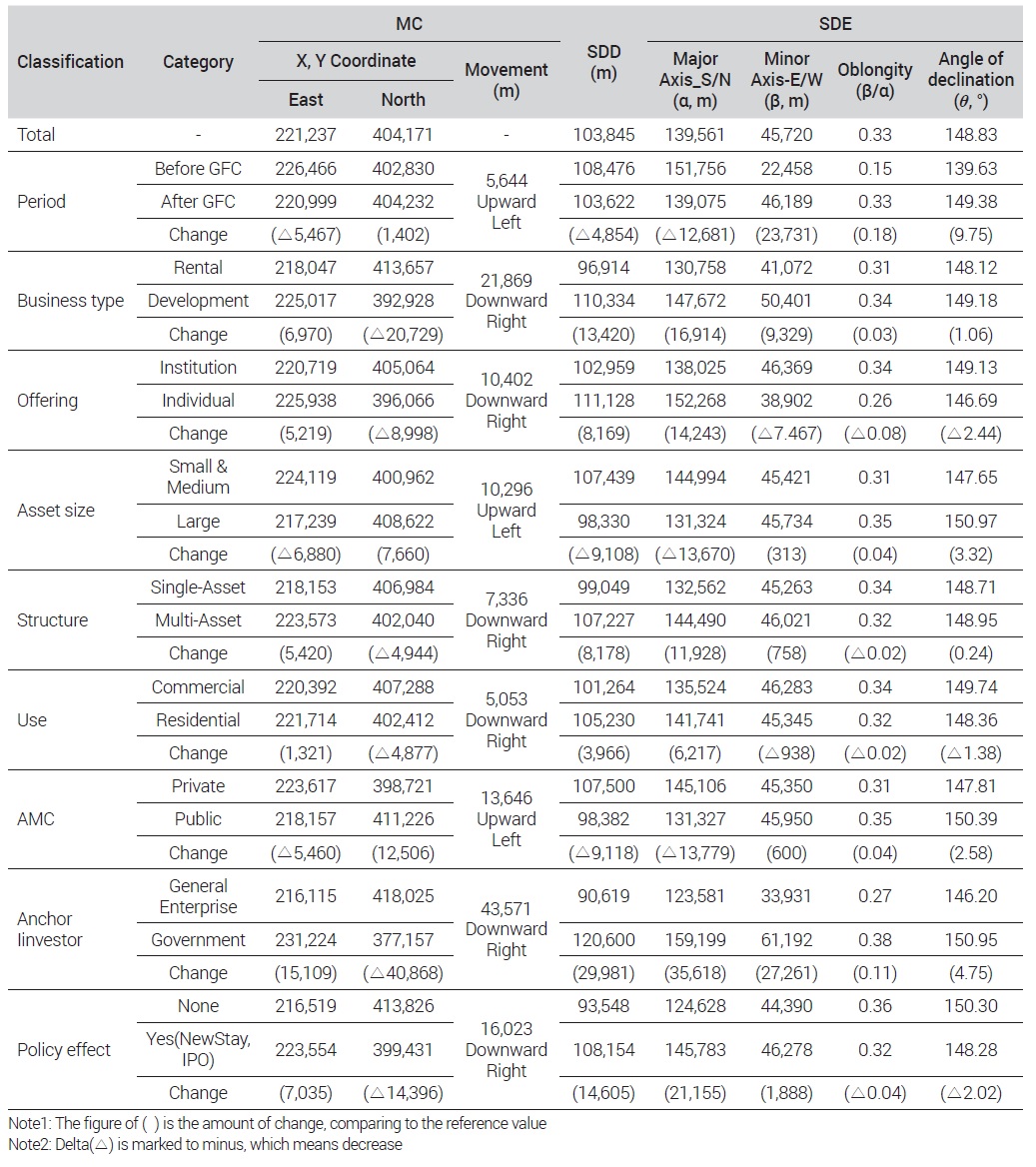

The spatial distribution of REITs real estate in Korea was briefly reviewed in previous sections. In this section, using the Bachi measurement method, we calculated the centrality, SDD, and SDE to obtain in-depth understanding of the locational movement of REITs underlying assets of individual regions and changes of direction.

To estimate the indices, the target regions should be divided into infinite regular grid cells, and weights should be given to the variables of interest to coordinate the centers of mass on the map. In this study, considering that multiples assets are included in many of the single REITs, the weights were proportionally assigned based on the number of assets21) rather than the asset size.

As shown in Figure 6, the coordinates of the MC of the 239 REITs throughout Korea were X: 221,237 a-nd Y: 404,171 at present according to the Bachi measurement. Substituting the coordinates into the satellite map of the National Geographic Information Institute, the location is a position in Cheoin-gu, Yongin-si, Gyeonggi, about 50.9 km away from Jung-gu, Seoul (e.g. the city hall of Seoul, which is a central facility of the region). The SDD was 103.8 km, and the distribution had the shape of a south-north ellipsoid of which the major axis (139.6 km) is three times as long as the minor axis (45.6 km). This means that the MC of the REITs is out of Seoul and consistent with the residential area differentiation pattern of the high social class or capital flow, which is distributed at the traffic nodal points of the local metropolitan cities along the Gyeongbu and Honam axes (Song et al., 2010).

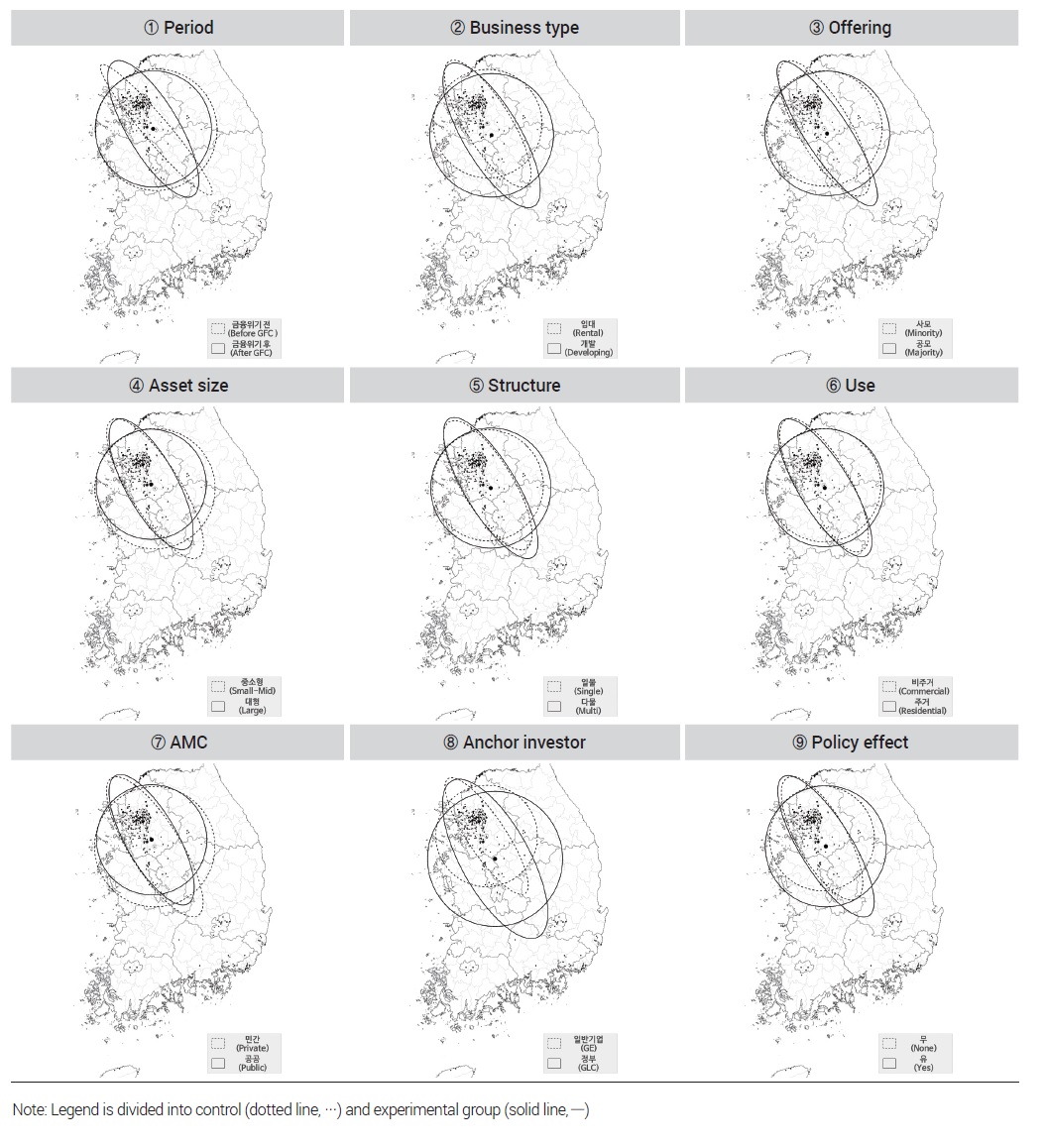

To compare in more details the control variables (predetermined, dummy: 0) and experimental variables (varied, dummy: 1) in the change of the spatial pattern of the REITs real estate attributes, the three indices (MC, SDD, and SDE) were analyzed, and the key characteristics were found, as described below (see Table 4 and Figure 7).

Movement of mean center, changes in standard deviation distance and standard deviation ellipse by REITs attributes (Bachi measurement)

Patterns of spatial distribution by REITs attributes using Bachi measurement (centrality, deviation distance, movement direction)

First, the dispersed distribution in which the centrality is in the down right direction (↘, to the southeast) and the SDD increases included most of the attributes such as business type (development), offering (public), structure (multi-asset), use (residential), anchor investor (government), and policy effect (present). In particular, government-invested anchor-type REITs showed the farthest movement of the centrality (Yongin-si, Gyeonggi → Jincheon-gu, Chungbuk) in comparison with general REITs, and their SDDs were extended to almost +30.0 km. The other five attributes showed slight movement (oriented to near distance) of the MC from Yongin-si, Gyeonggi to Anseong-si, Gyeonggi, and the SDD increased slightly (4.0 to 14.6 km). This increase of the SDD from the MC suggests that REITs are moving to the edges of the Seoul Metropolitan Area, as various kinds of REITs that are matched with the characteristics of investors are licensed.

Second, the concentrated distribution in which the centrality is in the upward left direction (↖, to the northwest) and the SDD decreases included only some of the attributes such as the period, asset size, and AMC. After the GFC, the large REITs-invested properties managed by the public sector had the type of distribution. These REITs are in complete contrast to the dispersed type, as the centrality moves forward from Anseong-si, Gyeonggi to Yongin-si, Gyeonggi, and the SDD decreased (△4.9 to △9.1 km). Although the distribution of REITs managed by the public sector was unexpected,22) it was found that investment by large REITs is still concentrated in areas near Seoul, which have superior location.

Third, the oblongity in the SDE, representing the degree of development in a certain direction, converged to a value of about 0.3, except for the period before the GFC (0.15), when the oblongity was extremely small, although there were differences in the major and minor axes among individual attributes.23) Therefore, the distribution was a sphere-like ellipsoid of which the angle of declination (θ) was 150°, suggesting that the axis of growth of REITs will be toward the southeast (↘).

In summary, the centers of early REITs were mostly in Seoul, but they have gradually moved to the south, especially to non-Seoul metropolitan cities, since 2013, when LH positively joined in the marketing of real estate-based financial products (e.g., 1st to 3rd Huimang Rent REITs for 1,070 apartments). In particular, the Gyeonggi areas adjacent to Seoul were the second best choices, because they have high land price competitiveness, excellent traffic access, high development pressure in view of demand creation, and relatively good living environment. In other words, REITs investment has extended from the 3 major zones in Seoul (inner city, Gangnam, Yeouido) to the other zones in Seoul and to 6 non-Seoul metropolitan cities, and the centers have been reorganized. This is consistent with the report by Kim et al. (2017) that posited that REITs establishment conditions are prepared sufficiently and their pattern of future growth should be carefully observed.

In the background, the distribution of the REITs assets may have been directly or indirectly affected by the increased supply of local rental houses in the public sector (parcel-transfer public rental houses, enterprise-type rental houses, purchased rental houses, Haengbok houses, etc.) by policy effect of the government-led NewStay, 2015.24)

Although some criticize that the REITs were not established spontaneously but by governmental policy with the intention of intervention to improve the financial structure, governmental policy has also served as a powerful drive or catalyst for the rapid growth of REITs (Song and Jang, 2017). With regard to the use of REITs assets, the MC is rapidly moving to residential use at high speed. However, the MC is expected to be stabilized, as private and governmental REITs for housing development extend throughout the country.

3. Measurement of Spatial Centralization and Decentralization of REITs Attributes Using Moran’s I

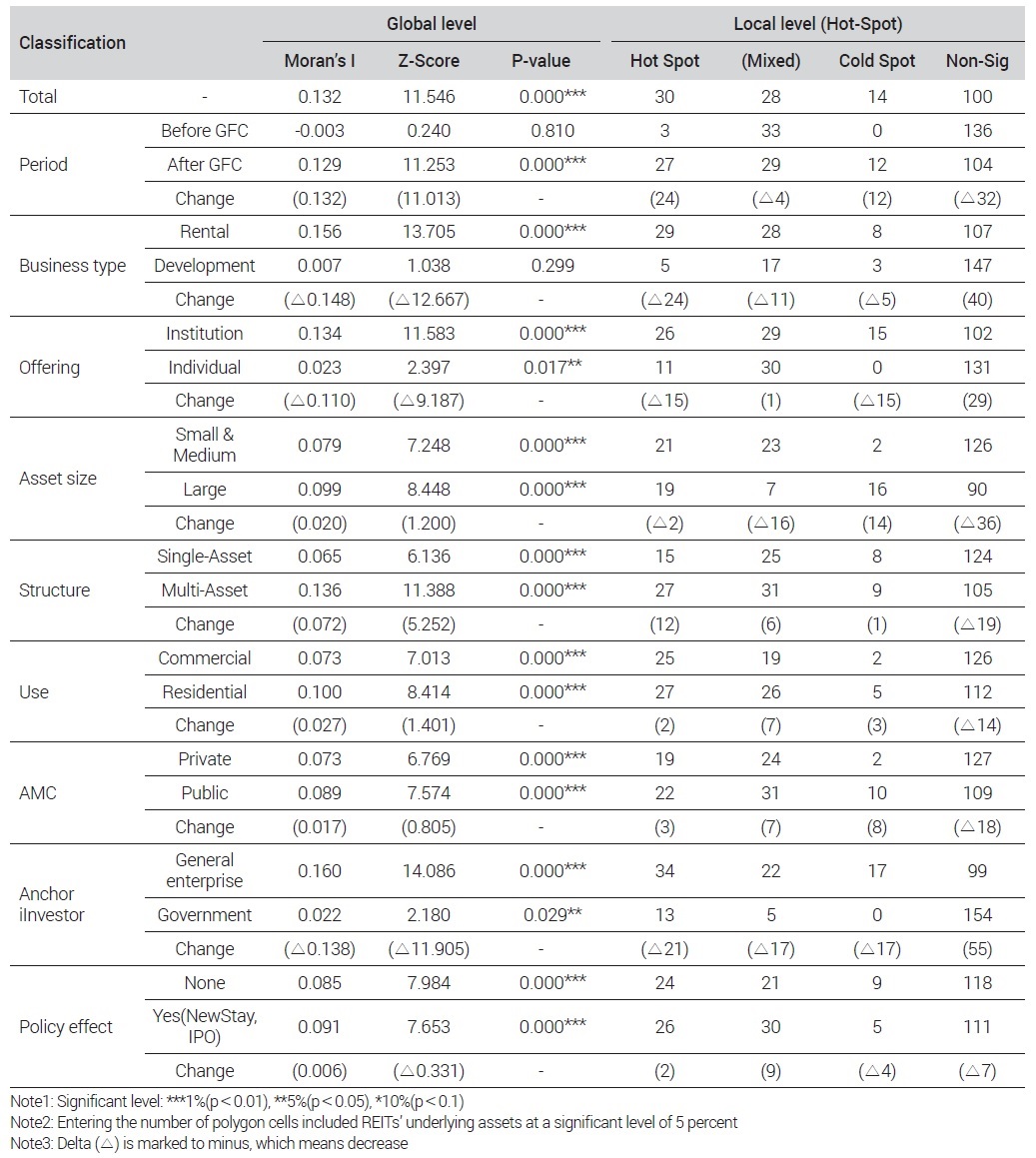

The Bachi measurement method discussed above is definitely useful in estimating the basic distribution characteristics, including the location, movement, and direction of REITs centers, which are analytical units of space, but the method is not suitable for explaining the level of clustering in a specific region. To overcome this limitation, we employed a spatial statistical model as a quantitative methodology capable of deciding whether the investment region is spatially centralized or decentralized with the increase of REITs (Lim et al., 2006; Oh & Lee, 2012). We calculated both the global Moran’s I, which is a single metric of autocorrelation in an entire target region, and the local Moran’s I, which is used to determine local hot spots.

For the estimation of Moran’s I, the entire land of Korea was divided into 5,603 units of regular hexagons25) having a basic radius of 5 km; then, the segmented units were overlaid to select 172 individual polygons (3.1%) including at least one REITs asset for analysis (see Figure 8). The selected hexagons included an average of 2.4 REITs assets (min:1, Max: 27), and the standard deviation was as large as 3.3. The dispersed point data were converted to locations of surface topology for collective measurement and easy normalization. This was done using the methodology developed by Lee (2015).

The spatial weight matrix26) reflects potential interactions between regions; among measures of physical contiguity, we adopted the Queen method, which considers the number of spatial neighbors sharing the boundary. Hence, this section begins with the assumption that REITs assets which are adjacent closely interact with each other.

The analysis of the spatial autocorrelation showed that the global Moran’s I of all 239 REITs in Korea is +0.132 (Z-Score=11.546), indicating that the strength of clustering is low. The Moran scatter plot in Figure 9 shows that REITs investment locations are mostly in Quadrants 1 and 3, with a positive correlation, and have the form of a straight line with a smooth slope. These results show that, like other types of real estate, such as houses, land, and commercial facilities, REITs are assets having a high spatial dependence on the administrative district (p<0.01); and, Tobler’s first law of geography (Tobler, W., 1970)27) also applies to REITs. In addition, our argument is supported by the empirical study by Kim et al. (2017), which first showed that the Moran’s I of REITs investment regions in Korea is 0.226, indicative of strong spatial clustering.

Scrutinizing the results from the viewpoint that the change of REITs assets compared to the predetermined variables is a relative variance28) shows that the individual attributes are unique and the change of the Moran’s I has significance (p<0.05), as shown in Table 5 below.

Measurement of spatial centralization and decentralization by REITs attributes (spatial statistical model)

Type Ⅰ is a centralized (+) structure with an increasing Moran’s Ⅰ in which REITs investment is dominant due to spatial homogeneity. Therefore, Type Ⅰ incorporates 6 variables, which are the period (after GFC), asset size (large), structure (multi-asset), use (residential), AMC (public), and policy effect (present). Among these variables, the variables corresponding to ‘after GFC’ (0.129) and ‘multi-asset (0.136) dramatically increased in comparison with ‘before GFC’ and ‘single-asset’, respectively (+0.072 to 0.132). However, the other 4 statistical values of ‘public (0.089)’, ‘policy effect present (0.091)’, ‘large (0.099)’, and ‘residential (0.100)’ were close to 0.1, and thus estimated to have very small variation (less than +0.03) under positive (+) autocorrelation.

Type Ⅱ is a decentralized (–) structure with a decreasing Moran’s I in which REITs investment was weak due to spatial heterogeneity. In contrast to Type Ⅰ, Type Ⅱ incorporates only 3 variables, which are business type, offering, and anchor investor. Generally, the REITs with variables of ‘rental’, ‘privately offered’, and ‘general enterprise’ showed very high correlation, as their values of Moran’s I were all greater than +0.1. The Moran’s I significantly decreased (△0.110 ~ △0.148) in REITs with variables of ‘development (0.007)’, ‘publicly offered (0.023)’, and ‘government (0.022)’.29) However, since the difference of the variable ’development’ was not significant (5%), the correlation with the business type may not be certain.

The test of Moran’s I, described above, was to essentially determine whether there is a spatial autocorrelation in all the REITs investment regions, not to describe the detailed clustering status in consideration of the density difference.30) Therefore, we calculated the local Moran’s I by decreasing the scope of the analytical target to specific sub-regions (see Table 5).

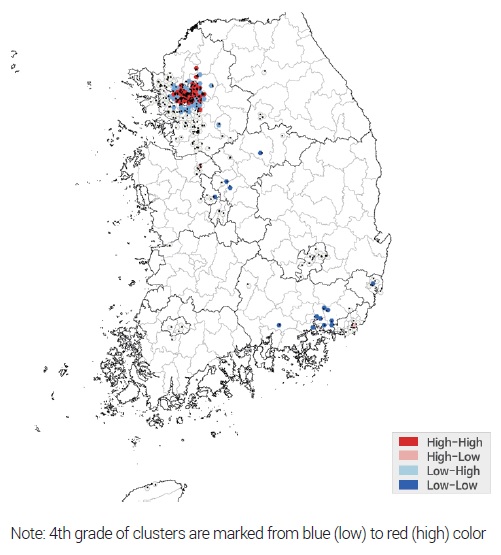

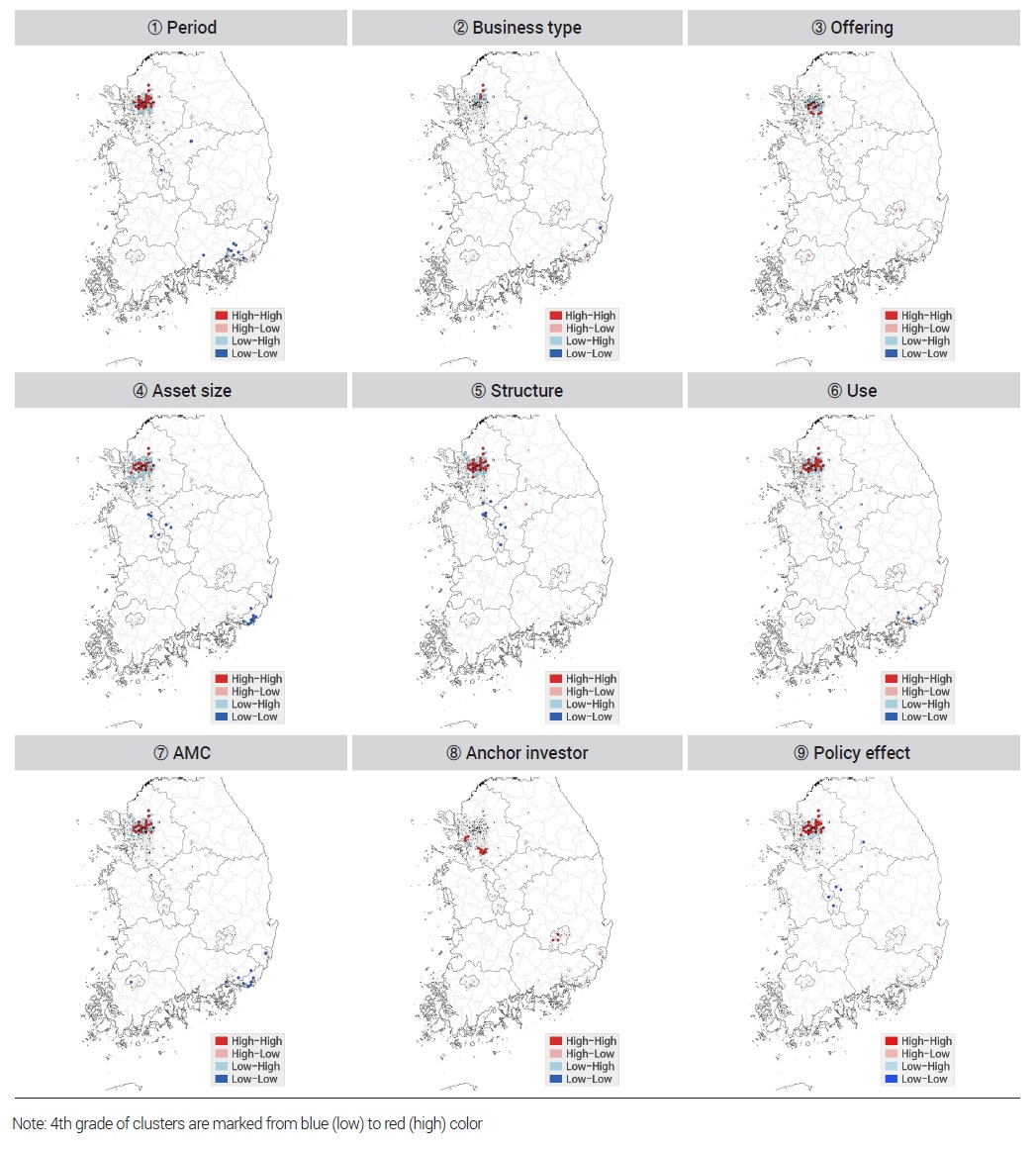

The LISA and the cluster map were prepared to investigate the autocorrelation in different regions depending on the spatial correlation types, and hot-spot analysis was also performed (see Figure 10).

The local Moran’s I of all REITs in Korea was calculated according to the procedures described above, and the results showed that the local Moran’s I of about 100 REITs, out of the total 172, was non-significant, meaning that the REITs were not clustered. Significant autocorrelation, the main interest of the present study, was found in 72 REITs (41.8%) (p<0.05).

In Figure 10, the red color (R) represents clustering of REITs with a high local value of Moran’s I, while the blue color (B) represents the opposite situation. Hence, the REITs distributions are distinctly differentiated into H-H type (30 REITs, 17.4%) in Seoul and the Seoul Metropolitan Area (22 in Seoul and 8 in Gyeonggi) and L-L type (14 REITs, 8.1%) mostly in the non-Seoul regions (4 in Chungbuk, 8 in Gyeongnam, 1 in Busan, and 1 in Ulsan), clearly showing the binary composition of the REITs investment regions. Many L-H type distributions (26 REITs, 15.1%) were found in Seoul and at the edges of the Seoul Metropolitan Area (5 in Seoul, 20 in Gyeonggi, 1 in Incheon), and several H-L type distributions (2 REITs, 1.2%) were found in Cheonan-si of Chungnam, and in Busan.

The spatial patterns of the individual attributes of the REITs investment were classified into four groups (H-H: core; H-L: isolated; L-H: peripheral; L-L: lagging) (Hong & Lee, 2011) to derive the connected structure of the regions in Korea’s national planning and their dynamic characteristics (see Table 5 and Figure 11).

Identification of aggregation and outlier by REITs attributes using spatial autocorrelation (based on Dummy=1)

First, Group Ⅰ, in which both H-H type and L-L type are upward (↑), incorporates the period, structure, use, and AMC. The H-H type dramatically increased (+12 to 24), mostly in multi-assets after the GFC, and the L-L type was superior (+3 to 8) in residential REITs invested in by public funds. The early hot spots31) before the GFC were the Gangnam zone in Seoul (Seocho and Songpa) and Gwacheon in Gyeonggi, where the land price was high; they extended to non-Gangnam zones in Seoul (Yongsan, Yeongdeungpo, Guro) and the northeast of Gyeonggi (Goyang, Guri, and Hanam). In addition, more than half of the multi-assets were continuously centralized in the Seoul Metropolitan Area.

Second, Group Ⅱ, in which the H-H type is upward (↑) and the L-L type is downward (↓), incorporates the policy effect only. With regard to REITs supported by the government-led New Stay program and the listed REITs, the H-H type (+2) increased and the L-L type (△4) decreased in the presence of support through systems. The number of H-H type REITs in this group is 18 in Seoul (Gangnam, Seocho, Songpa, Yongsan, and Seongdong), 7 in Gyeonggi (Bucheon, Goyang, and Hanam) and 1 in Incheon (Namdong-gu), and they showed a strong clustering. On the other hand, the L-L type REITs, located in Chungcheong (1 in Sejong, 1 in Daejeon and 2 in Cheongju-si of Chungbuk) and Wonju in Gangwon, showed different patterns.

Third, Group Ⅲ, in which the H-H type is downward (↓) and the L-L type is upward (↑), incorporates asset size only. The analytical results were different from our expectations, because large REITs of H-H type slightly decreased (△2) and large REITs of L-L type dramatically increased (+14). For instance, L-L type small and medium REITs were limited to Gyeongnam (Changwon and Gimhae), but REITs assets having higher price gradually extended to the south regions of Korea, including Yangsan-si in Gyeongnam, Chungcheong (3 in Chungnam, 2 in Chungbuk, and 1 in Sejong), and Busan (8 in Haewundae-gu and Nam-gu), in proportion to the asset price.

Fourth, Group Ⅳ, in which both H-H type and L-L type are downward (↓), incorporates the business type, offering, and anchor investor. The decrease was severe (△15 ~ △21) in H-H type REITs invested in by the government by private offerings, and L-L type REITs also showed a significant decrease. Compared to the conventional general REITs promoted mostly by private offering, the former suggests severe capital outflow within the Seoul Metropolitan Area from the 3 Gangbuk areas of Seoul (Dobong-gu, Gangbuk-gu, and Nowon-gu) and the areas adjacent to Seoul (Seongnam, Hanam, Goyang, and Euijeongbu in Gyeonggi). The latter represents the decreased spatial correlation by the drop-outs of the small and medium cities in the non-Seoul regions, such as Gyeongnam (Gimhae and Changwon) and Chungcheon (Chungju).32)

Finally, Group Ⅴ, in which the H-L type or L-H type is upward or downward (↑, ↓), is considered a separate spatial phenomenon that is far from the principle of ‘Like draws to like’. Although partially redundant with variables applied to Groups Ⅰ to Ⅳ, variation was found in the anchor investor (△17), asset size (△16), policy effect (9), AMC (7), and use (7). The variables in this group are adjacent to polygons comprising high or low (+, –) values, and irregular coexistence is often found. The areas that were found to be different from the neighboring areas were Incheon, Goyang, and Gwancheon in Gyeonggi, and Cheonan in Chungnam. Considering the locational conditions, these areas reflect the heterogeneous uniqueness of transition zones33) that gradually turn into REITs investment areas by slow suburbanization in interfacial areas between the Seoul Metropolitan Area and the small and medium cities in the non-Seoul regions.

Ⅴ. Conclusions and Implications

The present study was conducted with all 239 real assets invested in by REITs throughout Korea as of the end of 2019 to measure the centrality movement and direction of individual attributes of underlying assets depending on the locational distribution and to empirically analyze the dynamic characteristics of the change of the spatial clustering level by using a spatial statistical model. The present study is a declaratory convergence study that combines the latest REITs data and the GIS spatial statistical method from a geographical point of view. The key analytical results are briefly described below.

First, with regard to the spatial distribution, the ratio of the locations of REITs assets in non-Seoul regions to those in Seoul was 6:4, showing similarity. The REITs assets were mostly residential facilities on the edged of the Seoul Metropolitan Area and commercial facilities in Seoul. In Seoul, the spatial imbalance was severe, as REITs assets in the three major zones accounted for almost half of all assets in the entire Seoul area. Cross analysis showed that investment areas are dependent on certain attributes, including business type, structure, use, AMC, anchor investor, and policy effect, which have significant effects on the actual locations (p<0.01).

The Bachi measurement showed that the MC (X: 221,237, Y: 404,171) is a position in Cheoin-gu, Yongin-si, Gyeonggi, and the SDD was very long (103.8 km). The MD, initially in Seoul and the Seoul Metropolitan Area, gradually moved to non-Seoul regions in the south over time. The oblongity of the distribution showed that the growth axis of the REITs is in the southeast direction, which suggests the direction of the national plan for future land development.

Among attributes of REITs assets, the period (after GFC), asset size (large), and AMC (public) were classified into centralized type, of which the centrality is in the upward left direction (↖) with a decreased SDD. On the other hand, a decentralized type of which the centrality is in the downward right direction with increased SDD was found in most of the attributes, including business type (development), offering (publicly offered), structure (multi-asset), use (residential), anchor investor (government), and policy effect (present). In particular, while the anchor type residential (apartment and houses) REITs assets in development projects of the construction stage developed by the government (funding) showed rapid movement of the MD, the other REITs assets showed a slow movement or stagnation. In this regard, the government-led New Stay policy (2015) may give positive effects by contributing to the balanced regional development through securing a sufficient amount of house supply and inducing distribution of investment areas.

Third, the global Moran’s I of all the REITs assets was about 0.1, indicative of a significant but weak positive (+) autocorrelation (p<0.01). In particular, the Seoul Metropolitan Area showed a severe spatial concentration at the center of the inner cities around Seoul, and the non-Seoul regions showed an external expansion by the construction of suburban new towns and the development of various housing zones. With reference to the use, the residential assets were centralized as the investment was focused on specific areas. However, the commercial assets, including the assets having an exclusive location mechanism such as warehouses, showed a low spatial correlation represented by the complete spatial randomness (CSR) distribution having a Moran’s I value near to zero. This finding is consistent with the report by Kim et al. (2017) that proved the presence of heterogeneous spatial autocorrelations depending on the types of the REITs assets.

With regard to the local LISA, Seoul and Gyeonggi, in which financial capitals are centralized, showed the H-H type where high values are adjacent to each other, but the southeast regions (Busan, Ulsan and Gyeongnam) dominantly showed a spatially binary pattern of the L-L type with strong clustering. Beside these regions, the boundary areas of the Seoul Metropolitan Area and the small and medium non-Seoul cities had the H-L type and the L-H, which show the contrast characteristics of transition zones.

Significance changes of the individual attributes were found by analyzing the increase and decrease of the number of autocorrelation types in the polygons. The period (after GFC) and structure (multi-asset) attributes were similar to those of densely centralized monocentric cities, but the anchor investor (government) and offering (publicly offered) were close to low-density decentralized polycentric cities. In the background was the centralized monocentric growth structure focused on Seoul and the Seoul Metropolitan Area supported by the high level of interests of the citizens in REITs investment. However, the REITs investment may gradually be extended to the construction of new towns or the development of housing zones in the non-Seoul regions. The recent diversity of the REITs asset location and the increase of the asset size are in line with the business diversification strategy of the institutional investors to make up a balance portfolio by extending the use of real estate assets and the investment areas and making return-risk adjustment in consideration of the composite external environmental factors including the business fluctuation, intensified competition among the AMCs, changes in the characteristics of replacement assets and the status of offerings in the market (Song, 2018).34)

The results of the empirical analysis described above have academic significance that the spatial correlation between the internal attributes of the REITs underlying assets and their locations within last two decades was identified and a methodology that allows for objective measurement was established. Although most of previous studies in the field of spatial locations were focused on the factors that determine the dividend rate from an economic viewpoint, we compensated and advanced the results by Kim et al. (2017) by screening the regions where REITs assets emerge frequently or investment is actively carried out. The results of the present study provide the fundamental data that are useful to identify the planned locational characteristics and the centrality trends preferred by the institutional investors in the field and to understand and prepare the strategy for investment diversification. Furthermore, the implication of the results of the present study is that the omnidirectional investment by REITs can be a useful means to promote the national sustainable land development and facilitate balanced regional development. The formation of residential complexes in various underdevelopment areas of non-Seoul regions through the urban regeneration REITs can provide the opportunities to revitalize the local economy and reorganize the spaces by inducing the centralization and decentralization of the population and industries. The policy proposal is that the basis of customized supportive systems should be prepared urgently to reflect the urban growth patterns and REITs attributes of individual regions.

Nevertheless, the present study was focused on the internal and unique attributes of REITs due to the realistic limitations in data acquisition and access, and thus external environmental factors or time-dependent changes related to the attributes could not be discussed in details. Due to the characteristics of the spatial data, the Bachi measurements and Moran’s I were used to investigate the degree of centrality and directions of the individual assets of the underlying assets, but we were not able to analyze the relations with other markets or goods or the various other factors to the changes. In particular, policy-based REITs for rental housing have a structural limitation regarding the analytical data, because the REITs are in the early stages of planning and designing or are currently under development. Therefore, further microscopic studies may need to be conducted to specify the spatial distribution growth patterns of the REITs investment regions according to the sub-markets and products (e.g. commercial real estate and indirect investment) to find significant causal relations among the factors to the centrality differences by using the GWR.

Acknowledgments

This work was supported by the 2019 Research Fund of the University of Seoul.

References

-

Anselin, L., 1995. “Local Indicators of Spatial Association: LISA”, Geographical Analysis, 27(2): 93-115.

[https://doi.org/10.1111/j.1538-4632.1995.tb00338.x]

- Bachi, R., 2007. New Methods of Geostatistical Analysis and Graphical Presentation: Distribution of Populations over Territories, Switzerland: Kluwer Academic Pub.

- Brueggeman, W.B. and Fisher J.D., 2016. Real Estate Finance and Investments(15th ed), New York: McGraw-Hill College.

-

Charles, S.L., 2020. “The Financialization of Single-family Rental Housing: An Examination of Real Estate Investment Trusts’ Ownership of Single-family Houses in the Atlanta Metropolitan Area”, Journal of Urban Affairs, 42(8): 1321-1341.

[https://doi.org/10.1080/07352166.2019.1662728]

-

Chilton, K., Siverman, R.M., Chaudhry, R., and Wang, C., 2018. “The Impact of Single-family Rental REITs on Regional Housing Markets: A Case Study of Nashville, TN”, Societies, 8(4): 1-11.

[https://doi.org/10.3390/soc8040093]

-

Choi, H.R. and Yu, J.S., 2011. “An Analysis on the Diversification Effects of Mixed-Asset Portfolio by Incorporating REITs: Focused on before/after the International Financial Crisis”, The Korea Spatial Planning Review, 71: 115-132.

[https://doi.org/10.15793/kspr.2011.71..006]

최혜림·유정석, 2011. “리츠 편입을 통한 복합자산 포트폴리오의 분산효과 분석: 국제금융위기 전·후기간을 중심으로”, 「국토연구」, 71: 115-132. -

Choi, M.S., Lee, M.K., and Lee, S.Y., 2017. “Risk Analysis on the Rate of Return of Construction Type in NewStay Rental Housing REITs”, Appraisal Studies, 16(1): 143-164.

[https://doi.org/10.23843/as.16.1.7]

최명섭·이무근·이상영, 2017. “건설형 뉴스테이 임대주택리츠 의 수익-위험 분석”, 「감정평가학논집」, 16(1): 143-164. -

Choi, S., 2011. Policy Directions for Improving Real Estate Indirect Investment System, Anyang: Korea Research Institute for Human Settlements.

최수, 2011. 「부동산 간접투자제도의 발전방안 연구」, 안양: 국토연구원. - Erol, I. and Ozbakir, B.A., 2009. “GIS-based Spatial Analysis for the Determinants of REIT-owned Commercial Property Rents in Istanbul Metropolitan Area”, Paper presented at the 16th Annual European Real Estate Society Conference, Stockholm, Sweden.

-

Feng, Z., Pattanapanchai, M., Price, S.M., and Sirmans C.F., 2019. “Geographic Diversification in Real Estate Investment Trusts”, Real Estate Economics, 1-20.

[https://doi.org/10.1111/1540-6229.12308]

-

Hong, D.S., 2020. “Financial Chains of Global Real Estate Finance: Focused on Publicly Offered Overseas Real Estate Funds in Korea”, Space and Environment, 30(2): 209-253.

[https://doi.org/10.19097/kaser.2020.30.2.209]

홍다솜, 2020. “글로벌 공간금융투자의 금융사슬: 한국의 공모형 해외 부동산펀드를 중심으로”, 「공간과 사회」, 30(2): 209-253. -

Hong, N.H. and Lee, M.H., 2011. “A Study on the Characteristics of Urban Spatial Structure Change of Seoul on the Sustainable Development: Focused on Land Use Change”, Journal of Korea Planning Association, 46(1): 39-50.

홍남희·이명훈, 2011. “지속가능한 개발 관점에서의 서울시 도시공간구조 변화특성에 관한 연구: 토지이용변화를 중심으로”, 「국토계획」, 46(1): 39-50. -

Im, E.S., Lee, J.Y., and Lee, H.Y., 2006. “Measurement of Urban Form in Urban Growth Management: Urban Sprawl versus Compactness”, The Korea Spatial Planning Review, 51: 223-247.

임은선·이종열·이희연, 2006. “도시성장관리를 위한 공간구조의 확산 – 압축패턴 측정”, 「국토연구」, 51: 223-247. -

Jin, C.H., 2015. A Study Revitalization for Public Offerings and Diversification of K-REITs, Sejong: Ministry of Land, Infrastructure and Transport.

진창하, 2015. 「리츠사업 다각화 및 공모활성화 방안 연구」, 세종: 국토교통부. -

Jung, H.N., 2008. K-REITs as a Tool for Advancing Korean Real Estate Market: Policy Directions for Vitalizing K-REITs, Anyang: Korea Research Institute for Human Settlements.

정희남, 2008. 「부동산시장 선진화를 위한 리츠제도 활성화 방안」, 안양: 국토연구원. -

Kim, B.S., 2019. “A Study on the Corporate Performance of REITs in Korea by Ownership Structure: Focused on the Role of Anchor Investor”, Master Dissertation, Seoul National University.

김병수, 2019. “국내 리츠(REITs)의 소유구조에 따른 기업 성과 연구: 앵커 투자자의 역할을 중심으로”, 서울대학교 석사학위논문. -

Kim, B.S. and Han, K.S., 2010. “An Empirical Study on the Factors Affecting the REITs Price”, Korean Corporation Management Review, 17(1): 41-62.

김봉수·한경수, 2010. “부동산투자신탁(REITs) 유형별 주가 영향 요인에 관한 실증연구”, 「기업경영연구」, 17(1): 41-62. -

Kim, G.S., 1985. Urban Form Measure and Application to Seoul Metropolitan Area, Seoul: National Research Foundation.

김광식, 1985. 「도시형태측정기법과 그 적용에 관한 연구」, 서울: 한국과학재단. -

Kim, G.S., 1986. “Measurement and Analysis of Seoul’s Urban Form”, Journal of Korea Planning Association, 21(1): 99-118.

김광식, 1986. “서울시 도시형태측정에 관한 연구”, 「국토계획」, 21(1): 99-118. -

Kim, H.T., Kim, S.S., and An, S.H., 2009. “The Pattern of Urban Growth and Measurement of Spatial Structural Change in Daejeon Metropolitan City”, Journal of Korean Society for Geospatial Information Science, 17(3): 41-48.

김흥태·김상수·안상현, 2009. “대전광역시 도시성장 패턴과 공간구조 변화 측정”, 「대한공간정보학회지」, 17(3): 41-48. -

Kim, H.Y., 2012. “The Spatial Variation Measurement of Multi-Centric Structure in Busan Metropolitan City”, Spatial Information Research, 20(2): 93-103.

[https://doi.org/10.12672/ksis.2012.20.2.093]

김호용, 2012. “부산광역시 다핵구조의 공간적 변동성 측정”, 「한국공간정보학회지」, 20(2): 93-103. -

Kim, J.H. and Ko, S.S., 2019. “A Study on the Factors Influencing Rate of Return of New Stay REITs: Focusing on the Comparison with Rent-based REITs”, Housing Studies, 27(2): 91-116.

[https://doi.org/10.24957/hsr.2019.27.2.91]

김준형·고성수, 2019. “뉴스테이 리츠의 수익률 영향요인 연구: 임대형 리츠와의 비교를 중심으로”, 「주택연구」, 27(2): 91-116. -

Kim, S.J. and Lee, M.H., 2016. “A Study on the K-REITs of Characteristic Analysis by Investment Type”, Journal of Korea Academia-Industrial cooperation Society, 17(11): 66-79.

[https://doi.org/10.5762/KAIS.2016.17.11.66]

김상진·이명훈, 2016. “K-REITs(부동산투자회사)의 투자 유형별 특성 분석”, 「한국산학기술학회논문지」, 17(11): 66-79. -

Kim, S.S., Jeong, M.O., and Hwang, J.H., 2017. “A Study on the Regional Distribution Pattern and Returns of REITs”, The Korean Regional Development Association, 29(4): 111-133.

김상석·정문오·황재훈, 2017. “리츠투자 수익률 분석을 통한 제도개선방안 연구”, 「한국지역개발학회지」, 29(4): 111-133. -

Kim, Y. and Ha, C.H., 2002. “An Analysis of the Population and Industrial Distribution Patterns through Regional Inequitable Growth: Focused on the Analysis of Regional Spatial Structure in Kyungnam Using Regression Analysis”, Journal of Korea Planning Association, 37(6): 51-64.

김영·하창현, 2002. “지역불균형 성장에 따른 인구 및 산업분포 패턴 분석: 회귀분석을 이용한 경남지역의 공간구조분석을 중심으로”, 「국토계획」, 37(6): 51-64. -

Kim, Y.H., 2015. “A Study on the Metropolitan Region Analysis: Based on the Average Land Price”, Journal of the Korea Real Estate Society, 33(1): 267-294.

김용희, 2015. “수도권 지역분석에 관한 연구(1980~2013): 지가를 중심으로”, 「대한부동산학회지」, 33(1): 267-294. -

Korea Appraisal Board, 2019. “REITs Yiled are Higher than Direct Investment”, Daegu.

한국감정원, 2019. “리츠 수익률, 부동산 직접투자 보다 높아”, 대구. -

Korea Research Institute for Human Settlements, 2004. Spatial Analysis, Seoul: Hanul Publishing Group.

국토연구원, 2004. 「공간분석기법」, 서울: 한울. -

Lee, C.H., 2015. “A Spatial Analysis on the Formation and Dissolution of Start-up Firms in the Seoul Metropolitan Region”, Journal of Cadastre & Land InformatiX , 45(1): 241-256.

이창효, 2015. “수도권 창업기업의 생멸에 대한 공간분포 패턴 분석”, 「지적과 국토정보」, 45(1): 241-256. -

Lee, C.J. and Lee, G., 2010. “Relation Analysis Between REITs and Construction Business, Real Estate Business, and Stock Market”, Korea Journal of Construction Engineering and Management, 11(5): 41-52.

[https://doi.org/10.6106/KJCEM.2010.11.5.41]

이치주·이강, 2010. “리츠와 건설경기, 부동산경기, 주식시장과의 관계 분석”, 「한국건설관리학회 논문집」, 11(5): 41-52. -

Lee, H.Y. and Noh, S.C., 2013. Advanced Statistic Analysis: Theory and Practice, Seoul: Moonwoosa.

이희연·노승철, 2013. 「고급통계분석론」, 서울: 문우사. -

Lee, J.H., 2001. The Urban Form, Seoul: Boseonggak.

이주형, 2001. 「도시형태론」, 서울: 보성각. -

Lee, J.H. and Sun, K.S., 2009. “The Change of Seoul Central Place according to Land Use Density and House Type by Distribution”, The Korean Regional Development Association, 21(2): 253-280.

이주형·선권수, 2009. “토지이용밀도 및 주거유형별 분포에 따른 서울시 중심지 변화에 관한 연구”, 「한국지역개발학회지」, 21(2): 253-280. -

Lee, S.W., Yoon, S.D., Park, J.Y., and Min, S.H., 2006. The Practice on Spatial Econometrics Models, Seoul: Pakyoungsa.

이성우·윤성도·박지영·민성희, 2006. 「공간계량모형응용」, 서울: 박영사 -

Lee, T.L. Byeon S.I., Hwang, G.S., and Park, C.G., 2016. “An Analysis on the Economic Impact of the Korean Real Estate Indirect Investment Activation”, Korea Real Estate Review, 26(3): 63-81.

이태리·변세일·황관석·박천규, 2016. “부동산 간접투자 활성화의 경제적 파급효과 분석”, 「부동산연구」, 26(3): 63-81. -

Oh, S.H. and Lee, W.J., 2012. “A Time Series Analysis of Urban Structural Change in Pyeongtaek City”, Journal of Korea Planning Association, 47(2): 33-44.

오세현·이우종, 2012. “평택시 도시공간구조의 시계열적 변화 분석”, 「국토계획」, 47(2): 33-44. -

Park, B.T. and Jin, C.H., 2019. “A Study on the Determinants of REITs IPO: Focusing on Financial Factors, Unique Characteristics, and Governance”, Korea Real Estate Review, 29(2): 7-25.

[https://doi.org/10.35136/krer.29.2.1]

박병태·진창하, 2019. “리츠 공모상장 결정요인의 특성 분석에 관한 연구: 재무적 요인, 고유특성 및 지배구조를 중심으로”, 「부동산연구」, 29(2): 7-25. - Rogerson, P.A., 2010. Statistical Methods for Geography: A Student’s Guide A Student’s Guide, Los Angeles: Sage.

-

Seo, K.M., Kim, H.Y., Lee, S.H., and Kwon, T.H., 2014. “Analysis on Change Characteristics of Spatial Structure Related with Urban Planning: Using Spatial Statistical Method”, Journal of the Korean Association of Geographic Information Studies, 17(2): 1-14.

[https://doi.org/10.11108/kagis.2014.17.2.001]

서경민·김호용·이성호·권태호, 2014. “도시계획과 연계한 공간 구조의 변화 특성 분석: 공간통계기법을 이용하여”, 「한국지리정보학회지」, 17(2): 1-14. -

Seo, S.B., 2015. “A Study on the Spatio-temporal Characteristics of Land Price Fluctuation”, The Korea Spatial Planning Review, 84: 23-34.

[https://doi.org/10.15793/kspr.2015.84..002]

서수복, 2015. “지가변동의 시대별 공간적 특성에 관한 연구”, 「국토연구」, 84: 23-34. -

Seo, M.S., Jung, I.H., and Cho, J.H., 2013. “A Study on Measures to Improve of Rental Housing REITs: Focusing on Feasibility and Structure”, Journal of The Residential Environment, 11(1): 85-95.

서민석·정인호·조주현, 2013. “임대주택 리츠 개선방안 연구: 사업성과 구조를 중심으로”, 「주거환경」, 11(1): 85-95. -

Shin, E.J., Yoo, S.J., and Han, S.Y., 2016. “A study on the Determinants of the Dividend Income of Healthcare REITs”, Journal of the Korean Society of Cadastre, 32(3): 59-73.

신은정·유선종·한수연, 2016. “헬스케어 리츠 배당수익 결정요인에 관한 연구”, 「한국지적학회지」, 32(3): 59-73. -

Song, K.W., 2018. A Study on the Application of Commercial REITs for Investment Diversification, Daejeon: Land & Housing Institute.

송기욱, 2018. 「투자자산 다변화를 위한 상업용 건축물 리츠 도입방안 기초연구」, 대전: LH토지주택연구원. -

Song, K.W., 2020. Analysis on Developing the Evaluation Indicators of Policy-driven REITs for Public Interest and Social Benefit, Daejeon: Land & Housing Institute.

송기욱, 2020. 「공공성과 사회적 편익 요소를 고려한 정책형 리츠 평가지표 개발 연구」, 대전: LH토지주택연구원. -

Song, K.W. and Chang, I.S., 2017. “Case Study and Financing Model of Rental Housing between Public and Private Sector utilizing the REITs”, Korea Real Estate Academy Review, 69: 58-71.

송기욱·장인석, 2017. “리츠를 활용한 공공과 민간의 임대주택 공급모델 기법 특성 및 적용사례 비교 연구”, 「부동산학보」, 69: 58-71. -

Song, K.W., Kim, C.S., and Nam, J., 2010. “The Effects of Local Characteristics on the Residential Distribution of Power Elites in Korea”, Journal of Korea Planning Association, 45(2): 35-49.

송기욱·김창석·남진, 2010. “파워엘리트의 거주지 분포에 영향을 미치는 지역특성요인에 관한 실증분석”, 「국토계획」, 45(2): 35-49. -

Tobler W., 1970. “A Computer Movie Simulating Urban Growth in the Detroit Region”, Economic Geography, 46: 234-240.

[https://doi.org/10.2307/143141]

-

Xuan, M.O., Jang, M.K., Quan J., and Kim, J.H., 2017. “Analysis of Value for Ownership Conversion in the Public Rental Housing REITs according to Real Option Scenarios Reflecting Macroeconomic Variables”, Korea Journal of Construction Engineering and Management, 18(3): 74-83.

현미옥·장미경·전준용·김주형, 2017. “거시경제변수를 반영한 실물옵션 시나리오별 공공임대주택리츠 분양전환 가치 분석”, 「한국건설관리학회 논문집」, 18(3): 74-83. -

Yabe, N., 2008. “Impacts of Real Estate Securitization on Land Price Changes in the Inner City of Tokyo Since 2001: A Geographically Weighted Regression Analysis”, Geographical Review of Japan, 81(5): 384-403.

[https://doi.org/10.4157/grj.81.384]

-

Yim, S.H. and Song, M.J., 2013. “An Analysis of Land Use Changes in Urban Center of Metropolis: The Case of Daegu City”, Korea Journal of Construction Engineering and Management, 48(6): 856-878.

임석회·송민정, 2013. “대도시 도심부의 토지이용 변화 분석: 대구광역시 사례로”, 「대한지리학회지」, 48(6): 856-878. -

Yoo, S.C., 2012. “Operating Performance and Characteristics of K-REITs”, Ph.D. Dissertation, Kangwon National University.

유상철, 2012. “리츠의 운영성과 및 특성”, 강원대학교 박사학위 논문. -

Data Analysis, Retrieval and Transfer System, Accessed December 31, 2020. http://dart.fss.or.kr, .

금융감독원 전자공시시스템, 2020.12.31.읽음. http://dart.fss.or.kr, . -

Economic Statistics System, Accessed December 31, 2020. http://ecos.bok.or.kr

한국은행 경제통계시스템, 2020.12.31.읽음. http://ecos.bok.or.kr -

Korea Association of Real Estate Investment Trusts, Accessed December 31, 2020. www.kareit.or.kr, .

한국리츠협회, 2020.12.31.읽음. www.kareit.or.kr, . -

Korea Housing & Urban Guarantee Corporation, Accessed December 31, 2020.www.khug.or.kr, .

주택도시보증공사, 2020.12.31.읽음. www.khug.or.kr, . -

Ministry of Land, Infrastructure and Transport, Accessed December 31, 2020. www.molit.go.kr, .

국토교통부, 2020.12.31.읽음. www.molit.go.kr, . -

National Law Information Center, Accessed December 22, 2020. www.law.go.kr, .

국가법령정보센터, 2020.12.22.읽음. www.law.go.kr, . -

National Pension Service (NPS) Investment Management, Accessed December 31, 2020. https://fund.nps.or.kr, .

국민연금 기금운용본부, 2020.12.31.읽음. https://fund.nps.or.kr, . -

National Housing Urban Fund, Accessed December 31, 2020. http://nhuf.molit.go.kr, .

주택도시기금, 2020.12.31.읽음. http://nhuf.molit.go.kr, . -

REITs Information System, Accessed December 31, 2020. http://reits.molit.go.kr, .

리츠정보시스템, 2020.12.31.읽음. http://reits.molit.go.kr, .