Final publication date 14 Jun 2021

An Analysis of the Changing Influence Factors on the Housing Affordability for One-person Tenant in Seoul

Abstract

It has become increasingly burdensome to raise housing costs due to a continued rise in housing prices, along with the slowing economic growth and job losses caused by low birth rates. Further, non-marriage, infectious diseases, and housing instability have become serious social problems. Among them, housing affordability for one-person tenants, which pay monthly rent, is considered the most serious. Therefore, this study aims to identify the factors of housing affordability for a one-person household with the most serious housing instability and to analyze the changing factors. For this purpose, RIR was calculated using data from the Korea Housing Survey in 2008, 2016, and 2019. Multiple regression analyses were performed with RIR as a dependent variable and with sociology of population characteristics, economic characteristics, and housing characteristics as independent variables. The results showed differences in the impact factors on the housing affordability of one-person households over each year. Based on the results, the implications of housing policy are as follows: First, it is deemed necessary to provide a quantitative housing suitable for the characteristics of one-person households. Second, it is necessary to expand specific housing support considering the characteristics of one-person households. Third, it is necessary to supply quality and affordable housing.

Keywords:

One-person Household, Tenants, Housing Affordability, RIR키워드:

1인 가구, 임차 가구, 주거비 부담, RIRⅠ. Introduction

1. Background and purpose of research

In recent years, various economic and social issues have emerged in Korea, such as slowing economic growth, low birthrate and increasing numbers of unmarried adults, and job losses among young people. At the same time, it has become extremely difficult and burdensome for people to secure housing due to very high jeonse (a key money deposit system) and housing purchase prices. Housing instability caused by such high costs is emerging as a serious social issue (Bae S.S., 2013; Kim M.J. and Cho M.H., 2018).

Housing cost burden refers to a burden caused by housing costs that individual households actually need to bear for housing services needed in their living (Joo W., 2012). To alleviate the ever-increasing housing cost burden, several housing policies have been introduced as follows: direct and indirect support for housing cost (expansion of housing benefits and home loan support, energy cost support, etc.), provision of affordable housing and infrastructure investment (diversification of public rental housing providers, substantial improvements of public rental home supply, house remodeling, etc.), and stabilization of the rental housing market (jeonse/monthly rental transaction report system, jeonse/monthly rent ceiling system, contract renewal application right, etc.) (Kang M.N. et al., 2019). However, despite the various policies put forth by the government, spending on housing remains very excessive, giving rise to such newly-coined words as “house poor” and “rent poor.”

According to the Korea Housing Survey in 2019, one-person households spend 33% of their income on housing, while regular households spend 27% of their income on housing, meaning that one-person households are the most cost-burdened group. One-person households, as they are free from burdens of raising children or supporting other members of family compared to multi-person households, are likely to have higher disposable income (Jung I. and Kang S.J., 2019). Their items of consumption are also different from those of multi-member households. While housing costs take up the greatest share (about 18%) of one-person households’ consumption, educational spending and food expenses account for higher portions in multi-person households (Household Trend Survey, 2018). In addition, because a larger number of one-person households reside in rental housing and pay monthly rent, they are relatively more cost-burdened than multi-person households.

In Korea, one-person households accounted for 15.5% of the entire households in 2010, and the number grew steadily to take up 28.6% of the entire number of households in 2017 (Jung I. and Kang S.J., 2019). One-person households are expected to become the biggest type of households in Korea by 2045, taking up 36.3% (Byun M.R. et al., 2019). As such, one-person households are gaining importance as a major type of households that represents the Korean society today.

Indeed, the housing purchase price index and jeonse price index in 2019 increased by 30% and 66%, respectively, from 2008. Although the increase and decrease rates of the monthly rent index are smaller than those of purchase and jeonse prices, monthly rent is still high. Like this, housing prices continue to rise, and increases in jeonse and monthly rent prices are particularly notable. However, overall housing standards have improved according to the Korea Housing Survey in 2019 by the Ministry of Land, Infrastructure and Transport (MLIT). Several viewpoints may exist when it comes to determining if housing standards have actually improved.

As such, this study aims to investigate if housing cost burden steadily increased from the past to the present or decreased with improved housing standards, and identify factors that influenced increases or decreases of housing cost burden in the past and the present, as well as the reasons why they changed. Based on the outcomes of this investigation, the study will further provide implications for housing policies designed to help mitigate housing cost burden.

2. Range and flow of research

This study aims to analyze factors that affect housing affordability of one-person tenants in the city of Seoul.

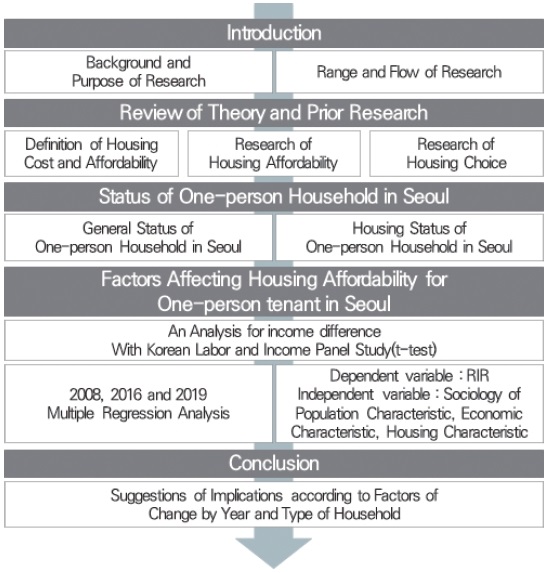

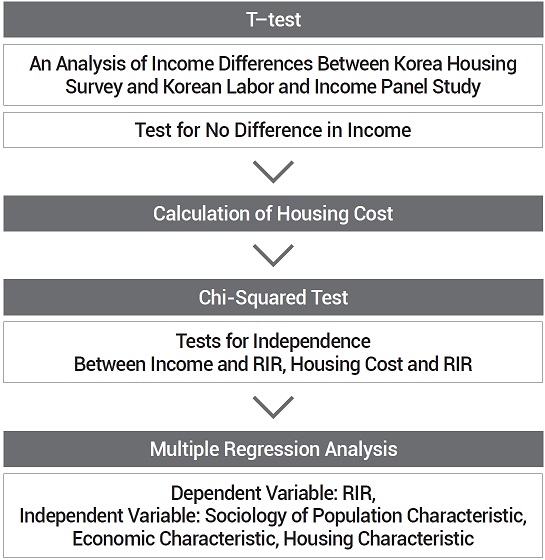

As <Figure 1> shows Housing costs were calculated based on data from the Korea Housing Survey by the MLIT for the years 2008, 2016, and 2019. We believed that an analysis of the data from the three particular years was necessary as the rent to income ratio (RIR) of one-person tenant households hit a record high in 2008, started to fall from 2016, and then reached a record low in 2019. When comparing different years from one another, the general practice is to use panel data. However, due to changes in people’s life cycle, lifestyle, and values, as well as changes in income and rent among one-person tenants in 2008, 2016, and 2019, individual tenants came to have different preferences and choices for housing, and thus the use of panel data was deemed inadequate for this study’s purpose. For this reason, the Korea Housing Survey data provided by MLIT were used instead. While Korean Labor and Income Panel Study and Household Income and Expenditure Survey can also be used to calculate the RIR, the former lacks in the number of samples and independent variables, while the latter makes it impossible to extract data confined to the city of Seoul only. Therefore, the Korea Housing Survey data were deemed more adequate for this study.

Tenant households, consisting of renter households that need to pay monthly rent and jeonse households that make a large lump-sum deposit payment up front, are a group of households that feel the most severe burden of housing costs. Among these, we believed that one-person households with a higher rate of renting would be even more burdened by housing costs. As such, this study mainly deals with one-person tenants in Seoul for its investigation. After removing outliers from the Korea Housing Survey data, such as households that left empty responses or answered “Not Sure,” 481 one-person tenants from 2008, 534 one-person tenants from 2016, and 1,494 one-person tenants from 2019 were analyzed.

RIR is a dependent variable based on the ratio approach, which serves as an indicator to show housing affordability, or the ratio of housing costs to average monthly income. One’s monthly income is defined as the gross sum of financial support from parents, earned income and other income, and housing costs are defined as the sum of rent and housing maintenance fees. In addition to conventional housing cost items such as rent, and lighting and heating expenses, utilities (water, gas, and electricity), and housing maintenance fees are also fixed monthly cost items. Therefore, in this study, housing costs are defined to include conventional housing cost items as well as maintenance fees. Tenant households are divided into those on the jeonse system, those paying monthly rent with a deposit, and those paying monthly rent without a deposit. For jeonse tenants, their key money deposits are converted to corresponding monthly rent amounts to calculate their respective housing costs.

The Korea Real Estate Board has been publishing jeonse-monthly rent conversion rates since 2011. According to the Housing Lease Protection Act, the jeonse-monthly rent conversion rate cap is set by adding 3.5% interest determined by the Presidential Decree to the Bank of Korea Base Rate (based on the same Act before its amendments in September 2020). At the time of the Korea Housing Survey in 2008, the Base Rate was 4.2%, so jeonse prices for this year were converted to monthly rent by using the conversion rate of 7.7%. As for the 2016 and 2019 data, jeonse prices were converted to monthly rent based on the jeonse-monthly rent conversion rates for different housing types from Statistics Korea and Seoul Open Data Plaza.

In order to discover factors that influence housing affordability of one-person tenants in Seoul, housing costs and housing affordability were first defined as above and then housing costs were calculated. Then, prior research on housing affordability and housing choices was reviewed to differentiate this study. Income differences between Korea Housing Survey and Korean Labor and Income Panel Study were subsequently validated through a t-test. Once it was validated that there were differences, a multiple regression analysis was performed by using the RIR as a dependent variable, and sociology of population characteristics, economic characteristics, and housing characteristics as dependent variables. Among variables of significance from 2008, 2016, and 2019, conclusions were drawn based on the variables commonly found, as well as those that are specific to each year, and then future implications of this study were discussed.

Ⅱ. Review of Theory and Prior Research

1. Definition of housing cost and affordability

Traditional housing costs refer to costs needed for housing as a means of survival, as suggested by Engel and Schwabe, and mean only rent and lighting and heating expenses (Kim H.S. et al., 2003). The Schwabe Index denotes the weight of housing expenses required for housing life as part of the total living costs. According to Schwabe’s Law, the higher a household’s income is, the smaller the rate of increase in its expenditure becomes (Lee J.H., 2015). In addition, the Schwabe Index is the rate of housing costs in household consumption expenditures that encompass not just consumption directly related to housing activities (rent, water, lighting, and heating expenses) but also fixtures and fittings, and household goods, and this index goes down with rising income (Lee H.J. et al., 2018).

More recently, however, housing costs refer to housing, water, and lighting and heating expenses, according to the Household Income and Expenditure Survey, and OECD (2017) defines housing costs as electricity, water, and gas fees in addition to mortgage principal repayment amount (for homeowners) or monthly rent (for tenants). Housing costs also refer to the sum of all costs related to housing that need to be paid by those who use housing in exchange of services provided by it (Kim H.S. et al., 2003). In other words, they denote costs that need to be constantly paid in order to live in a house either owned or rented (Bae S.S. et al., 2013).

Housing affordability refers to a burden caused by housing costs that individual households actually need to bear for housing services for their living. In general, the more developed an economy is and the higher one’s income is, the smaller the share of spending on food, clothes, and shelter associated with basic survival becomes and the greater the share of spending on culture, leisure, dining, and education becomes (Joo, W., 2012).

Housing affordability is an element that determines one’s ability to secure housing of a certain standard without posing an excessive burden on one’s finance. If a household spends excessively on housing costs, it affects grocery, medical, and educational expenditures, leading to deterioration of the household’s overall quality of life (Lee J.E. et al., 2018). In order to prioritize or expand housing-related support for households with heavier burden of housing costs, the level of housing affordability/burden of each household needs to be measured first (Lee, 2016). There are mainly two methods to measure housing affordability – one is the rent to income ratio (RIR) approach and the other is the residual income approach. Most researchers use the RIR approach. According to the US Department of Housing and Urban Development, an RIR below 30% means affordable cost burden, an RIR between 30 and 50% represents excess cost burden, and an RIR over 50% translates to severe cost burden, which is given the highest priority for policy support.

2. Research of housing affordability

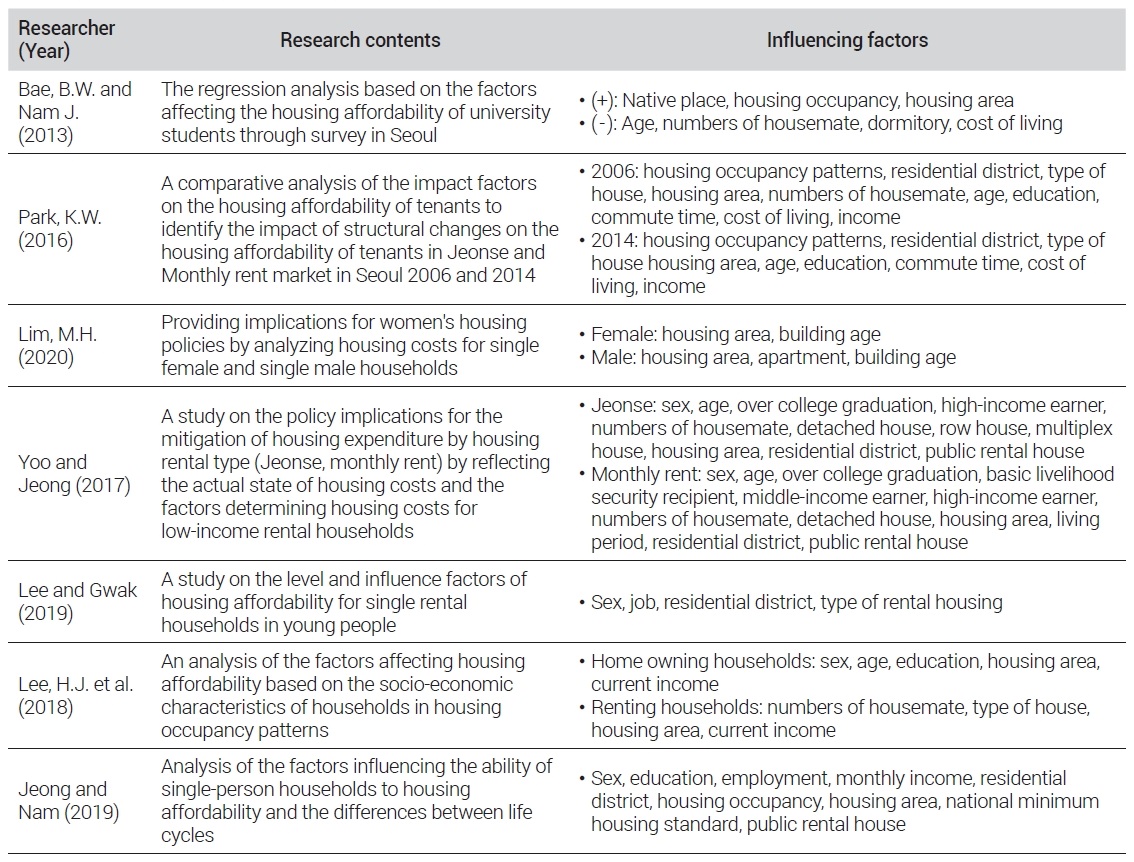

The study on housing Affordability can be divided into studies by gender, life cycle, region, income class (central to low-income class), housing occupancy type, number of households, education level, etc. and details are as shown in Table 1.

Lim M.H. (2020) divided gender-specific housing costs into ownership costs and tenancy costs for comparison and analysis purposes centering on one-person households, in order to analyze housing costs of female and male households by age nationwide. The study found that female one-person households spent more on housing costs than male one-person households. Also, as shown by Jeong S.Y. et al. (2019), there is a higher rate of female one-person households among the elderly, and because one-person households in this group are formed for different reasons from the youth and the middle-aged, they feel more burdened by housing costs. Based on these findings, the study suggested the need for introducing selective support measures that take gender-specific characteristics and elderly households into consideration when establishing housing policies.

Studies that examined decision factors for housing costs by householder age (through life cycle segmentation) found that, as shown by Lim M.H. (2020) and Jeong S.Y. et al. (2019), housing cost burden was more severe among young and elderly households than among middle-aged households (Kwon G.W. et al., 2016). In particular, it was found that college students residing in Seoul are much more burdened due to housing than college students residing elsewhere (Bae B.W. and Nam J., 2013). Moreover, those from non-Seoul/capital area experienced more severe housing cost burden than those from Seoul/capital area (Bae B.W. and Nam J., 2013). On the other hand, it was found that older households were more burdened by housing costs than younger households (Choi Y. et al., 2014; Kwon G.W. et al., 2016; Koh H. et al., 2017), and a study that dealt only with cases from Busan found that housing affordability is likely to increase among older householders and one-person households (Choi Y. et al., 2014).

Meanwhile, it is becoming increasingly difficult for low-income tenants to pay monthly rent due to excessive increases in key money deposit for jeonse housing and conversion of the jeonse system to monthly rent. As such, Yoo B.S. et al. (2017) analyzed actual housing affordability and decision factors, and found that the RIR is higher among jeonse tenants than those on monthly rent, and of those, low-income tenants had the highest RIR. The study explained that this is because housing welfare policies for low-income households are centered on tenants on monthly rent, and suggested that current housing policies need to expand the recipient base for housing welfare benefits (Yoo B.S. et al., 2017).

While prior research on housing costs mostly dealt with tenant households, Lee J.E. et al. (2018) used the housing price to income ratio (PIR) to investigate the distribution of housing affordability in the capital area. As a result, it was found that Seoul had the most severe housing cost burden, and it was particularly high in central Seoul-Jongno-gu, Jung-gu, and Yongsan-gu, more specifically. This means that an area with higher housing prices has higher housing cost burden as well.

3. Research of housing choice

The probabilistic choice model, theoretically developed and advanced by McFadden (1981), perceives each and every individual as a decision-making unit and believes that any individual, when presented with several options, chooses an option that maximizes utility (Kim J.S., 2004). The probabilistic choice model is based on the utility maximization theory, which argues that people always make decisions in a way that maximizes utility. It assumes that an individual can maximize utility from the options available to him or her (Kil Y.M. et al., 2016).

A household’s choice of housing is universally explained by the life cycle hypothesis by Ando and Modigliani (1963) (Kil Y.M. et al., 2016). Life cycle refers to major stages of a household from its formation to disappearance, and phenomena typically taking place in each stage. People in their 20s and 30s typically reside as tenants of either jeonse or monthly rental housing. However, as they grow older, home ownership increases as they start a family while making more income. Like this, it is generally known that one’s life cycle greatly influences one’s housing choice (Nam J. et al., 2015).

Housing choices may vary depending on a household’s socio-economic status represented by age, income, education, and occupation, one’s preference, and external factors such as rent (Park W.S., 2015). In previous studies, housing locations were chosen based primarily on economic factors such as housing prices, rent, and government support, secondly on housing environment, and thirdly on housing unit size and community facilities, etc. Life cycle influences housing choices. In addition, one’s housing choice is also influenced by his/her income, education, as well as other external factors such as changes in housing prices. One-person households, in particular, differ greatly in terms of economic conditions and housing consumption depending on how they were formed, and life cycle has a great effect on such background (Kim J.W. et al., 2010). Also, because housing has a characteristic of a product that can be chosen, a resident is more willing to pay a higher housing price or rent depending on his or her satisfaction of the housing unit and residential environment, leading to a higher possibility of excess housing cost burden (Lim S.H., 2016). Because one’s choice of housing is influenced by a combination of various factors, it is necessary to consider households’ decision of housing as well in order to analyze how factors influencing housing affordability change.

4. Differentiation from prior research

This research is different from prior research in several ways: first, it performed a multiple regression analysis by considering factors that reflect latest housing trends that were not considered in previous studies. Existing studies on housing cost and housing affordability mostly considered a particular point in time or a specific group of people only when investigating factors influencing housing affordability. While there is a study that compared different times, it simply described changes in variables without considering the relationships between several different variables. Moreover, research that takes people’s individual characteristics, and changes in preferences and values into account is largely insufficient. Typical one-person or two-person households prefer small- to medium-sized housing, and the actual living area is steadily decreasing (Park M.S. et al., 2017). Recently, as outdoor activities have decreased and an increasing number of people are working from home due to COVID-19, “home” has a new meaning as the safest space. This has also led to changes in the meaning of housing and house preference, and an analysis considering such changes needs to be performed.

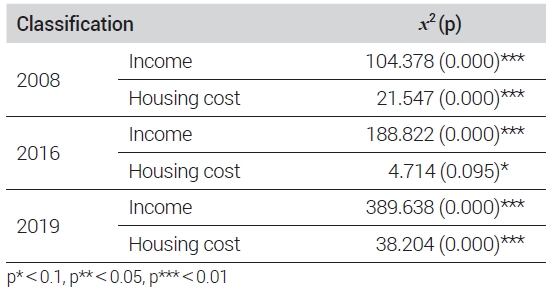

Secondly, this study is different in terms of research methodology as it utilized t-testing with another survey to ensure the validity of using the Korea Housing Survey data. A chi-squared test was also performed in this study to validate independence between different variables. This is because housing costs and income used as independent variables were used for calculating dependent variables as well. Previous studies performed analyses without determining the adequacy of data used in each study. For instance, while the RIR can be calculated by using either of Korean Labor and Income Panel Study and Household Income and Expenditure Survey that determines income levels, previous research simply used data from one survey only. Therefore in this study, the adequacy of the data used was determined through a t-test, believing that it was necessary to validate the use of the Korea Housing Survey data. Meanwhile, the RIR, which is a dependent variable, denotes the share of housing cost in one’s monthly average income, but income and housing cost are used as independent variables as well, which may cause redundancy. Therefore, to avoid redundancy, independence of the variables was confirmed through chi-squared testing of income and the RIR and of housing cost and the RIR, and they were set as independent variables to be subsequently used for the multiple regression analysis of this study.

Lastly, this study differentiates itself from prior research as it offers a variety of implications for housing policies tailored to one-person households, by considering change factors that affect housing affordability of one-person households residing in Seoul, rather than suggesting policies designed to simply offer quantitative supply of housing and to stabilize housing prices.

Ⅲ. Status of One-person Household in Seoul

1. General status of one-person household in Seoul

According to the Population and Housing Census, a one-person household is defined as “a household that has one member who takes care of daily needs such as cooking and sleeping, etc. independently by himself or herself.” In this study, a one-person household is defined as a household headed by the person, consisting of a single member, with the total number of household members being one.

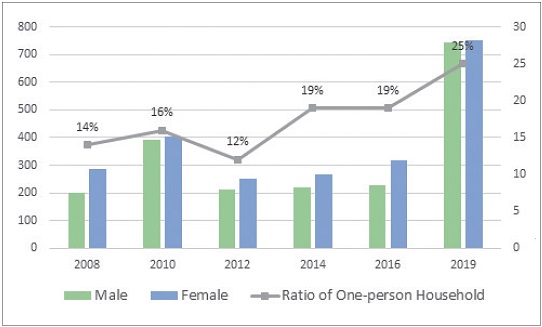

According to the Korea Housing Survey for the past 10 years like <Figure 2>, one-person households in Seoul took up 14% of the entire households in 2008, and it has been on the steady rise as factors that lead to changes in household types such as natural increases and decreases of population, late marriage, divorces, bereavements, and changes in values became stronger, to reach 25% of the entire households as of 2019. This figure is anticipated to grow to 36.3% in 2045. This is because the impact of new social phenomena such as the so-called alone trend, single people, and solo dining (Byun M.R., 2019) is becoming greater than expected and the share of one-person households is growing at an accelerating rate.

As <Figure 2> shows, because the female population is generally larger than the male population and women tend to live relatively longer than men, there is a higher proportion of female one-person households. However, with the recent growth of male one-person households, men and women respectively take up half of the entire one-person households, and gender distinction is disappearing (Park M.S. et al., 2017).

In terms of householders’ age, those in their 20s and 30s took up the largest proportion of one-person tenants from 2008 to 2019, and the share of those in their 60s is on the steady rise. For multi-member tenants, the proportion of those in their 30s and 40s was high in 2008, but in 2019, the share of the middle aged who are in their 50s or older has increased. As the marriage rate has steadily decreased and the divorce rate has been at a steady level for the past 10 years (2009-2019), one-person households in the middle-age group are anticipated to grow steadily.

2. Housing characteristics of one-person household in Seoul

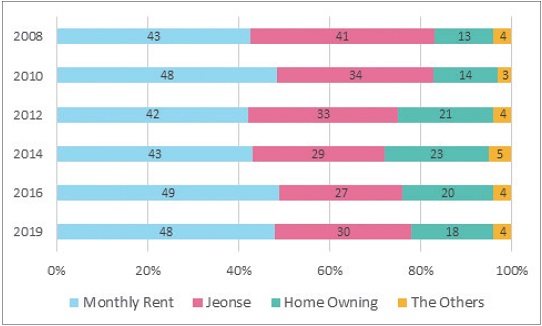

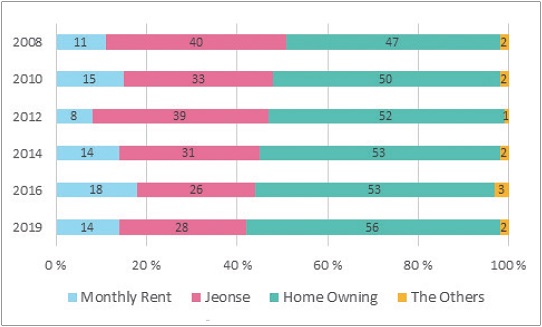

Looking at the type of occupancy by household type like <Figure 3> and <Figure 4>, one-person households had a high rate of renting (combined rate of jeonse/monthly rental) regardless of the year, with the number of jeonse tenants on the decline and the number of monthly rent tenants on the rise. Multi-person households have shown a higher home ownership rate except in 2008. The rate of one-person households has increased from the past, and the rate of renters is also steadily rising, whereas multi-person households have a higher rate of home ownership, which is steadily increasing compared to tenant households.

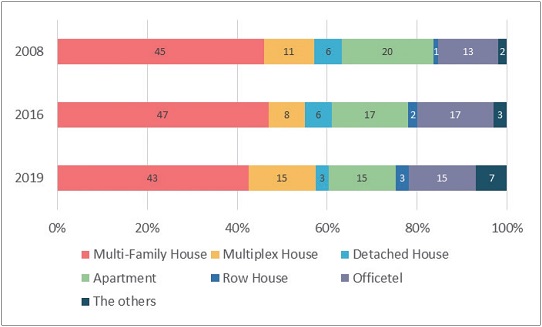

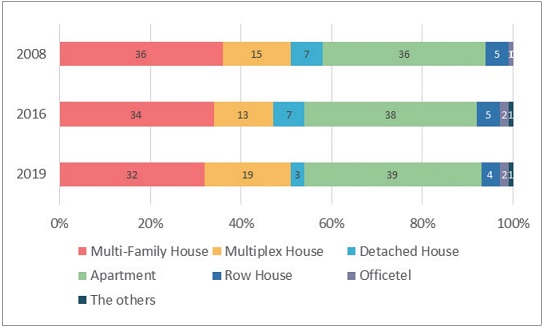

Looking at the proportions of different housing types by household type like <Figure 5> and <Figure 6>, multi-family houses are home to the largest number of households, and the proportion of households living in multiplex houses is increasing. Apartments are home to the most number of multi-person tenant households, and the proportion is on the rise. Unlike one-person tenants, multi-person tenant households have members to raise/support, and thus they tend to live in apartments, which offer generally more comfortable residential environment and larger floor area. As for housing floor area (hereinafter, “housing area”), it was found that multi-person households live in places about double the size of those of one-person households.

Both one-person tenants and multi-person tenant households have a higher proportion of private rental housing. The largest share of multi-person tenant households reside in private rental housing, but the number decreased in 2019 compared to 2008, while the number of multi-person tenant households residing in public rental housing increased. A larger number of one-person tenants mostly on monthly rent reside in private rental housing than in public rental housing.

Housing costs of both one-person tenants and multi-person tenant households have increased over the years. As for housing satisfaction and residential environment satisfaction, both one-person tenants and multi-person tenant households had higher satisfaction in 2019 than in 2008, with multi-person tenant households showing higher satisfaction than one-person tenants.

Housing costs, which are the sum of monthly rent and housing maintenance fees, were 490,000 won on average for one-person tenants in 2008 but increased by 4% to 510,000 won in 2019. For multi-person tenant households, housing costs increased by 5% to 920,000 won in 2019 from 880,000 won in 2008.

As for monthly average income, it went up 17% to 1,910,000 won in 2019 from 2008 for one-person tenants and 23% to 3,680,000 won in 2019 from 2008 for multi-person tenant households.

Monthly average cost of living for one-person tenants was 1,170,000 won in 2019, up 54% from 2008, while for multi-person tenant households, it was 2,370,000 won in 2019, up 43% from 2019.

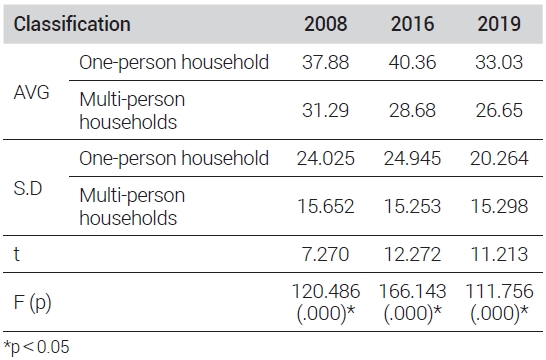

The RIR of one-person tenants was 37.9% in 2008, 40.36% in 2016, and 33% in 2019, indicating that one-person tenants were the most cost-burdened in 2016 but less cost-burdened in 2019. For multi-person tenant households, the RIR was 31.3% in 2008, 28.68% in 2016, and 26.64% in 2019, suggesting that they were most cost-burdened in 2016 and less cost-burdened in 2019.

3. Sub-conclusion

One-person households took up 14% of the entire households in Seoul in 2008 and the figure grew to 25% in 2019. In 2009, a higher rate of one-person households were residing in rental homes compared to 2008, while the rate of home ownership increased among multi-person households.

As for housing types for one-person tenants, more households lived in multi-family houses and apartments in 2008, 2016, and 2019, but the share of those residing in apartments increased in 2019.

Among one-person tenants, 10-13% live in public rental housing while 87-90% live in private rental housing, showing a higher rate of private rental housing than public rental housing among one-person tenants, which changed little over the period from 2008 to 2019.

The housing area decreased from 36m2 in 2008 to 30m2 in 2019 because one-person households prefer smaller-sized units requiring less costs of maintenance and repair. As such, the trend in the housing market, too, is geared more to supplying small-sized units rather than medium- and large-sized homes.

The levels of housing satisfaction and residential environment satisfaction in 2019 were found to have increased from 2008 as well. Changes in our society as well as our values, with more people choosing single life or late marriage, resulting in a low birthrate, have affected housing choices by one-person households who have a stronger tendency to choose housing with better residential environment that can offer an overall higher level of satisfaction.

In 2008, there were more female one-person households than their male counterparts, but the rate of increase of male one-person households is becoming more notable recently due to the increased numbers of divorces and so-called “wild geese fathers.” With these changes, the rates of female and male one-person households in 2019 were found to be about the same.

As for changes in one-person households by age, those in their 20s and 30s accounted for more than a half of all one-person households in 2008, while those in their 70s became the largest group in 2016, and then those in their 20s and 30s took up the biggest share in 2019. It was found that the proportion of the elderly over 60 years old has been on the rise from 2008 to 2019.

Housing costs, which are the sum of average monthly rent and housing maintenance fees, were 510,000 won in 2019, up 4% from 2008, while monthly average income was 1,910,000 won in 2019, up 17% from 2008. However, the RIR calculated based on these figures dropped by 4% to 33% in 2019, and this is because the income growth rate was higher than the rent growth rate. Meanwhile, the monthly average cost of living was found to have increased together with income growth.

Ⅳ. Analysis Framework

1. Research methodology

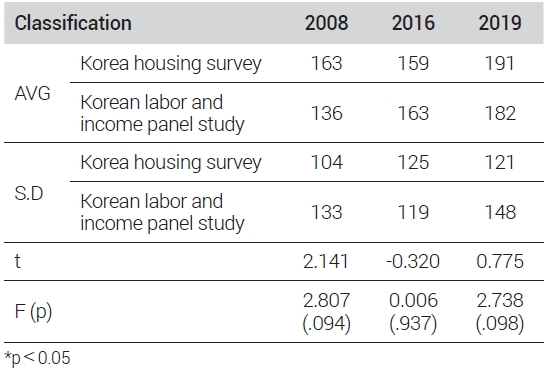

Like <Figure 7> First, A t-test was performed to see if there was any difference between the data from the Korea Housing Survey and the Korean Labor and Income Panel Study in terms of income among one-person households in Seoul. A t-test is a method used to determine if there is a difference between the means of two groups. An Independent Samples t-Test used for analysis is based on the null hypothesis that the means of two groups are the same, and if the p value is smaller than 0.05, then its alternative hypothesis is adopted, with the belief that there is a significant difference between the means of the two groups. For the Korean Labor and Income Panel Study, no data existed for 2019, so the data from 2018 were used instead to perform the t-test. After demonstrating that there was no difference between the two household groups, we chose the Korea Housing Survey data for this study’s analysis to calculated housing costs. The RIR was calculated as a ratio of housing costs to monthly average income. However, because the RIR as a dependent variable is a ratio of housing costs to the income, and income and housing costs are used as independent variables, it was adopted as an independent variable only after validating that income, housing costs, and the RIR are indeed independent from one another through chi-squared testing. Afterwards, another t-test was performed to see if there is any difference between one-person households and multi-person households among tenant households in terms of the RIR, and then a multiple regression analysis was performed to examine the factors influencing the housing cost burden on one-person tenants each year, using the RIR for each year as a dependent variable. Then, based on the influencing factors of the housing cost burden of one-person tenants, it was analyzed how these factors were different from those of multi-person tenant households, as well as how and why the influencing factors of the housing cost burden of one-person tenants changed.

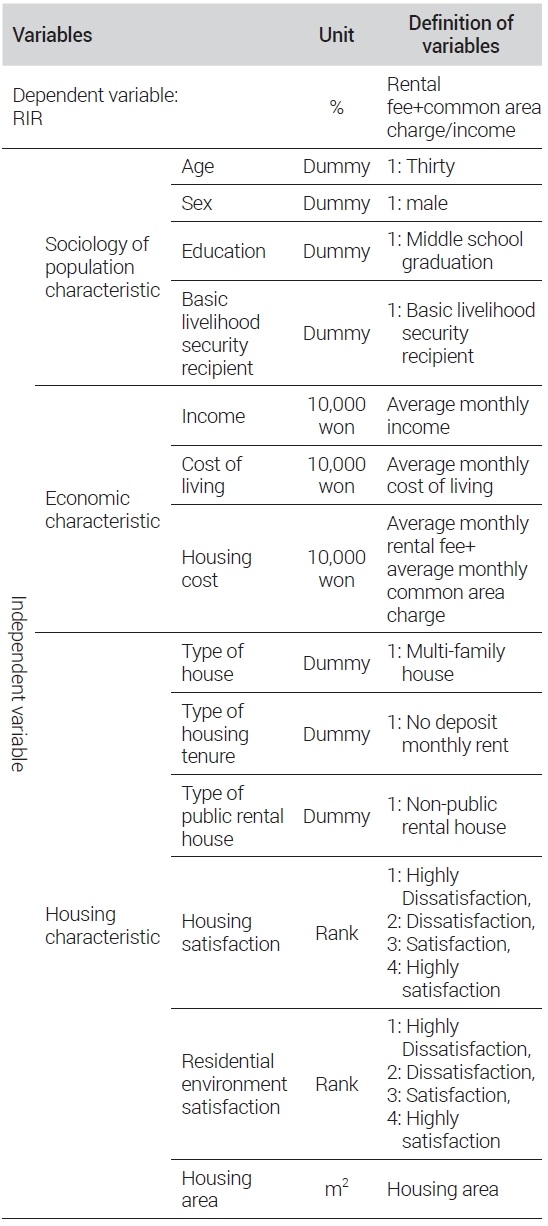

2. Setting of variables

While the RIR was used as a dependent variable for the multiple regression analysis, sociology of population characteristics, economic characteristics, and housing characteristics, each consisting of items listed in Table 2, were used as independent variables.

The Sociology of Population Characteristics consists of Age, Sex, Education, and Basic Livelihood Security Recipients. While the increase of one-person households is attributable to a changed way of thinking regarding family relationships and marriage, different age groups have different reasons for starting one-person households. The youth start their own households by becoming independent of their respective families or by choosing not to marry. The middle-aged become one-person households due to disintegration of family relationships, while the elderly become one-person households because of loss of family members or aging (Park M.S. et al., 2017). Because socioeconomic changes influence the formation of one-person households as well as housing choices over one’s life cycle (Kim M.C. et al., 2017), age was chosen as a variable.

In general, women pay relatively higher housing costs than men, as they tend to choose housing that is safer from crime, comfortable, and pleasant in terms of living. Sex was chosen as a variable because we believed that housing choices differ depending on the sex, and this difference is likely to affect housing costs.

The number of one-person households that are basic livelihood security recipients also increased from 2008 by 4% to 12% of the entire one-person households in 2019. This was selected as a variable because it is believed that such households would find it increasingly difficult to bear housing costs due to rising housing prices and economic slowdown. Education has been used as a variable to replace economic status, but is set as an independent variable in this study because income and education are two separate variables.

Economic Characteristics are comprised of Income, Housing Cost, and Cost of Living. Income and Housing Cost of a household are set as variables as they have the most direct influence on housing cost expenditure. Cost of Living is also chosen as a variable as it is associated with income.

Housing Characteristics consist of Type of House, Type of Housing Tenure, Type of Public Rental House, Housing Satisfaction, Residential Environment Satisfaction, and Housing Area. As for Type of House, it is further divided into detached house (including detached house with shop), multiplex house, apartments, row house, multi-family house, officetel, and others (house within a non-residential building, small tiny housing, shack, vinyl greenhouse, hut, others) that are set as dummy variables. Type of House is set as a variable as rent and housing maintenance fees vary depending on housing type. Jeonse and Monthly Rent were set as dummy variables as there exists a difference in terms of how tenants pay their housing costs.

The government is implementing a policy to raise the ratio of public rental housing to 10% or higher by 2025. As such, Type of Public Rental House was selected as a variable to see whether or not the government’s policy for public rental housing has had practical impact on mitigating housing cost burden.

Housing Satisfaction and Residential Environment Satisfaction are believed to be variables that reflect the latest housing trends. The number of one-person households is steadily growing with increases in aging population, late marriages, and divorces. Recently, one-person householders tend to perceive their home not just as a space for meeting their basic necessities of life but as an environment that offers convenience of living alone, and is safe and entertaining enough not to feel lonely. Housing that offers all of the above residential environment naturally comes with a high rental price. These two variables were selected because changes in one’s value in perceiving housing influences housing choices, which in turn affect one’s housing cost burden.

In general, housing area is proportional to housing cost. The larger the housing area is, the higher the rent and housing maintenance fees inclusive of water, lighting, and heating become. Therefore, Housing Area was also used as a variable. All of the variables are listed in Table 3.

Ⅴ. Factors Influencing Housing Cost Burden on One-Person Tenants in Seoul

1. Factors influencing housing cost burden

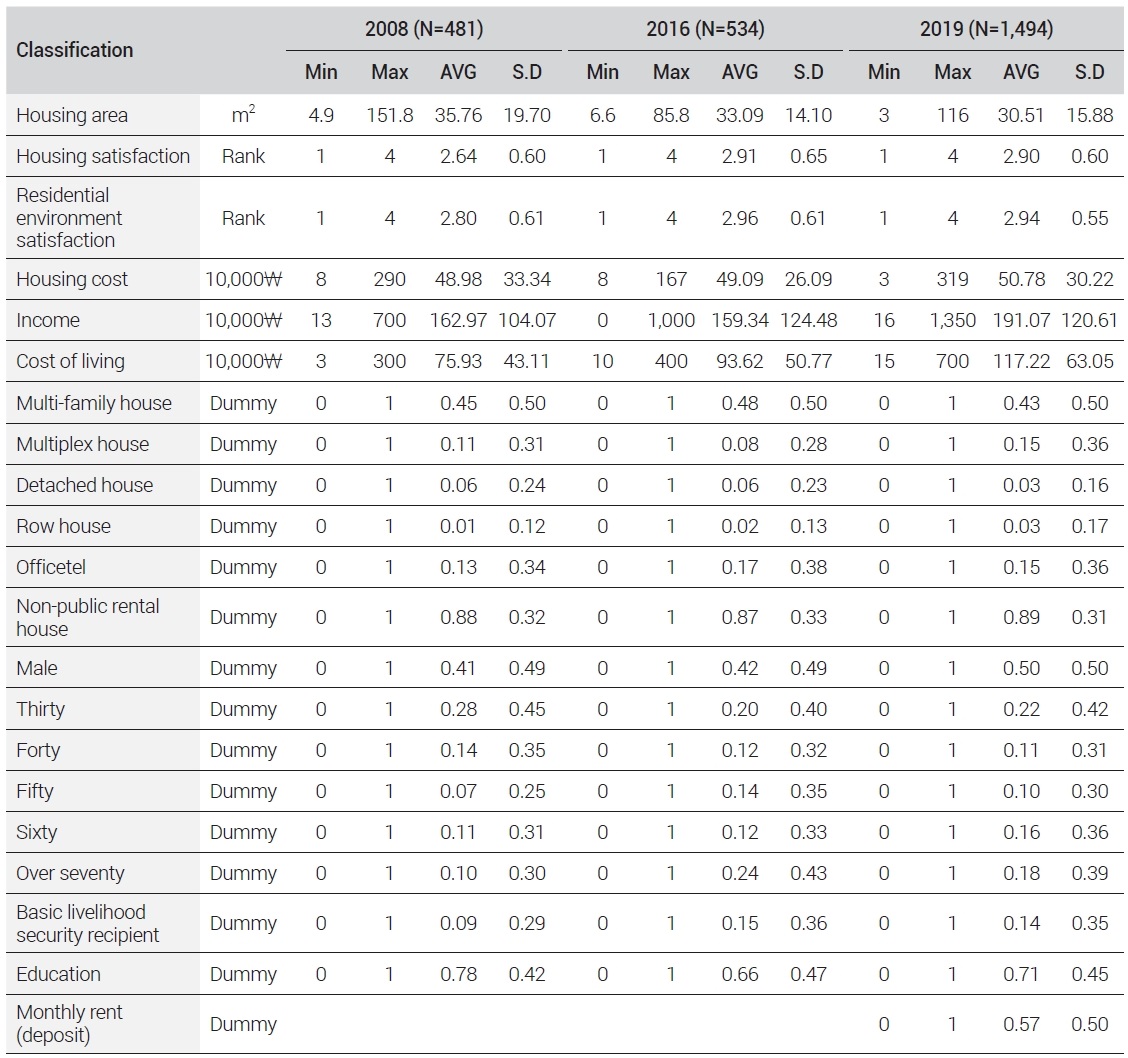

A t-test was performed to validate the hypothesis that there is a difference between the income from the Korean Labor and Income Panel Study and that from the Korea Housing Survey. The test results are shown in Table 4, indicating that there is no difference between the Korean Labor and Income Panel Study and the Korea Housing Survey in terms of income. Therefore, there is no issue in using the income data from the Korea Housing Survey instead of the income data from the Korean Labor and Income Panel Study.

In addition, another t-test was performed to validate the hypothesis that the RIR of one-person households is different from that of multi-person households. The results are shown in Table 5, indicating that both one-person households and multi-person households had different RIRs for all the years examined in this study. As for the RIR by household type for each year, the RIR for one-person households was the highest in 2016 and the lowest in 2019, while the RIR for multi-person households was the highest in 2008 and has thereafter been on a gradual decline.

A chi-squared test was performed to examine the connection between income and RIR, and between housing cost and RIR. The results are shown in Table 6, and since the chi-squared test of income and RIR showed statistically significant results, it can be said that income and RIR differed from one another. Also, because the chi-squared test of housing cost and RIR showed statistically significant results, it can be said that housing cost and RIR differed from one another. Therefore, Income and Housing Cost were selected as separate independent variables for this study’s analysis.

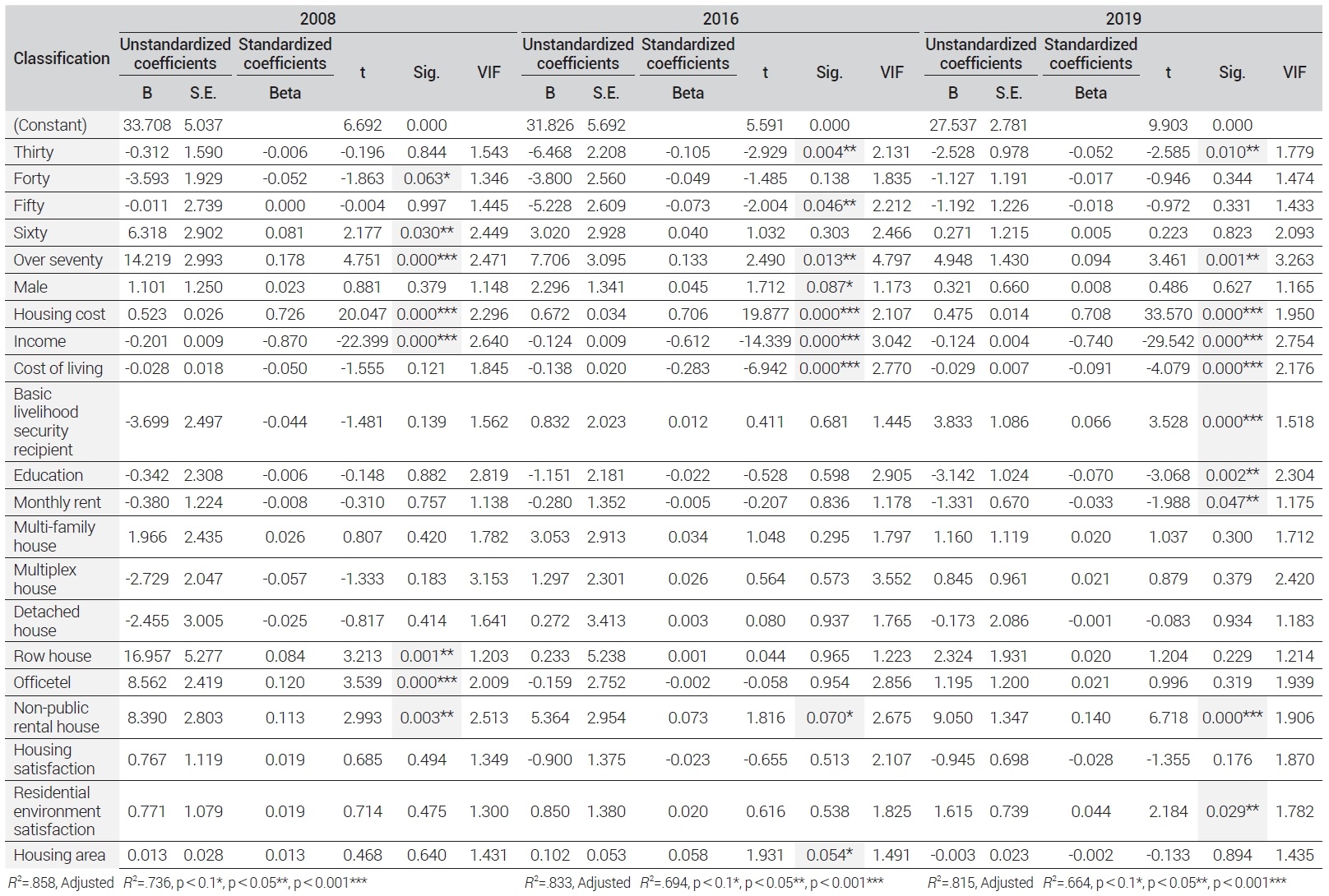

In order to identify factors that affect housing affordability of one-person tenants, a multiple regression analysis using the RIR of 2008 as a dependent variable was performed. As shown in Table 7, R2 in this regression model was 0.858 representing a high explanatory power and the VIF value was lower than 10, showing no issue of multicollinearity. Housing Cost, Income, Row House, Officetel, Sixty, and Over Seventy were variables of significance. More specifically, the study found the following:

First, households residing in row houses had a severe housing cost burden. 2008 was a time when housing prices fell across the housing market regardless of location or size due to economic instability caused by the financial crisis. However, the increase rate of jeonse prices of row houses in 2008 from 2007 was relatively greater than those of other types of housing. Row House was found as a significant variable for this reason. Second, Officetel was a significant variable. Since the market for officetels had the highest price growth rate in 2008 compared to other years and since then has been on the decline, this variable was selected as a factor distinctive for the year 2008 only.

Third, Housing Cost and Income were also significant factors as people found themselves more severely burdened by housing cost when their income was lower and their housing cost was higher. This is because if household income increases, even though the amount of housing costs increases, it takes up a smaller share of the income. This can be explained with Schwabe’s Law (Park K.W., 2016).

Fourth, households residing in private rental housing (“Non-public Rental House”), or tenants residing in regular rental homes, were more cost-burdened than those residing in public rental housing (“Public Rental House”). Because public rental houses are cheaper than market prices and allow long-term tenancy, tenants spend less on housing costs monthly than multi-person tenant households. However, because most one-person households reside in non-public rental houses, which are easy to find and move into but come with higher prices than public rental home, they are cost-burdened for housing.

Lastly, as suggested in several existing studies, the older the householder was, the more severe the housing cost burden became. This is because as the householder gets older, he or she loses income sources and/or the ability to engage in economic activities, so people in older age groups have less ability to bear housing costs than those in younger age groups. Especially in 2008, due to an economic slowdown caused by the financial crisis, those in their 60s were particularly burdened by housing cost, as they reached the retirement age as well.

In order to identify factors that affect housing affordability of one-person tenants, a multiple regression analysis using the RIR of 2016 as a dependent variable was performed. As shown in Table 7, R2 in this regression model was 0.833 representing a high explanatory power, and the VIF value was lower than 10, showing no issue of multicollinearity. Housing Cost, Income, Cost of Living, Thirty, Fifty, and Over Seventy were variables of significance. More specifically, the study found the following:

First, prior research suggested that the older the age is, the more severe housing cost burden became. Based on the fact that Over Seventy for one-person households in their 70s and older was found to be a significant variable, this study’s results are consistent with findings from prior research. Second, those in their 30s were not burdened by housing cost. Unlike in the past, it is no longer unusual to live alone, and those in their 30s have a higher rate of income growth. This is believed to be the reason why they feel less burdened by housing cost. Third, like people in their 30s, those in their 50s felt less cost-burdened for their housing. The average retirement age is 57, and many baby-boomers (born between 1955 and 1963) retire at this age (Statistics Research Institute, 2010). As this massive population group, known as the baby-boom generation, reached the retirement age, they took out more household loans to secure cost of living, and thus felt relatively less burdened by housing cost than other times.

Fourth, as in 2008, people felt more severe burden of housing cost when their income was lower and their housing cost was higher. Lastly, Cost of Living in this study is used to mean all sorts of costs required for living including food, housing maintenance fees (excluding rent), clothing, educational expenses, and healthcare expenses. It was found that the smaller one’s cost of living was, the heavier one’s housing cost burden was. A correlation was found between Income and Cost of Living. This means that, with higher cost of living, income was also high, making housing cost less burdensome, but when cost of living was low, income was also low, making the burden of housing cost heavier.

In order to identify factors that affect housing affordability of one-person tenants, a multiple regression analysis using the RIR of 2019 as a dependent variable was performed. As shown in Table 7, R2 in this regression model was 0.815, representing a high explanatory power, and the VIF value was lower than 10, showing no issue of multicollinearity. Residential Environment Satisfaction, Housing Cost, Income, Cost of Living, Non-public Rental House, Thirty, Over Seventy, Basic Livelihood Security Recipient, Education, and Monthly Rent were variables of significance. More specifically, the study found the following:

First, higher housing cost and lower income influenced housing cost burden more greatly. Second, those in their 30s felt less burdened by housing cost. It can be interpreted that as a growing number of people in their 30s enjoy single lifestyle and get married late while earning more income, they tend to find burden of housing cost less severe. Third, as suggested in prior research and the Korea Housing Survey results, people who were in their 70s or older were most cost-burdened as they have little or no income, and less ability to pay for housing cost.

Fourth, those living in private rental housing felt a more severe burden of housing cost. This implies that it is becoming increasingly burdensome for tenants to pay for housing cost as jeonse/monthly rent prices continue to rise.

Fifth, higher residential environment satisfaction was linked to heavier burden of housing cost. This is first and foremost because rental fees are higher in areas with better residential environment, leading to higher housing cost and heavier burden. Another reason can be found from residential trends of one-person households. Unlike in the past, as generations born into wealth and abundance appreciate and value work and life balance more, their consumption is geared toward enhancing their quality of life. In other words, people living alone pursue convenience more than multi-person households, have higher demand for safety, and desire an environment where they can enjoy activities of their choice. This complex residential trends of one-person households influence their housing choices, which in turn affect their housing cost as well. Residential environment satisfaction is a variable reflecting changing trends. It appears that people are willing to pay for higher housing cost as they pursue a better environment and higher quality of living despite heavier burden.

Sixth, basic livelihood security recipients were severely burdened by housing cost. They have little or no income source and live on government subsidy, and even if they do earn an income, it is very small, and they are less able to pay for their housing cost. Therefore, it is believed that basic livelihood security recipients have a greater burden of housing cost than other groups.

Seventh, households with minimum high school education or higher had less burden of housing cost. If one’s level of education is high, he or she can use more information in making housing choices and have more advantage in securing housing cost (Lim S.H., 2016). In addition, in one-person households, householders themselves are the source of income, and their education is directly related to income. Therefore, with higher education, it is believed to be more advantageous to secure housing cost.

Lasly, those on monthly rent were less burdened by housing cost. Indeed, households on monthly rent had the lowest RIR in 2019, and this is consistent with the Korea Housing Survey results, which showed that housing cost burden had decreased.

Table 7 shows the analytical results of factors influencing housing affordability of one-person tenants in 2008, 2016, and in 2019. Significant variables commonly found in all of the three years were Housing Cost, Income, and Over Seventy. The first common variable of significance is income. The higher the income was, the smaller housing cost burden became, and the lower the income was, the greater housing cost burden became. When the housing cost takes up the same proportion among groups with different income levels, the group with higher income has enough financial room to spend on other items and feels less burdened by housing cost, while the group with lower income needs to reduce cost of living for other items when the housing cost increases. Second, it was found that people over 70 years old felt heavier burden of housing cost. The elderly do not earn income due to retirement and lack the ability to engage in economic activities, and thus feel heavier burden of housing cost.

Next, significant variables for each of the three years were examined. In 2008, Row House, Officetel and Sixty were found as significant factors. First, housing prices fell regardless of location and size in 2008 due to the financial crisis. However, Row House was a significant variable because the increase rate of row houses on the jeonse system was relatively higher than that of other housing types on the jeonse system. Second, Officetel was also found to be a variable specific to 2008 as the officetel market that year had the highest price increase rate compared to other years, which then started to fall.

When designing this study, jeonse and monthly rent were analyzed separately. Among the three years, only 2019 was found to be a significant variable when households on monthly rent had less burden of housing cost. Although it was announced that overall housing standards had improved based on the results from the Korea Housing Survey by MLTI, it will be difficult to determine whether or not housing cost burden decreased based solely on these results, indicating the need for additional analysis in the future.

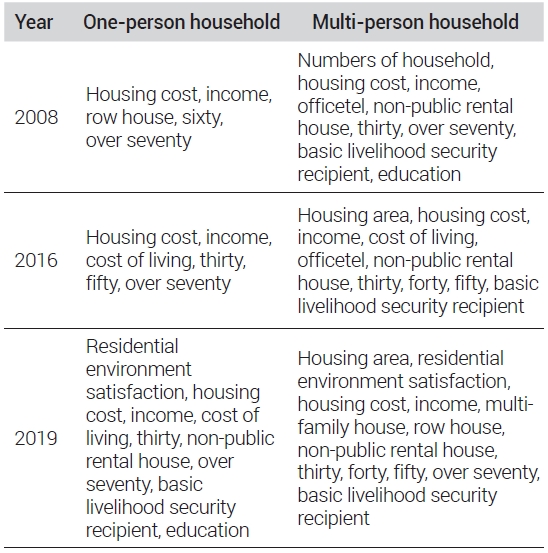

Furthermore, 2008 was a year when the housing sale prices and jeonse prices in Seoul were the highest due to the financial crisis, and those in the 60s at this time felt particularly severe burden of housing cost as they reached the retirement age as well. This is a variable as Table 8 shown that sets one-person households apart from multi-person households as well, as multi-person households have at least two people as income sources and thus have better ability to pay for housing cost than one-person households.

An influencing factor that is significant only for 2016 is Fifty. The average retirement age was 57 in 2016, and a massive population group, known as the baby-boom generation, retired during this period. Fifty was found as a significant variable as those in their 50s were relatively less burdened by housing cost due to retirement fund and loan.

Factors of significance specific to 2019 only are Residential Environment Satisfaction, Basic Livelihood Security Recipients, and Education. First, residential environment satisfaction was found to be a significant factor in 2019. More and more one-person households choose neighborhoods that offer greater safety and residential environment satisfaction than before. That is, one-person households of late tend to pursue a better quality of living and thus choose to live in an area with favorable residential environment even if they are cost-burdened.

Second, basic livelihood security recipients felt heavier burden of hosing cost. With continuous rises in jeonse prices and monthly rent, basic livelihood security recipients with little or no income feel more severe housing cost burden. Therefore, Basic Livelihood Security Recipients were chosen as a significant variable specific to 2019 that were not found in other years.

Third, it was found that one-person households with higher education are less cost-burdened. If one’s level of education is high, he or she can use more information in making housing choices and has more advantage in securing housing cost. Therefore, with all other factors being equal, households with higher education were found to feel less cost-burdened (Lim S.H., 2016). Moreover, as Table 8 show, education is a factor that is specific to one-person households rather than multi-person households. In one-person households, householders themselves are the source of income, and their education is directly related to income. Therefore, with higher education, it is believed to be more advantageous to secure financial resources to pay for housing cost. Multi-person households, on the contrary, have more than two income earners, and thus education does not influence as much in terms of housing cost.

Ⅵ. Conclusion

In recent years, housing instability is intensifying in Korea due to social changes such as low birthrate, non-marriage, late marriage, aging, economic slowdown, low interest rates, stagnant employment rate, and infectious diseases. Among various groups, housing instability among one-person households with a high rate of renting and weak home purchasing power is emerging as a serious problem. As of 2017, one-person households accounted for 28.6% of the entire households in Korea, and the figure is expected to grow in 36.3% in 2045. As such, one-person households are gaining importance as a representative household type of Korean society. Despite continued growth in the number of one-person households, supply of housing and housing support measures specifically designed for this group are largely insufficient. Therefore, to promote housing stability and alleviate the burden of housing cost, this study aimed to identify the factors that affect housing cost burden on one-person tenants in Seoul by using the RIR, an indicator of housing cost burden. It also provided implications for housing policies by discovering factors that changed each year and the causes behind such changes.

To summarize the results of the analysis, the study found that Housing Cost, Income, and Over Seventy were common variables that influenced housing affordability of one-person tenants in 2008, 2016, and 2019. It was found that households with lower income and higher housing cost felt more cost-burdened for their housing. This is because with a higher income, even if the amount of housing costs increases, it takes up a smaller share of the income. This can be explained with Schwabe’s Law (Park K.W., 2016). In addition, one-person households in their 70s or older are severely cost-burdened for their housing as they have little or no income. Considering the ongoing trend of an aging society, measures designed to alleviate housing cost burden on elderly one-person households in their 70s or older need to become an important part of all housing policies.

An analysis of changes in influencing factors in the three years investigated in this study found that in 2008, Row House, Officetel, and Sixty were the influencing factors. Housing prices fell regardless of location and size in 2008 due to the financial crisis. However, the increase rate of row houses on the jeonse system was relatively higher than that of other housing types on the jeonse system, and the price increase rate was the highest among officetels. Thus it appears that those residing in row houses and officetels felt a greater burden of housing cost. Moreover, due to negative projection of the economy in the aftermath of the financial crisis and increased uncertainty, one-person households of retirees in their 60s who had difficulty in securing reemployment felt more burdened to pay for housing cost.

The factor that influenced housing affordability in 2016 specifically was householders in their 50s. It was found that householders in their 50s felt less burdened by housing cost because many of the baby-boom generation retired during this time took out more household loans to secure cost of living after retirement. Several new housing policies designed to reinforce housing cost support for jeonse/monthly renters were announced in 2016, which included measures to strengthen support for lease deposit loans, introduce more ways to provide support to more beneficiaries, and to implement an overhaul of the housing and welfare support system to supply rental homes and funding for jeonse/monthly rent with a priority given to those who are in greater need of housing support. As such, those in their 50s at that time felt less burdened by housing cost.

The factors that influenced housing affordability in 2019 are Residential Environment Satisfaction, Basic Livelihood Security Recipients, and Education over high school graduation. How people view their home is changing due to changes in values and expansion of a society where more members enjoy living alone, and outbreaks of infectious diseases. More and more people now perceive their home not only as a space for taking care of basic necessities of living but also as the safest place. Therefore, as an increasing number of households are willing to pay for high housing cost to reside in their respective homes of choice, actual housing cost burden may become aggravated. It is difficult for basic livelihood security recipients to pay for housing cost as they have little or no source of income. If jeonse/monthly rent housing prices continue to rise, basic livelihood security recipients will feel more burdened by housing cost than other groups. Furthermore, it was found that those with higher education felt less burdened by housing cost. In one-person households, householders themselves are the source of income, and their education is directly related to income. Therefore, with higher education, it is believed to be more advantageous to secure financial resources to pay for housing cost. For multi-person households, however, education does not seem to affect as much because householders have other sources of income than themselves.

Based on these findings, this study suggests the following housing policy implications: first, the focus of housing supply policies needs to shift from quantity-oriented supply of housing to introducing more specific approaches tailored to the characteristics of one-person households. The Korean government and the Seoul metropolitan government are currently providing housing under the “Happiness Housing,” “Youth Housing at Subway Catchment Areas,” and “Hope Housing” programs. However, considering the growth of one-person households and housing affordability, the quantity of supply is small. Moreover, since housing is provided mainly to newlyweds and young people, policies tailored to groups with relatively poor housing affordability are believed to be insufficient. Also, while housing is supplied for young people and newlyweds, only a few households are actually eligible to take advantage of such housing as it comes with strict terms and conditions. The city of Seoul is experiencing difficulties in securing sites for housing development. Therefore, it is necessary to utilize various methods and measures such as redevelopment, reconstruction, small-scale housing rearrangement projects, and autonomous housing improvement projects to supply a sufficient number of new, affordable housing to support one-person households.

Second, more specific housing support measures that consider the particular characteristics of one-person households are needed. The Seoul metropolitan government provides housing support to newlyweds and young people in the forms of lease deposit support, monthly rental support for young people, the Seoul housing voucher program, etc. However, considering the recent competition rate for winning 200,000 won of monthly rent support for the youth was 7:1, the current policy is not attuned to the specific needs of one-person households. Therefore, greater housing support tailored to one-person households is needed, by providing housing support in consideration of housing price increases and by expanding and concretizing beneficiary groups to receive such support.

Third, supply of affordable, quality housing is needed. With the growing social trend of people placing themselves at the center of living and consumption, one-person households prefer homes that they desire, rather than homes that are affordable and cost effective only. Moreover, due to the unexpected pandemic of late, people came to place greater importance on the quality of housing when making housing choices, as they think more highly of comfort and convenience that their housing will offer than of location. Therefore, supply of affordable, quality housing in consideration of social and economic characteristics of one-person households is required.

Acknowledgments

This work was supported by the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2017S1A5B1020332) and financially supported by Korea Ministry of Land, Infrastructure and Transport (MOLIT) as 「Innovative Talent Education Program for Smart City」.

This paper is a translation of a paper written in Korean into English, and a Korean version is released on the website(www.kpa1959.or.kr).

References

- Ando, A. and Modigliani, F., 1963. “The Life-Cycle Hypothesis of Saving: Aggregate Implications and Tests”, American Economic Review, 53(1): 55-84.

-

Bae, B.W. and Nam, J., 2013. “A Study on Housing Affordability of University Student in Seoul”, Seoul Studies, 14(1): 23-38.

배병우·남진, 2013. “서울시 거주 대학생의 주거비 부담능력 분석”, 「서울도시연구」, 14(1): 23-38. -

Bae, S.S. and Kim, M.C., 2013. “A Study on Housing Affordability Measures and Standards for Policy Applications”, Sejong: KRIHS.

배순석·김민철, 2013. “주거비부담능력 평가방식 및 부담기준의 도입과 정책적 활용방안”, 세종: 국토연구원. -

Byun, M.R., Min, B.K., and Park, M.J., 2019. “An Empirical Analysis of the Spatial Distribution and Flow Patterns of Seoul’s Single-Person Households”, Korea Journal of Population Studies, 42(4): 91-119.

[

https://doi.org/10.31693/KJPS.2019.12.42.4.91

]

변미리·민보경·박민진, 2019. “서울시 1인가구의 공간분포와 주거이동 분석”, 「한국인구학」, 42(4): 91-119. -

Choi, Y., Kim, S.H., and Lee, J.S., 2014. “A Study on Housing Affordability for Rental Residents Employing Logit Models –In Case of Busan Metropolitan City–”, Korea Real Estate Academy Review, 59: 45-58.

최열·김상현·이재송, 2014. “로짓모형을 이용한 월세 거주자의 주거비부담능력 결정요인 분석 –부산시 사례를 중심으로–”, 「부동산학보」, 59: 45-58. -

Jeong, I. and Kang, S.J., 2019. “Korea One-Person Households Report 2019”, KB.

정인·강서진, 2019. “한국 1인가구 보고서”, KB 금융지주 경영연구소. -

Jeong, S.Y. and Nam, G.M., 2019. “A Study on Determinants of Housing Affordability for Single-family Household”, Journal of Governance Studies, 14(3): 51-84.

정서연·남궁미, 2019. “1인가구 주거비 부담능력에 영향을 미치는 요인에 관한 연구”, 「국정관리연구」, 14(3): 51-84. -

Joo, W., 2012. “The Housing Cost Burden (Schwabe coefficient) Is Soaring”, Hyundai Research Institute Issue Report, No. 11: 1-12.

주원, 2012. “주거비부담(슈바베 계수)이 급증하고 있다”, 현대경제연구원, 이슈리포트 11월호: 1-12. -

Kang, M.N., Kim, K.Y., Kim, H.S., Park, C.K., and Cho, Y.J., 2019. “Support Policy to Reduce Housing Cost Burden”, KRIHS Issue Report, No. 5: 1-8.

강미나·김근용·김혜승·박천규·조윤지, 2019. “주거비 부담 경감을 위한 지원 정책”, 「국토이슈리포트」, 제5호: 1-8. -

Kil, Y.M. and Jung, C.M., 2016. “An Analysis of Tenure Choices by Housing Type Focused on Relative Price, Housing Financial Policy and Expected Price”, Journal of Real Estate Analysis, 2(2): 43-60.

길용민·정창무, 2016. “주택유형에 따른 점유형태 선택 결정요인 분석–상대가격, 주택금융정책 그리고 가격기대를 중심으로”, 「부동산분석」, 2(2): 43-60. -

Kim, H.S. and Hong, H.O., 2003. “Housing Expenditure, Housing Affordability and Housing Subsidy in Korea”, The Korea Spatial Planning Review, 39: 85-102.

김혜승·홍형옥, 2003. “저소득층의 주거비지불능력을 고려한 주거비보조에 관한 연구”, 「국토연구」, 39: 85-102. -

Kim, J.S. and Lee, J.H., 2004. “A Study on the Effect of Household Characteristics on Housing Choice Behavior”, Journal of Korea Planning Association, 39(1): 191-204.

김정수·이주형, 2004. “가구특성에 따른 주택선택행태에 관한 연구”, 「국토계획」, 39(1): 191-204. -

Kim, J.W. and Cho, J.H., 2010. “A Study on Characteristics of Housing Demand of Single-Person Households and Policy Proposals: The Case of Residents in Seoul”, KREUS, 10(2): 1-23.

김주원·조주현, 2010. “1인 가구의 주택수요 특성과 정책적 제언 –서울시를 중심으로–”, 「건국대학교 부동산도시연구원」, 10(2): 1-23. -

Kim, M.C., Lee, T.L., and Lee, Y.S., 2017. “A Study on the Housing Stability of the Rent Household”, Sejong: KRIHS.

김민철·이태리·이윤상, 2017. “임차가구의 주거 안정을 위한 정책 추진방향과 전략”, 세종: 국토연구원. -

Kim, M.J. and Cho, M.H., 2018. “A Study on the Effectiveness of Housing Cost and Housing Satisfaction on Housing Welfare Policy”, Korean Journal of Policy For Policy Analysis and Evaluation, 28(3): 107-138.

김민정·조민효, 2018. “주거복지정책의 주거비부담 및 주거만족도 효과성 분석”, 「한국정책분석평가학회보」, 28(3): 107-138. -

Koh, H. and Yoo, S.J., 2017. “A Study on the Housing Cost Burden for Elderly Households”, Journal of the Korean Society of Cadastre, 33(2): 47-55.

고홍·유선종, 2017. “고령세대 주거비 부담에 관한 연구”, 「한국지적학회지」, 33(2): 47-55. -

Kwon, G.W. and Jin, C.H., 2016. “A Study on the Determinants of Housing Expenditure Burden Considering Family Life Cycle”, Housing Studies, 24(3): 49-69.

권건우·진창하, 2016. “생애주기별 가구의 주거비 부담 결정요인에 관한 연구”, 「주택연구」, 24(3): 49-69. -

Lee, H.J., Kim, D.K., and Jeong, C.M., 2018. “Socioeconomic Distinctions and Determinants of Housing Expenditure for Home-Owning and Renting Households”, Journal of the Korean Housing Association, 29(1): 59-70.

[

https://doi.org/10.6107/JKHA.2018.29.1.059

]

이현정·김대규·정창민, 2018. “자가가구와 차가가구의 사회경제적 차이 및 주거비 지출 영향요인”, 「한국주거학회 논문집」, 29(1): 59-70. -

Lee, J.E. and Kim. K.S., 2018. “Housing Cost Burden Distribution of Seoul Metropolitan Area Evaluated with PIR”, Proceedings of Conference of Korea Real Estate Analysis Association, 99-122.

이지은·김갑성, 2018. “PIR로 평가한 수도권 지역 주거비부담 분포양상”, 「한국부동산분석학회 학술발표논문집」, 99-122. -

Lee, J.H., 2015. “The Welfare Policy Approach to the Housing Cost of the Elderly in Women: Focusing on the Schwabe Index”, Proceedings of Fall Conference of the Korean Association for Policy Studies, 1564-1579.

이정화, 2015. “여성노인의 주거생활비에 대한 복지정책적 접근: 슈바베지수를 중심으로”, 「한국정책학회 추계학술발표논문집」, 1564-1579. -

Lee, J.Y., 2016. “The Need for the Expansion of Statistics in the Monthly Salary Market and the Level of Housing Cost”, Paper presented at the KAHPS·MOLIT·Statistics Korea Joint Hosting Symposium, Seoul, Korea.

이준용, 2016. “월세시장의 통계확대 필요성과 주거비부담 수준”, 2016. 한국주택학회·국토교통부·통계청 공동주최 심포지움, 서울특별시: 대한상공회의소. -

Lee, S.U. and Gwak, M.J., 2019. “Analysis of Influential Factors in the Housing Cost Burden of Single-Youth Renter Households”, Journal of Financial Consumers, 9(3): 33-54.

[

https://doi.org/10.30592/KAFC_JFC.09.03.02

]

이상운·곽민주, 2019. “청년층 1인 임차가구의 주거비부담 영향 요인 분석”, 「금융소비자연구」, 9(3): 33-54. -

Lim, M.H., 2020. “A Study on Gender Difference of Housing Costs: Focusing on Single-Person Household”, Housing Studies, 28(2): 113-129.

[

https://doi.org/10.24957/hsr.2020.28.2.113

]

임미화, 2020. “성별 주거비용 비교분석:1인가구를 중심으로”, 「주택연구」, 28(2): 113-129. -

Lim, S.H., 2016. “The Determinants of Housing Affordability”, Korean Journal of Social Welfare, 68(3): 29-50.

[

https://doi.org/10.20970/kasw.2016.68.3.002

]

임세희, 2016. “주거비 과부담 결정요인”, 「한국사회복지학」, 68(3): 29-50. - McFadden, D.,1981. “Econometric Models of Probabilistic Choice.” in Structural Analysis of Discrete Data with Econometric Applications, edited by Manski, C. and McFadden, D., 198-272. Cambridge: MIT Press.

-

Nam, J. and Kim, J.H., 2015. “An Analysis of Factor Influencing on the Choice of Housing Types and Tenure by Income Bracket in Seoul”, Journal of the Korean Urban Management Association, 28(2): 199-222.

남진·김진하, 2015. “서울시 소득계층별 주택유형과 점유형태 선택요인 분석”, 「도시행정학보」, 28(2): 199-222. - OECD, 2017. Better Life Index.

-

Park, K.W., 2016. “An Analysis on the Relationwhip Between the Structural Change of Rental Housing Market and Renter’s Housing Cost Burden of Seoul”, Master’s Dissertation, University of Seoul.

박관우, 2016. “서울시 전월세시장의 구조변화와 임차가구의 주거비부담과의 관계분석에 관한 연구”, 서울시립대학교 석사학위논문. -

Park, M.S. and Lee, J.C., 2017. “Housing Policy Responding to One-person Households Increase”, Sejong: KRIHS.

박미선·이재춘, 2017. “1인가구 증가에 따른 주택정책 대응방안 연구”, 세종: 국토연구원. -

Park, W.S., 2015. “Analysis of Residential Location Preference Factors by Characteristics of Households in the Case of Seoul Metropolitan Area Households: Comparative Analysis with the Case of Daegu·Gyeongbuk Households”, Journal of The Korean Association of Regional Geographers, 21(3): 515-528.

박원석, 2015. “수도권 가구의 가구특성별 주거입지 선호요인 분석–대구·경북 가구사례와의 비교분석”, 「한국지역지리학회지」, 21(3): 515-528. -

Yoo, B.S. and Jeong, K.H., 2017. “Determinants of Housing Cost Burden for Low Income Tenants: Focusing on Difference between Chonsei and Monthly Rental Household”, Journal of Regional Studies and Development, 26(1): 1-38.

유병선·정규형, 2017. “저소득 임차가구의 주거비부담 결정 요인 분석: 전세가구와 월세가구의 차이를 중심으로”, 「지역발전연구」, 26(1): 1-38.